Investors haven't been this worried about a market crash in 4 years

Market volatility has been relatively low in recent weeks. The CBOE Volatility Index (^VIX), which jumped this week, has generally been trending lower, reflecting the near-term sense of calm.

Furthermore, investor sentiment readings since President Donald Trump’s election reflect increased optimism in the market.

But one survey tells a very different story.

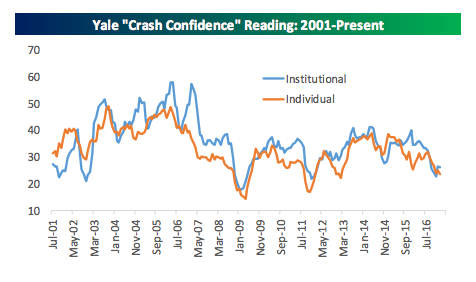

According to Yale’s latest Crash Confidence Index, concern about a market crash within the next six months is at its highest level in four years (the low reading below means investors think the odds of a crash are more likely).

Concern about a market crash hit its all-time high in early 2009, which was not long after the Lehman Brothers bankruptcy. The event exacerbated turmoil in the credit market and worries of a deep economic depression.

Meanwhile, investors have been paying up for insurance against an unexpected stock market shock. The CBOE SKEW Index, which reflects the price for protection against “market tail risk” (i.e. the chance of a major sell-off in the S&P 500), has reached its highest level since Brexit in June.

It’s worth noting that Yale’s index is not considered a predictor of market crashes. Rather, it’s a contrarian indicator. Note: when fears were highest in early 2009, what followed was the beginning of the bull market, which lives on today.

There are other things to be paying attention to

“The crash test survey isn’t something I would pay too much attention to,” RBC Chief Equity Strategist Jonathan Golub said.

President Trump has been dominating the headlines lately, and market watchers have been quick to tie him to any current or future market moves.

But recent market strength may not be as dependent on Trump’s pro-growth promises as presumed, Golub said. He explained that improved economic data and reflation, accompanied by a return to a more normalized interest rate, are behind the upward move in stocks.

“Strong stock returns in the months prior to Election Day and on November 8, when Hillary Clinton was expected to win, support this view,” according to Golub. “Success for Trump’s pro-growth policy would be cherry on top for this strong market, but it’s not what’s fueling it.”

The bottom line: Whether its Trump or the economy or something else, there’s a lot of confusion and disagreement surrounding the recent market run. And we’ll only know in hindsight if the ultimate outcome is a prolonged bull market, a market crash, or something else.