Market Participants Recognise Ocado Group plc's (LON:OCDO) Revenues Pushing Shares 54% Higher

Ocado Group plc (LON:OCDO) shareholders would be excited to see that the share price has had a great month, posting a 54% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

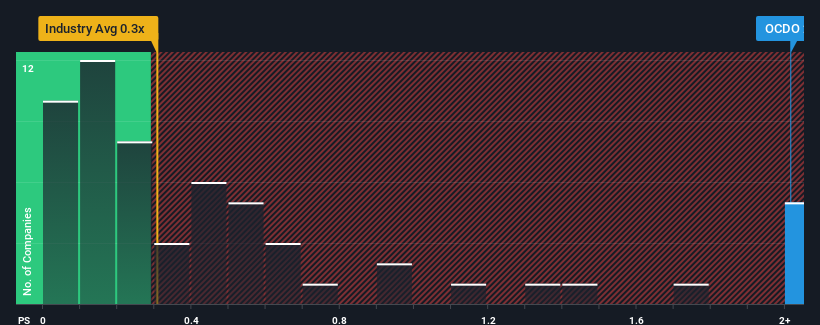

Since its price has surged higher, when almost half of the companies in the United Kingdom's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider Ocado Group as a stock probably not worth researching with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Ocado Group

How Ocado Group Has Been Performing

Ocado Group could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ocado Group will help you uncover what's on the horizon.

How Is Ocado Group's Revenue Growth Trending?

In order to justify its P/S ratio, Ocado Group would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the analysts following the company. With the industry only predicted to deliver 4.0% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Ocado Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Ocado Group's P/S Mean For Investors?

Ocado Group's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Ocado Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Ocado Group has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here