Markel (MKL) Rises 22% in a Year: Should You Buy the Stock?

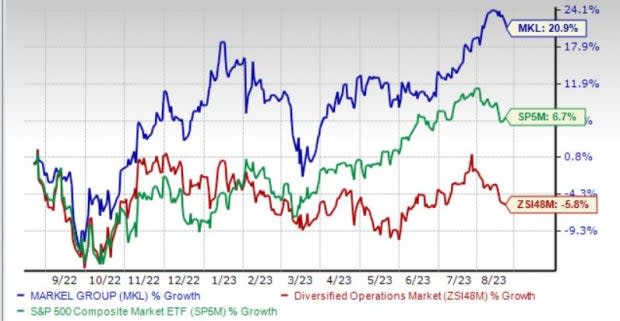

Markel Group’s MKL shares have rallied 21.6% in a year against the industry’s decrease of 5.8%. The Zacks S&P 500 composite gained 6.9%.

A niche focus, improved pricing, effective risk management, strategic buyouts and solid capital position should continue to drive this Zacks Rank #1 (Strong Buy) company.

Markel, with a market capitalization of $19.5 billion, has a decent history of delivering positive surprises. It beat estimates in three of the last four reported quarters, while missing in one.

Image Source: Zacks Investment Research

Can the Stock Retain the Momentum?

Earnings of this insurer increased 29% in the last five years, outperforming the industry average of 10.6%.

The Zacks Consensus Estimate for 2023 earnings is pegged at $83.32 per share, implying an increase of 22.9% from the year-ago reported figure on 10.2% higher revenues of $14.6 billion. The consensus estimate for 2024 earnings is pegged at $93.16, implying an increase of 13.2% from the year-ago reported figure on 8.8% higher revenues of $15.9 billion.

MKL’s gross premiums increased at a two-year CAGR of 19.4%. New business volume, strong policy retention levels, continued increases in rates and expanded product offerings should help MKL continue to deliver better premiums.

Markel aims to double the size of its insurance operations and thus targets $10 billion of annual insurance premiums in five years. This should lead to $1 billion of annual underwriting profit. MKL expects to achieve this goal primarily through organic growth of its existing operations. We estimate operating revenues to witness a three-year CAGR of (2022-2025) 13.4%.

Investment income has been rising over the past many years. A better interest rate is likely to boost investment results. Markel expects to benefit gradually from higher interest rates within its fixed maturity portfolio through recent purchases at higher yield rates. It believes the impact to become more meaningful in the future as lower-yielding securities mature and are replaced by higher-yielding securities. We estimate a 42.7% increase in net investment income in 2023.

Through Markel Ventures, MKL has been investing in the ownership of the best asset management firms. The insurer has been pursuing acquisitions to achieve profitable growth in insurance operations and to create additional value on a diversified basis in Markel Ventures operations.

Markel has a solid capital position that supports the insurer in engaging in share buybacks on the strength of its solid capital position.

Attractive Valuation

The company’s shares are trading at a forward price-to-earnings multiple of 16.5, lower than the industry average of 19.8. Before valuation expands, it is wise to take a position in the stock.

Other Stocks to Consider

Some other top-ranked stocks from the same industry are General Electric GE, ITT ITT and 3M Company MMM.

The Zacks Consensus Estimate for GE’s 2024 earnings indicates a year-over-year increase of 86%. GE delivered a four-quarter average earnings surprise of 35.43%. It carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for 2023 and 2024 earnings has moved up by 11.8% and 8.4% in the past 30 days. Shares of GE have gained 49.6% in a year.

The Zacks Consensus Estimate for ITT’s 2023 and 2024 earnings indicates a year-over-year increase of 3.1% and 11.7%, respectively. ITT delivered a four-quarter average earnings surprise of 6.44%.

The consensus estimate for 2023 and 2024 earnings has moved up by 3.7% each in the past 30 days. Shares of ITT have gained 23% in a year. It carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for MMM’s 2024 earnings indicates a year-over-year increase of 9.3%. MMM delivered a four-quarter average earnings surprise of 13.79%. It carries a Zacks Rank #2.

The consensus estimate for 2023 and 2024 earnings has moved up 3.5% and 2.5% in the past 30 days. Shares of MMM have lost 30.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Markel Group Inc. (MKL) : Free Stock Analysis Report