Market Wrap: Altcoins Underperform as Bearish Sentiment Rises

Don't miss CoinDesk's Consensus 2022, the must-attend crypto & blockchain festival experience of the year in Austin, TX this June 9-12.

Bitcoin (BTC) declined from a high of $30,658 during the New York trading day as buyers remained on the sidelines. The cryptocurrency is up by 3% over the past week, but has struggled to outperform a majority of alternative cryptos (altcoins).

Internet Computer's ICP token pared Thursday's gains and declined by 10% over the past 24 hours, compared with BTC's flat performance over the same period. Avalanche's AVAX token and Solana's SOL token were down by 4% on Friday, while Polkadot's DOT token rose by 4%.

Sentiment among crypto traders remains bearish, evidenced by a downtick in the bitcoin Fear & Greed Index over the past few days. The index moved deeper into "extreme fear" territory, similar to what occurred in January of this year, which preceded an upswing in BTC's price.

Still, technical indicators suggest limited upside for bitcoin, particularly at its 50-day moving average, currently at $34,177.

In traditional markets, the S&P 500 and Nasdaq declined on Friday as the 10-year Treasury yield ticked higher. Gold was also lower on Friday, and is down by 5% over the past three months, compared with a 25% loss in BTC and a 4% dip in the S&P 500 over the same period.

Latest prices

●Bitcoin (BTC): $29,548, −2.35%

●Ether (ETH): $1,749, −3.87%

●S&P 500 daily close: 4,108, −1.64%

●Gold: $1,854 per troy ounce, −0.69%

●Ten-year Treasury yield daily close: 2.96%

Short-term upswing?

Some analysts expect crypto prices to stabilize over the short term, which typically occurs after periods of significant price declines.

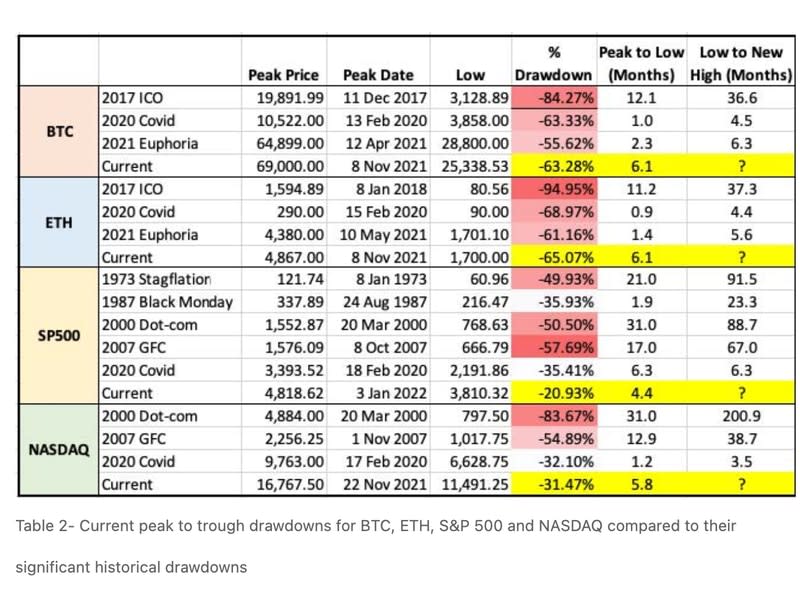

"For BTC and ETH, the current drawdown is now identical to the 2020 [COVID-19] drawdown. It is possible that we see a short-term bounce from these oversold levels," QCP Capital, a Singapore-based crypto trading firm wrote in a Friday report. A similar peak-to-trough decline occurred in the S&P 500 and Nasdaq, which could point to a short-term relief bounce in speculative assets.

Still, in 2017, it took roughly one year for BTC and ETH to reach a trough, which means upside could be limited until an absolute bottom in price occurs, according to QCP.

Bitcoin dominance intact

So far, some crypto traders have been reducing their exposure to risk. Typically, during down markets altcoins decline by more than bitcoin because of their greater risk profile. As a result, bitcoin's market cap rises relative to the total crypto market cap (dominance ratio) during bear markets.

The chart below shows a recent breakout in the BTC dominance ratio, similar to what occurred in 2018. That means a reversal of the risk-on environment over the past two years is underway. An increase in the dominance ratio toward 50% could offer some relief for altcoins relative to BTC, albeit within the context of a confirmed bearish cycle for cryptocurrencies.

For now, upside price moves are confined to short-term trading ranges.

Altcoin roundup

Chainlink expands to Solana: The blockchain oracle network said Friday that developers who build decentralized finance (DeFi) applications on the Solana mainnet can now incorporate seven of Chainlink’s price feeds into their products. Popular decentralized finance (DeFi) projects including Aave, Compound and dYdX already use Chainlink’s data services.

WAVES's wild ride: WAVES, a token based on the Waves public blockchain that enables users to access Web 3 apps, experienced a two-fold increase over the past week. “We have to work on the algorithm” after several depeggings from the dollar, founder Sasha Ivanov said on CoinDesk TV’s “First Mover” program earlier this week. WAVES is still down by 84% from its all-time high in March.

Volume stabilizes: "We have seen more balanced flows although it seems both buyers and sellers have been reluctant to get too aggressive, in our view. BTC and ETH continue to dominate trading volumes. Cardano's ADA saw larger volumes as its token climbed as much as 36% in the days leading up to month end," David Duong, head of institutional research at Coinbase, wrote in an email.

Relevant insight

Japan Passes Landmark Stablecoin Bill for Investor Protection: Report: The new legal framework will take effect in a year.

Middle East Oil Producers Move Into Bitcoin Mining With Crusoe Energy Stakes: The U.S. startup – which uses flared natural gas to power bitcoin mining rigs – counts the sovereign wealth funds of Abu Dhabi and Oman as investors.

Riot Blockchain Sells More Bitcoin, Trims Hashrate Guidance: It’s the miner’s third consecutive month of bitcoin sales.

Consumers Lost Over $1B to Crypto Fraud Since January 2021, FTC Says: Crypto is quickly becoming the "payment of choice for many scammers," says the agency.

Market Rout Prompts Analyst to Slash Bitcoin Miners’ Price Targets by Average of 65%: BTIG’s analyst remains positive on the longer-term outlook for the miners, however, and is sticking with his buy ratings for the stocks.

Crypto Firms, Especially Exchanges, Slash Jobs as Market Rout Continues: Many crypto companies are announcing substantial job cuts and hiring freezes amid challenging times for cryptocurrency and equity markets.

Opinion: Are Exchange Layoffs the First Sign of Crypto Winter, or Is It Already Over?: Coinbase, Gemini and other crypto exchanges are laying off employees. Things could get worse from here – but there’s reason to hope for a soft landing, according to CoinDesk's David Morris.

Opinion: Tackling the Quantum Threat to Bitcoin: It's time the crypto community faced up to the challenge of super-computing to their networks, according to Michael Casey, CoinDesk's chief content officer.

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Biggest Gainers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Stellar | +1.6% |

Biggest Losers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Internet Computer | −10.2% | ||

Polkadot | −5.6% | ||

Solana | −5.5% |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.