Marriott’s Investor Day: 5 Top Slides From the Hotel Giant’s Presentation

Marriott last Wednesday gave a multi-hour, 144-slide presentation to investment analysts, providing insights into strategy at the world’s largest hotelier. Executives outlined their financial model through 2025.

Here are some key takeaways.

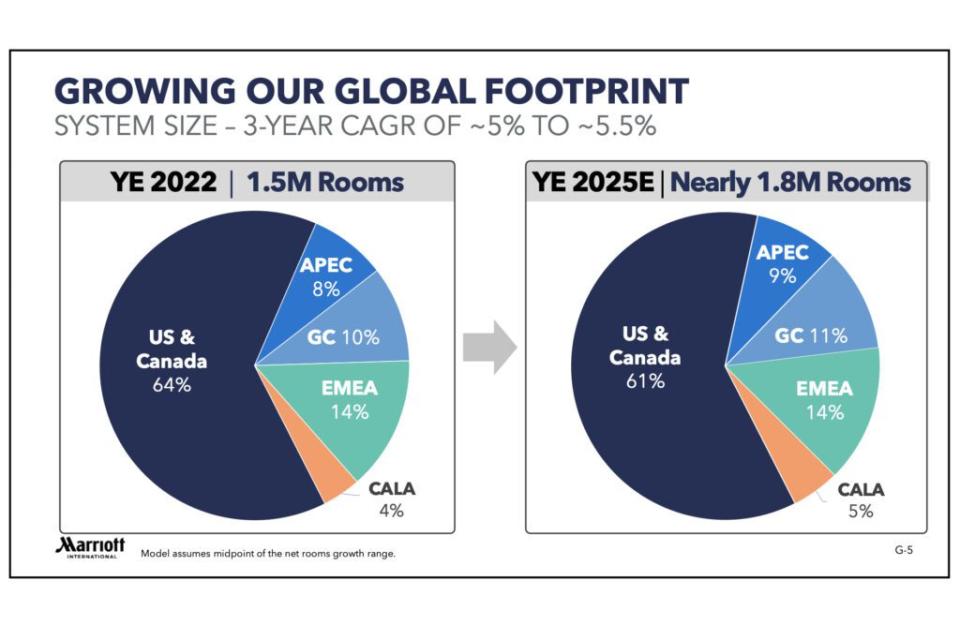

1. Marriott aims to grow its footprint.

Marriott plans to add about 230,000 to 270,000 net rooms over three years. This would represent a three-year compound average growth rate of 5% to 5.5%.

Net room expansion at that pace would represent a post-pandemic return to the company’s decade-long average for net room expansion.

The company also plans to spend as much as $870 million through 2025 to “support room growth.” I interpret “support rooms growth” to mean three things: It may acquire more small hotel groups, such as its recent acquisition of City Express; ;ike its recent MGM deal, it may do more co-marketing and licensing deals; and it may also create more hotel brands and collections.

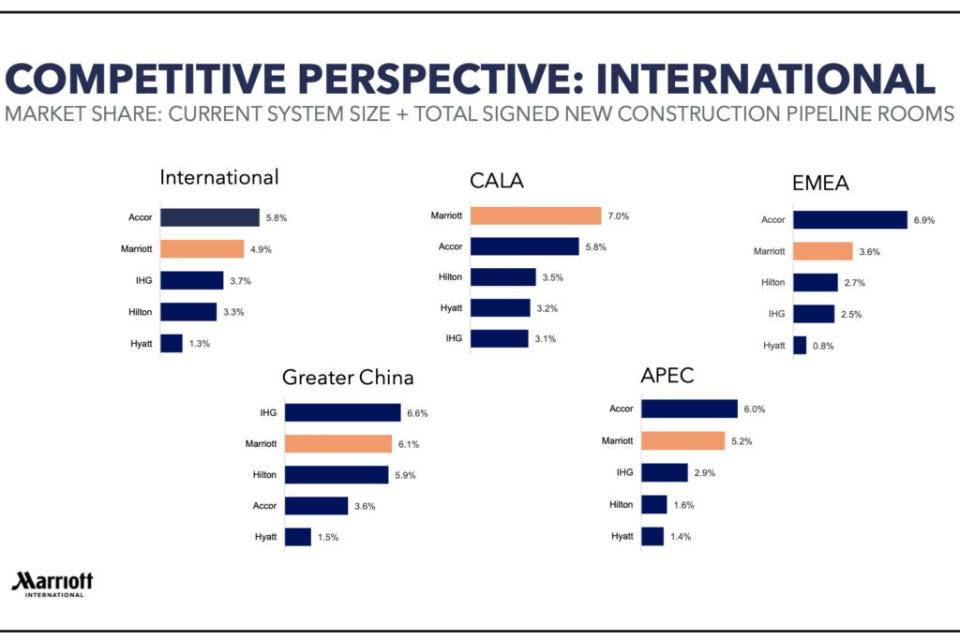

2. Marriott intends to become more global.

It has nearly doubled its presence in international markets since 2008.

Close to 40% of its rooms today are outside the U.S. and Canada.

By 2025, the U.S. and Canada may represent only a slim majority of the company’s total fees through franchise and management contracts worldwide.

3. Non-room revenue is increasingly significant.

The company forecasted average global growth in revenue per available room at between 3% and 6% between now and 2025.

But Marriott wants to grow its revenue from non-room sources, such as fees from its co-branded credit cards, timeshare royalty fees, and residential branding fees.

Today, nearly 20% of Marriott’s total fee revenue is derived from sources apart from traditional room bookings.

A decade-and-a-half ago, that share was only 5%.

Already in 2022, it generated $547 million in credit card fees, and that number will only grow.

4. Marriott sees luxury as an important part of its portfolio.

It has 497 luxury hotels open today.

It has 225 in its pipeline.

“We are leading in luxury distribution globally with 17% of the market — nearly one-and-a-half times the size of the next largest competitor,” said Tina Edmundson, president of luxury.

It said it had a 30% market share of open and under-construction rooms in the luxury segment in the U.S. and Canada.

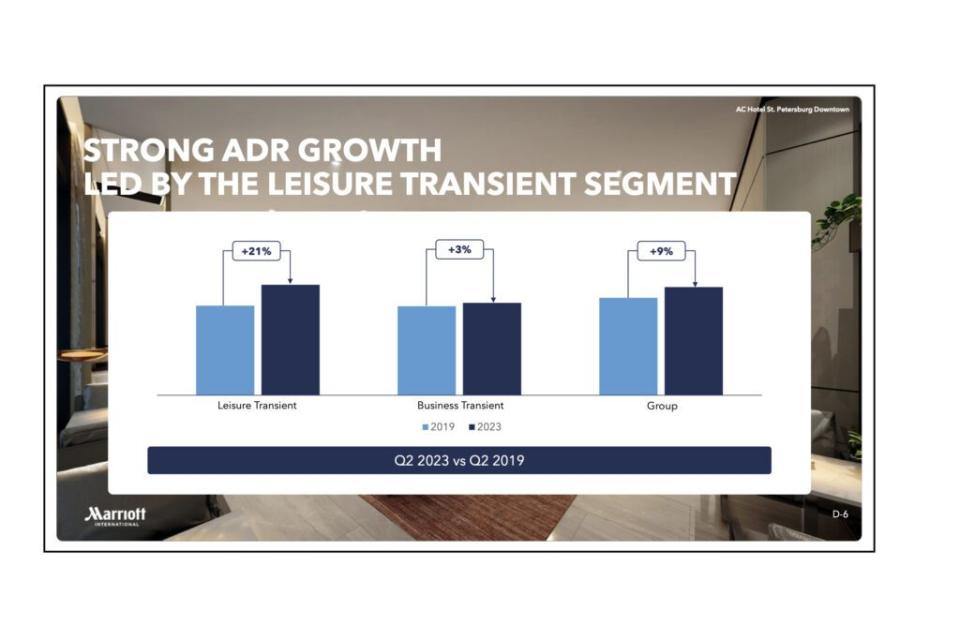

5. The era of hotel discounting may not return for quite some time.

Marriott has enjoyed strong pricing power even though occupancy levels haven’t returned to pre-pandemic levels worldwide on average.

In one chart (shown below), Pinto highlighted how Marriott’s systemwide comparable average daily rate as of June 30, exceeded the comparable figure as of June 30, 2019.

“In general, our philosophy is to avoid chasing occupancy and to be willing to trade some occupancy for average daily rate to drive overall hotel profitability,” said Drew Pinto, executive vice president and chief revenue and technology officer.

Instead of cutting room rates to woo customers, Marriott has been tending to drive short-term leisure demand through packages and promotions featuring benefits, such as credits for on-property amenities, like food and beverage or spa.

These campaigns produced $1.8 billion in revenue for its hotels year-to-date through August.

What do you think? Tell me. I’m at so@skift.com and on LinkedIn.

Get breaking travel news and exclusive hotel, airline, and tourism research and insights at Skift.com.