Markforged Holding Corp (MKFG) Faces Revenue Decline Amidst Strong Cost Management in Q4 and ...

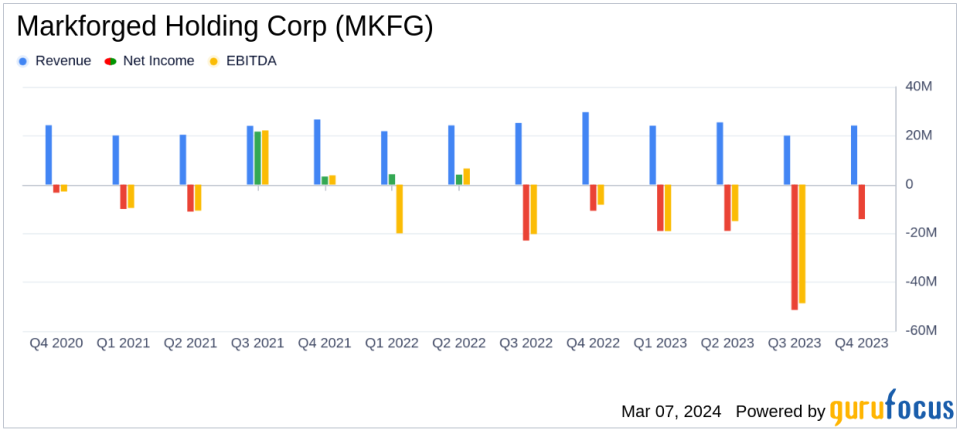

Revenue: Q4 revenue decreased to $24.2 million from $29.7 million in Q4 2022, while full-year revenue dropped to $93.8 million from $101.0 million.

Gross Margin: Improved sequentially to 48.4% in Q4 from 46.9%, with full-year gross margin at 47.4%, down from 50.2% in 2022.

Operating Expenses: Q4 operating expenses decreased to $31.1 million from $33.2 million, reflecting effective cost management.

Net Loss: Increased to $14.2 million in Q4 from $10.7 million in the same period last year, with a full-year net loss of $103.567 million.

Cash Position: Ended the year with $116.9 million in cash, cash equivalents, and short-term investments, down from $167.9 million at the end of 2022.

New CFO Appointment: Assaf Zipori officially assumes the role of Chief Financial Officer.

2024 Financial Outlook: Anticipates revenues between $95 - $105 million with non-GAAP gross margins in the range of 48% - 50%.

On March 7, 2024, Markforged Holding Corp (NYSE:MKFG) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for transforming manufacturing with its 3D metal and continuous carbon fiber printers, reported a sequential increase in gross margin and a decrease in operating expenses, demonstrating strong cost management despite a challenging macroeconomic environment.

Financial Performance and Challenges

Markforged's Q4 revenue saw a 20.4% sequential increase from the third quarter of 2023 but experienced a decline from the previous year's Q4 revenue of $29.7 million. The full-year revenue also saw a decrease to $93.8 million compared to $101.0 million in 2022. The company's gross margin improved sequentially to 48.4% in Q4, although there was a decrease in the full-year gross margin to 47.4% from 50.2% in the previous year. Operating expenses were reduced to $31.1 million in Q4, reflecting disciplined cost management.

Despite these efforts, Markforged faced a net loss of $14.2 million in Q4, which was greater than the net loss of $10.7 million in the same quarter of the previous year. The full-year net loss significantly increased to $103.567 million. The company ended the year with a strong cash position of $116.9 million, although this was a decrease from $167.9 million at the end of 2022. These financial challenges highlight the importance of Markforged's strategic focus on product innovation and operational efficiency to navigate a period of economic uncertainty.

Strategic Initiatives and Outlook

Markforged's CEO, Shai Terem, emphasized the company's positive momentum and strategic execution, particularly in the face of elevated interest rates affecting capital spending. The company's focus on reducing costs and building resilient supply chains is expected to drive long-term demand for its Digital Forge platform. Markforged's robust product portfolio, including the launch of three new products in 2023, positions the company for potential growth, especially in the latter half of 2024.

"We ended the year with positive momentum as we continued to execute our strategy to lead the adoption of additive manufacturing on the factory floor," said Shai Terem, President and CEO of Markforged. "We have a strong product portfolio and are encouraged by robust utilization across our global fleet network."

For the fiscal year 2024, Markforged anticipates revenues to be within the range of $95 - $105 million, with non-GAAP gross margins expected to be between 48% and 50%. The company projects a non-GAAP operating loss in the range of $42.5 million to $47.0 million for the year, resulting in a non-GAAP loss per share between $0.19 and $0.22.

Markforged's financial performance reflects its resilience in a challenging market and underscores the importance of innovation and cost control in the hardware industry. As the company continues to navigate economic headwinds, its strategic initiatives and strong product portfolio provide a foundation for potential growth and a path to profitability.

For more detailed information, investors and interested parties are encouraged to access the earnings press release and related materials on the company's investor relations website and to join the webcast and conference call discussing the results.

Markforged's commitment to strengthening manufacturing resiliency through its advanced 3D printing solutions remains central to its mission, as it aims to bring industrial production to the point of need for its diverse global customer base.

For further insights and analysis on Markforged Holding Corp's financial results and outlook, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Markforged Holding Corp for further details.

This article first appeared on GuruFocus.