Markel Group's Insurance Business Is Underperforming

Markel Group Inc. (NYSE:MKL) is a holding company active in insurance and investment operations. Founded in 1930, it is headquartered in Richmond, Virginia.

The company's business, as CEO Tom Gayner (Trades, Portfolio) has repeatedly explained, can be described as a three-engine flywheel. The insurance business, the first engine, has historically provided the capital for the other two engines, namely investments and Markel Ventures. The investment outcomes of these businesses can, in turn, be used to increase the underwriting capital base, making the flywheel spin in a never-ending cycle.

Source: Markel's investor relations

We will now take a brief look at the three businesses that compose Markel.

The insurance division is not focused on regular insurance. Their products are, on average, more complex than auto or normal property and casualty insurance lines. %hey include, for example, energy, workers's compensation insurance products and catastrophe-exposed property risk coverage (both insurance and reinsurance).

Markel is willing to underwrite risks in niche areas of the insurance market, where they have high specialization and their competitors cannot (because they do not have domain knowledge) or do not want to go. This is part of their competitive advantage.

The investment business is focused on fixed income and equities (partial ownership). Its investment approach is very similar to that of Warren Buffett (Trades, Portfolio) and the late Charlie Munger: the businesses they look for must have high return on capital, low debt, should be run by managers with high integrity and have good reinvestment opportunities. Finally, they must be available at a discount to fair price or at least at a reasonable valuation.

The last engine, Markel Ventures, is a relatively young business (it was launched in 2005). It consists of the acquisition and whole ownership of non-insurance businesses. In 2023, the Ventures portfolio produced slightly less than $5 billion of revenue and $628 million in Ebitda.

Fourth-quarter and year-end results: A bad combined ratio

Last year, Markel Group's earned premiums rose 9% from $7.58 billion in 2022 to $8.29 billion in 2023. On the other hand, underwriting profit was down 79%, from $626.62 million in 2022 to $132.74 million in 2023.

Underwriting profit is calculated by subtracting claims incurred and operating expenses from net earned premiums, so it is basically what remains after both internal and external expenses have been paid.

As insurance segment revenues are growing, the reason for the poor underwriting profit is related to the higher amount of claims paid per dollar underwritten.

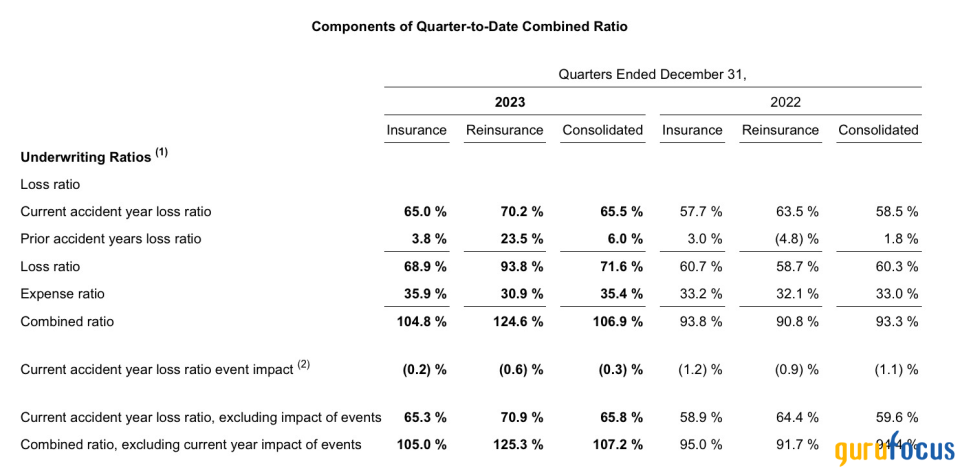

Another way to measure the quality of insurance-related earnings is by looking at underwriting ratios. Among them, the combined ratio is particularly useful to judge underwriting performance and compare it with previous periods. This parameter is calculated by adding the loss ratio, which measures how effective the company is on the underwriting side, to the expense ratio, which tells how the company handles expenses on the operating side.

At the end of the fourth quarter, Markel's consolidated combined ratio was 106.90%, up from 93.30% in the prior-year period. This is not only a deteriorating measure in itself, but the fact the combined ratio is greater than 100% indicates the division is operating at a loss.

Source: Markel Second-Quarter 2023 Report

Gayner was very clear about the fact that, even if the other divisions are doing great, he is not happy about the situation and, as a consequence, the company has already taken several measures to right the ship. During the most recent conference call, he said:

"We have made several significant management changes in the past year and taking actions such as withdrawing or reducing certain lines of business, reducing line sizes, increasing accountability, modifying incentive compensation arrangements, increasing the scope and scale for some of the proven winners in our insurance operations and decreasing or eliminating pockets with disappointing performance."

Time will tell if the implemented changes have the desired effect. I think that it is not extremely important for Markel's insurance business to have a very low combined ratio, like other top players in the insurance market (even if it would be nice to have), provided they do not consistently operate at a loss. What is really important for Markel's three engines system to work is that the total amount of net written premiums is growing. This is indeed crucial to make sure the other two engines can continue to have increasingly higher capital to deploy.

Let's turn now to investing results. For the past year, the company earned a net investment income of $734.5 million, up from $446 million posted in 2022. The increase is mainly due to higher interest rates, of which it took advantage in the last year, especially by increasing its allocation to money market funds. On the equity side, the value of its unrealized gains rose to $6.10 billion, helped by the recent stock market rally.

The investment 10-year annualized return is 11.9%, around 100 basis points higher than the S&P500, which is not so exciting as they give priority to safety and diversification, but, as we know, even a small annual performance advantage compared to the broad market will turn to big absolute gains over a long period of time.

The last engine, Markel Ventures, is the one that performed best. For the collection of non-insurance businesses, even if revenues were only up 5% to around $5 billion, operating income and Ebitda rose by 35% and 24%, mainly due to better operating margins. Markel Ventures did not add any new companies last year, but it increased ownership stakes in some of the already existing holdings.

Valuation considerations

On the valuation side, the company is selling for an undemanding earnings multiple of 9.60, with a diluted net income per common share of $146.98, up from a negative net income of $23.72 in 2022. However, it must be said that Markel's earnings are heavily influenced by factors that can quickly change year over year, like interest rates and equity unrealized gains.

Markel's book value per share as of Dec. 31 amounts to $1,096. Similarly to Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B), until recently investors valued the company using its book value. This is no longer a valid yardstick, or at least it's not the only one to use to infer Markel's intrinsic value, especially because of the many different businesses that are now part of the Markel Ventures and Investments businesses.

Moreover, according to GuruFocus' reverse discounted cash flow model, the company's current market value implies a negative free cash flow growth of 2.24%, a measure that should be quite easy to beat considering the company's free cash flow growth in the past 10 years has been in the mid-teens.

Conclusions

Markel Group's three-engine system was designed so that each engine can provide cash to the other two businesses. Top management's capital allocation efforts are continuously focused on making the company's flywheel grow bigger and bigger.

I am convinced the recent deterioration in the insurance business is only temporary and the corrective actions Markel is putting in place will bear fruit in the next few quarters.

Finally, the current price can prove to be a good entry point for investors who are willing to place their trust in Markel's management team and culture.

This article first appeared on GuruFocus.