MarketAxess (MKTX) Boosts Trading for Emerging Market Bonds

MarketAxess Holdings Inc. MKTX recently announced the launch of Open Trading for local currency bonds of Poland, Czech Republic, Hungary and South Africa. This move enhances MKTX’s award-winning emerging market (EM) trading product, as traders can now trade in these bonds with an all-to-all solution. MKTX also completed the acquisition of Pragma, further enhancing its artificial intelligence-powered technology solutions for clients.

With the launch of Open Trading for the four local currency markets, MKTX’s offerings will be enhanced, thereby improving trader retention and satisfaction. As its end-to-end global EM offerings are improved, local dealers can connect to international buyers, and hence liquidity will improve. Improvement in liquidity will reinforce the main aim of an electronic trading platform i.e., to improve trading outcomes and lower transaction costs.

This move builds on MKTX’s Open Trading core value proposition of providing access to non-dealer counterparties, which are unavailable in traditional inter-dealer networks. This will further deliver real price improvements and improve efficiency in trading. The company’s acquisition of Pragma should boost the efficiency of its trading platform.

This move is expected to improve MKTX’s trading volume in the future. Higher trading volumes are expected to drive the company’s most significant top-line contributor, which is commissions. In the first half of 2023, EM local currency bonds contributed 40% to MKTX’s global EM volumes. Moreover, the company aims to expand Open Trading to more local currencies next year.

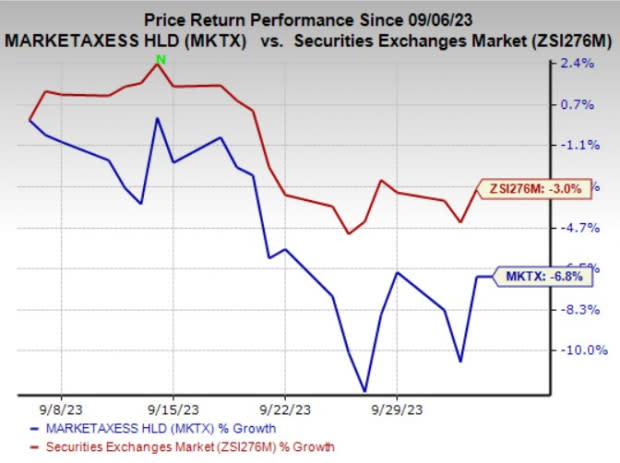

Shares of MarketAxess lost 6.8% in the past month compared with the industry’s 3% decline. Nevertheless, its strong fundamentals are likely to help shares bounce back in the days ahead.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Presently, MarketAxess carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Finance space include Axos Financial, Inc. AX, Houlihan Lokey, Inc. HLI and MidCap Financial Investment Corporation MFIC. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axos Financial’s earnings surpassed estimates in each of the last four quarters, the average surprise being 11.6%. The Zacks Consensus Estimate for AX’s 2023 earnings and revenues indicates a rise of 6.9% and 14.2%, respectively, from the year-ago actuals.

The bottom line of Houlihan Lokey beat estimates in three of the trailing four quarters, missing once, the average beat being 7.4%. The Zacks Consensus Estimate for HLI’s 2023 revenues indicates a rise of 2.8% from the year-ago tally. The consensus mark for HLI’s 2023 earnings has moved 0.2% north in the past 60 days.

MidCap Financial Investment’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 5.7%. The Zacks Consensus Estimate for MFIC’s 2023 earnings and revenues indicates a rise of 13.4% and 19.4% from the respective year-ago actuals. The consensus mark for MFIC’s 2023 earnings has moved 0.6% north in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

MidCap Financial Investment Corporation (MFIC) : Free Stock Analysis Report