Market Cool On AKITA Drilling Ltd.'s (TSE:AKT.A) Revenues

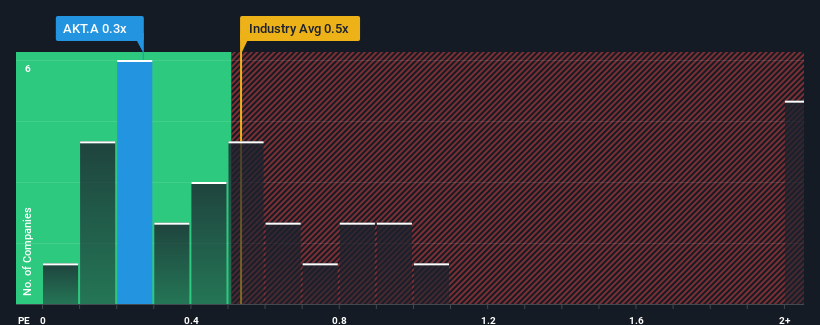

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Energy Services industry in Canada, you could be forgiven for feeling indifferent about AKITA Drilling Ltd.'s (TSE:AKT.A) P/S ratio of 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for AKITA Drilling

What Does AKITA Drilling's Recent Performance Look Like?

AKITA Drilling certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think AKITA Drilling's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Some Revenue Growth Forecasted For AKITA Drilling?

In order to justify its P/S ratio, AKITA Drilling would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 73%. The latest three year period has also seen a 25% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 17% as estimated by the only analyst watching the company. That would be an excellent outcome when the industry is expected to decline by 1.1%.

With this information, we find it odd that AKITA Drilling is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Bottom Line On AKITA Drilling's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that AKITA Drilling currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AKITA Drilling (1 can't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on AKITA Drilling, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here