Market Cool On good natured Products Inc.'s (CVE:GDNP) Revenues

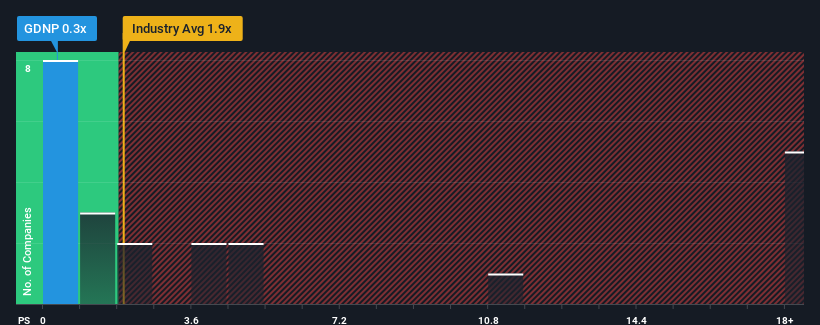

With a price-to-sales (or "P/S") ratio of 0.3x good natured Products Inc. (CVE:GDNP) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in Canada have P/S ratios greater than 1.9x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for good natured Products

What Does good natured Products' P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, good natured Products has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on good natured Products.

Is There Any Revenue Growth Forecasted For good natured Products?

In order to justify its P/S ratio, good natured Products would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 11% during the coming year according to the three analysts following the company. Meanwhile, the industry is forecast to moderate by 12%, which suggests the company won't escape the wider industry forces.

With this information, it's perhaps strange but not a major surprise that good natured Products is trading at a lower P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of good natured Products' analyst forecasts revealed despite having an equally shaky outlook against the industry, its P/S much lower than we would have predicted. Even though the company's revenue outlook is on par, we assume potential risks are what might be placing downward pressure on the P/S ratio. The market could be pricing in revenue growth falling below that of the industry, a possibility given tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should typically see a P/S closer to the industry average.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with good natured Products, and understanding these should be part of your investment process.

If you're unsure about the strength of good natured Products' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.