Market Still Lacking Some Conviction On Crown Point Energy Inc. (CVE:CWV)

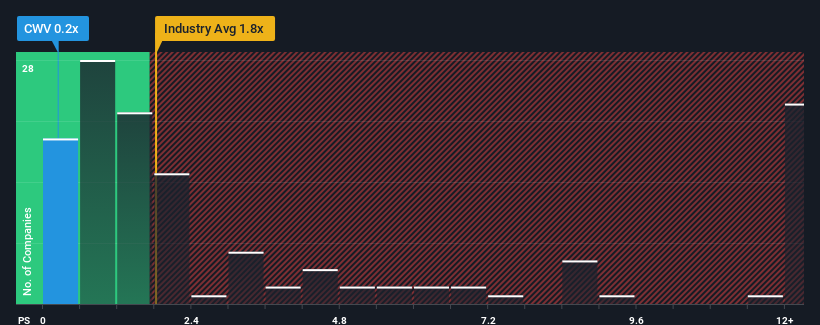

Crown Point Energy Inc.'s (CVE:CWV) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Oil and Gas industry in Canada, where around half of the companies have P/S ratios above 1.8x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Crown Point Energy

What Does Crown Point Energy's P/S Mean For Shareholders?

Revenue has risen firmly for Crown Point Energy recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Crown Point Energy's earnings, revenue and cash flow.

How Is Crown Point Energy's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Crown Point Energy's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 7.2% shows it's a great look while it lasts.

With this information, we find it very odd that Crown Point Energy is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Crown Point Energy's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at the figures, it's surprising to see Crown Point Energy currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Crown Point Energy that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here