Marqeta (NASDAQ:MQ) Exceeds Revenue Expectations In Q4

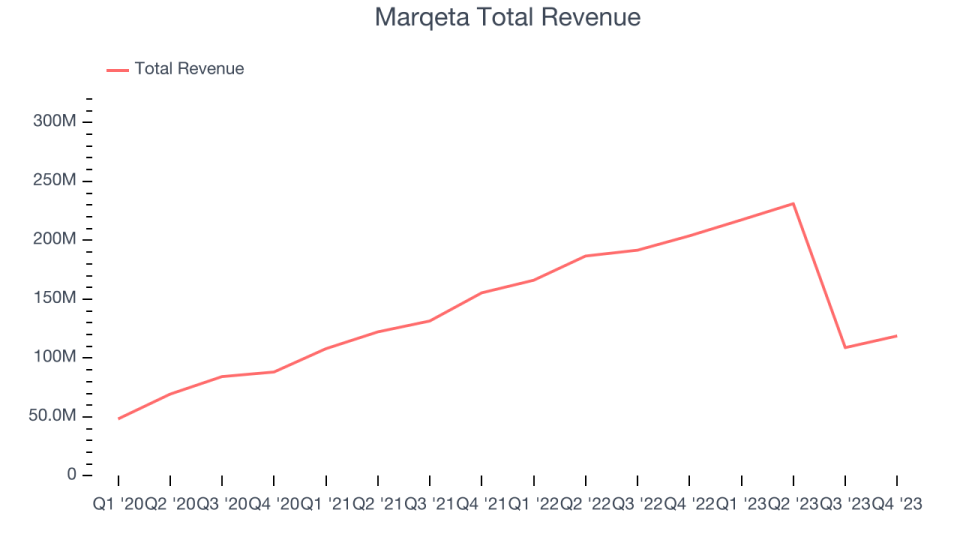

Leading edge card issuer Marqeta (NASDAQ: MQ) reported results ahead of analysts' expectations in Q4 FY2023, with revenue down 41.7% year on year to $118.8 million. It made a GAAP loss of $0.08 per share, down from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy Marqeta? Find out by accessing our full research report, it's free.

Marqeta (MQ) Q4 FY2023 Highlights:

Revenue: $118.8 million vs analyst estimates of $110.4 million (7.7% beat)

EPS: -$0.08 vs analyst estimates of -$0.08 (2.1% beat)

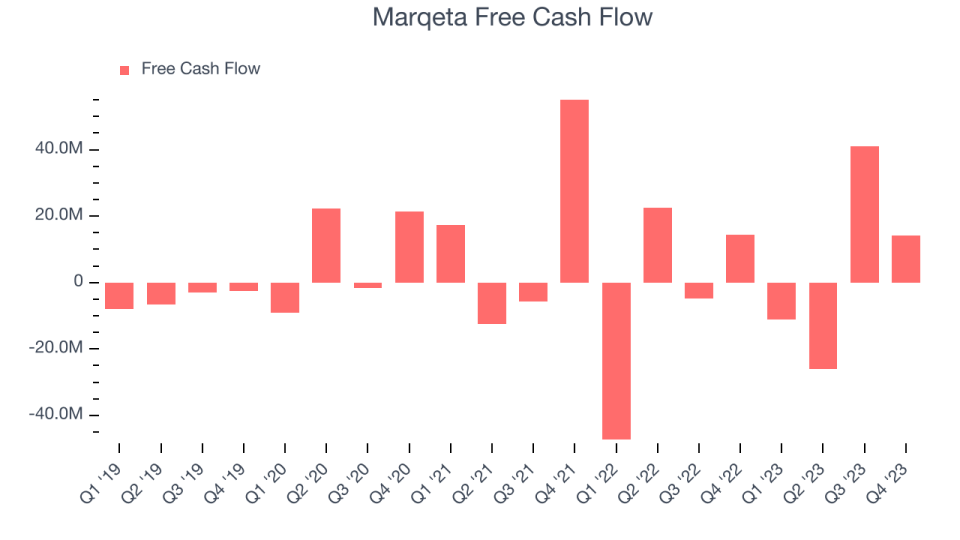

Free Cash Flow of $14.08 million, down 65.7% from the previous quarter

Gross Margin (GAAP): 70%, up from 42.7% in the same quarter last year

Market Capitalization: $3.72 billion

"2023 was transformative for Marqeta, as we enhanced our platform with new credit card program management capabilities, renewed the large majority of our processing volume to longer term deals, and delivered on operating efficiency," said Simon Khalaf, CEO at Marqeta.

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Sales Growth

Marqeta's revenue was down 41.7% year on year this quarter, primarily due to a contract renewal with Cash App and resulting change in revenue presentation. The impact of fees owed to Issuing Banks and Card Networks related to the Cash App primary Card Network volume is since Q3 netted against revenue earned from the Cash App program within Net Revenue, negatively impacting the growth rate. In prior periods, these costs were included within Costs of Revenue, so on the other hand Gross Margin has improved significantly.

This quarter, Marqeta's revenue was down 41.7% year on year, which might disappointment some shareholders.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Marqeta's free cash flow came in at $14.08 million in Q4, roughly the same as last year.

Marqeta has generated $17.94 million in free cash flow over the last 12 months, or 2.7% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Marqeta's Q4 Results

We were excited Marqeta's revenue outperformed Wall Street's estimates. Positive free cash flow is a plus, although some investors might want to see a stronger improvement. The market was likely expecting more, however, and the stock is down 4.4% after reporting, trading at $7.02 per share.

So should you invest in Marqeta right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.