Markel's (MKL) Q4 Earnings Beat, Revenues Lag Estimates

Markel Group Inc. MKL reported fourth-quarter 2023 net operating earnings per share of $56.48, which beat the Zacks Consensus Estimate by 139.5%. The bottom line more than doubled year over year.

Markel witnessed improved earned premiums and increased net investment income.

Quarterly Operational Update

Total operating revenues of $3.7 billion missed the Zacks Consensus Estimate by 1.1%. The top line rose 2.7% year over year.

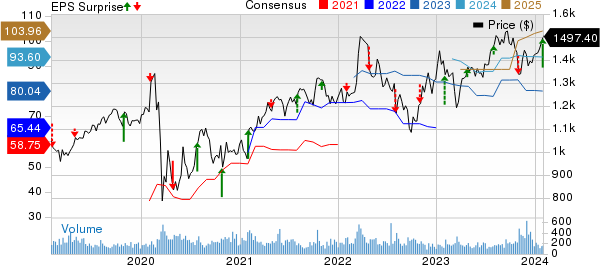

Markel Group Inc. Price, Consensus and EPS Surprise

Markel Group Inc. price-consensus-eps-surprise-chart | Markel Group Inc. Quote

Net investment income increased 46.9% year over year to $213 million in the fourth quarter.

MKL’s combined ratio deteriorated 1300 basis points (bps) year over year to 107 in the reported quarter.

Full-Year Update

Revenues of $15.8 billion increased 35.4% from 2022.

Earned premiums grew 9% to $8.3 billion, reflecting growth in gross premium volume in recent periods

Combined ratio deteriorated 600 bps to 98, primarily attributable to a higher attritional loss ratio.

Segment Update

Insurance: Gross premiums increased 7% year over year to $9.2 billion. The uptick was driven by more favorable rates and new business growth across many product lines, most notably personal lines and property product lines.

Underwriting profit came in at $162.2 million, down 71% year over year. The combined ratio deteriorated 620 bps year over year to 97.8. It included $39.6 million of net losses and loss adjustment expenses attributed to the 2023 catastrophes.

Reinsurance: Gross premiums decreased 15% year over year to $1 billion, primarily attributable to lower gross premiums within professional liability product lines.

Underwriting loss was $19.3 million against the year-ago income of $83.8 million. The combined ratio deteriorated 980 bps year over year to 101.9 in 2023. It included $57.1 million of adverse development on prior accident years’ loss reserves.

Markel Ventures: Operating revenues of $5 billion improved 5% year over year. The growth was driven by higher revenues at construction services businesses and transportation-related businesses, as well as a contribution from Metromont.

Operating income of $437.5 million increased 55% year over year, driven by products businesses, particularly consumer and building products businesses.

Financial Update

Markel exited 2023 with invested assets of $30.8 billion, up from $27.4 billion at 2022 end.

The debt balance decreased year over year to $3.8 billion as of Dec 31, 2023 from $4.1 billion at 2022 end.

Shareholders' equity of $15 billion at 2023 end decreased from $13.2 billion at 2022 end.

Book value per share increased 17.1% from year-end 2022 to $1,095.95 as of Dec 31, 2023.

Net cash provided by operating activities was $2.8 billion in 2023, up from $2.7 billion in 2022, reflecting an increase in operating cash flows from Markel Ventures and investments.

Zacks Rank

Markel currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Diversified Operators

Danaher Corporation’s DHR fourth-quarter 2023 adjusted earnings (excluding 59 cents from non-recurring items) of $2.09 per share surpassed the Zacks Consensus Estimate of $1.90. The bottom line declined 17.7% year over year.

Danaher’s net sales of $6.4 billion outperformed the consensus estimate of $6 billion. However, the metric declined 10.2% year over year due to a decrease in sales of COVID-related products and weakness in the Biotechnology and Diagnostics segments.

Organic sales in the quarter decreased 11.5%. Foreign-currency translations and acquisitions had a positive impact of 1% and 0.5%, respectively, on quarterly sales. Base business core sales (adjusted) declined 4.5% in the quarter.

General Electric Company GE reported fourth-quarter 2023 adjusted earnings of $1.03 per share, which beat the Zacks Consensus Estimate of 90 cents per share. However, the bottom line decreased 16.9% year over year.

Total segment revenues of $18.5 billion beat the consensus estimate of $17.8 billion. The top line increased 15.3% year over year.

For the first quarter of 2024, GE expects adjusted revenues to grow in the high-single-digits from the year-ago period. Adjusted earnings are predicted in the band of 60-65 cents per share.

Honeywell International Inc. HON posted earnings of $2.60 per share for the fourth quarter, in line with the Zacks Consensus Estimate. Earnings increased from $2.52 per share a year ago.

Revenues of $9.4 billion missed the Zacks Consensus Estimate by 2.7% but improved from $9.2 billion generated in the year-ago quarter. Organic sales increased 2%. Operating margin contracted 290 basis points to 16.8%.

For 2024, the company projects adjusted EPS between $9.80 and $10.10. It expects sales of $38.1 billion to $38.9 billion, year-over-year organic growth of 4% to 6% and segment margin expansion of 30 to 60 basis points.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Markel Group Inc. (MKL) : Free Stock Analysis Report