Markel (MKL) Q3 Earnings Miss Estimates, Revenues Rise Y/Y

Markel Group Inc. MKL reported third-quarter 2023 net operating earnings per share of $16.56, which missed the Zacks Consensus Estimate by 21%. However, the bottom line increased 25.7% year over year.

Markel witnessed improved earned premiums and increased net investment income, partially offset by higher attritional loss ratio and operating expenses.

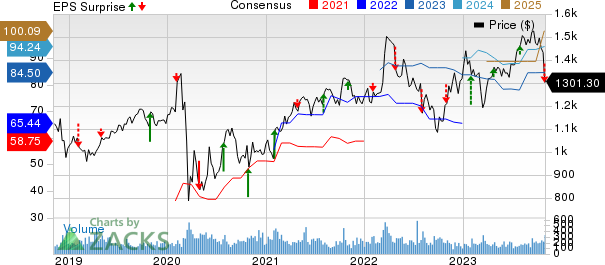

Markel Group Inc. Price, Consensus and EPS Surprise

Markel Group Inc. price-consensus-eps-surprise-chart | Markel Group Inc. Quote

Quarterly Operational Update

Total operating revenues of $3.6 billion missed the Zacks Consensus Estimate by 0.4%. The top line rose 8.7% year over year on higher earned premiums, product revenues, services and other revenues and higher net investment income.

Earned premiums increased 8.4% year over year to $2.12 billion in the quarter. The increase was primarily attributable to higher gross premium volume in recent periods. The figure was lower than our estimate of $2.2 billion.

Net investment income increased 70.6% year over year to $192.2 million in the third quarter. The increase was primarily attributable to higher interest income on short-term investments and cash equivalents due to higher short-term interest rates in 2023. The figure was higher than our estimate and the Zacks Consensus Estimate of $149.7 million.

Total operating expenses of Markel increased 10.1% year over year to $3.3 billion, primarily due to higher losses and loss adjustment expenses, underwriting, acquisition and insurance expenses, amortization of intangible assets and services and other expenses. The figure was higher than our estimate of $3.2 billion.

MKL’s combined ratio deteriorated 600 basis points (bps) year over year to 99 in the reported quarter, primarily due to a higher attritional loss ratio and less favorable development on prior accident years’ loss reserves in 2023, partially offset by lower catastrophe losses. The Zacks Consensus Estimate was pegged at 93.

Segment Update

Insurance: Gross premiums increased 3% year over year to $2.3 billion. The uptick was driven by more favorable rates and new business growth within personal lines, property and general liability product lines, partially offset by lower premium volume within professional liability product lines. The figure matched our estimate.

Underwriting profit came in at $25 million, down 71% year over year. The combined ratio deteriorated 360 bps year over year to 98.6. It included $44.3 million of net losses and loss adjustment expenses attributed to the 2023 catastrophes.

Reinsurance: Gross premiums decreased 30% year over year to $126 million. The decrease was primarily attributable to lower gross premiums within our professional liability product lines and the unfavorable timing impact of renewals on multi-year deals within general liability and marine and energy product lines, partially offset by additional assumed reinstatement premiums recognized in 2023 due to prior accident year development within property product lines. The figure was lower than our estimate of $312.2 million.

Underwriting loss was $5.8 million against the year-over-year income of $43.2 million. The combined ratio deteriorated 1,870 bps year over year to 102.1 in the third quarter. It included $23.3 million of adverse development on prior accident years’ loss reserves. This adverse development was due in part to adverse development on general liability product lines and was net of modest favorable development across several other product lines, including property product lines.

Markel Ventures: Operating revenues of $1.24 billion improved 2.5% year over year. The growth was driven by higher revenues at construction services businesses and transportation-related businesses, due to a combination of increased demand, higher prices and growth, as well as increased production at one of the equipment manufacturing businesses. The increase was partially offset by the impact of decreased demand at certain consumer and building products businesses, consulting services businesses and one of construction services businesses.

Operating income of $107.3 million increased 77% year over year, driven by products businesses, particularly consumer and building products businesses, which had higher margins in 2023 compared with 2022. The increase in operating income at many of the businesses was partially offset by the impact of lower revenues and operating margins at one of the construction services businesses due to decreased demand.

Financial Update

Markel exited the third quarter with investments, cash and cash equivalents and restricted cash and cash equivalents of $28.8 billion as of Sep 30, 2023, up 5.1% from 2022 end.

The debt balance decreased 8.1% year over year to $3.7 billion as of Sep 30, 2023. The debt-to-capital ratio was 21% as of Sep 30, 2023, reflecting an improvement of 300 basis points from 2022 end. The decrease reflects a decline in senior long-term debt, primarily attributable to the retirement of 3.625% unsecured senior notes due Mar 30, 2023, as well as an increase in shareholders' equity.

Book value per share increased 8.3% from year-end 2022 to $1,013.25 as of Sep 30, 2023.

Net cash provided by operating activities was $1.9 billion in the first nine months of 2023, up 4.5% year over year. The increase in net cash flows from operating activities was primarily due to a rise in operating cash flows from Markel Ventures. It was partially offset by a $125.1 million payment made to complete a retroactive reinsurance transaction to cede a portfolio of policies comprising liabilities related to the run-off book of the U.K. motor casualty business.

Zacks Rank

Markel currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Conglomerates

Honeywell International Inc.’s HON third-quarter 2023 earnings of $2.27 per share surpassed the Zacks Consensus Estimate of $2.22. The bottom line was nearly flat on a reported basis. On an adjusted basis, earnings inched up around 1%. Total revenues of $9,212 million outperformed the Zacks Consensus Estimate of $9,207.9 million. The top line inched up around 3% from the year-ago quarter. Organic sales increased 2% due to growth in commercial aviation, defense and space and process solutions. Aerospace’s quarterly revenues were $3,499 million, up 18% year over year. Our estimate for Aerospace revenues in the third quarter was $3,376.5 million.

Honeywell Building Technologies’ revenues remained flat at $1,530 million. Our estimate for segmental revenues was pegged at $1,572.1 million. Performance Materials and Technologies’ revenues totaled $2,867 million, up 5% year over year. Our estimate for Performance Materials and Technologies revenues in the third quarter was $2,849 million.

General Electric Company GE reported third-quarter 2023 adjusted earnings of 82 cents per share, which beat the Zacks Consensus Estimate of adjusted earnings of 56 cents per share. The bottom line increased 134.3% year over year. Total revenues of $17,346 million beat the consensus estimate of $15,675 million. The top line increased 19.9% year over year. GE started reporting its revenues under two segments, effective from the first quarter of 2023, namely GE Aerospace and GE Vernova. The company completed the spin-off of GE HealthCare into an independent publicly traded company, retaining an approximately 19.9% stake in GE HealthCare’s common stock.

Aerospace revenues jumped 25% year over year to $8,409 million in the reported quarter. The Zacks Consensus Estimate for the quarter was $7,896 million. Organic revenues rose 25% year over year. Orders grew 34% year over year. The GE Vernova has two subsegments, namely Renewable Energy and Power. The Renewable Energy segment’s revenues totaled $4,151 million, up 15% year over year. The consensus estimate for the quarter was $3,676 million. Organically, the same increased 14%.

3M Company’s MMM third-quarter 2023 adjusted earnings (excluding $6.42 from non-recurring items) of $2.68 per share surpassed the Zacks Consensus Estimate of $2.34. 3M’s net sales of $8,312 million outperformed the Zacks Consensus Estimate of $7,952.7 million. However, the top line declined 3.6% year over year due to a 3.7% decrease in organic sales. Foreign currency translation had a positive impact of 0.6%, while divestitures hurt the top line by 0.5%. The company reports top-line results under four business segments — Safety & Industrial, Transportation & Electronics, Health Care and Consumer.

Revenues from Safety and Industrial totaled $2,751 million, decreasing 4.9% year over year. The decline can be attributed to a 5.8% decrease in organic revenues. The Zacks Consensus Estimate for Safety and Industrial segment revenues was pegged at $2,778 million. Revenues from Transportation & Electronics totaled $2,171 million, reflecting a year-over-year decrease of 3%. Acquisitions boosted segmental revenues by 1.4%, while divestitures had a 0.4% negative impact. The Zacks Consensus Estimate for Transportation & Electronics segment revenues was pegged at $2,043 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

Markel Group Inc. (MKL) : Free Stock Analysis Report