Marriott (MAR) Provides 3-Year Growth Plans, Repeats 2023 View

Marriott International, Inc. MAR announced is three-year financial model through 2025. The company also reiterated its 2023 outlook provided in August. Following the news, the stock gained 1.1% on Sep 27.

MAR has provided two-year compound annual growth rate (CAGR) projections for specific key performance indicators spanning from 2023 to 2025. It intends to increase its global portfolio to nearly 1.8 million rooms by the end of 2025 by adding between 230,000 and 270,000 net rooms over a three-year period, thereby maintaining its position as an industry leader. This signifies a three-year CAGR for net rooms of 5% to 5.5%.

Furthermore, the company's model anticipates global RevPAR 0growth to exhibit a two-year CAGR ranging from 3% to 6% between 2023 and 2025. This follows a notable rise of 12% to 14% for the current year.

Management projects total gross revenues to improve in the range of 16-18% year over year in 2023. The metric is suggested to jump at a two-year CAGR of 6.5-9.5% to reach $5.4-$5.8 billion in 2025.

Adjusted EBITDA is likely to increase in the range of 18-21% year over year in 2023. This metric is envisioned to rise at a two-year CAGR of 7-10% to reach $5.2-$5.7 billion in 2025.

In 2023, it is expected that adjusted earnings will see a year-over-year climb in the 25-29% band. It will grow at a CAGR of 10-15% over a two-year period, reaching in the range of $10.10-$11.45 by 2025.

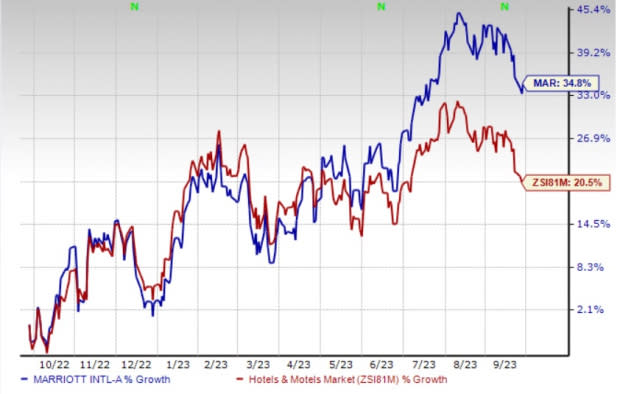

Image Source: Zacks Investment Research

Stock Performance

In the past year, the stock has gained 34.8% compared with the industry’s growth of 20.5%.

The Zacks Rank #3 (Hold) company is strongly focusing on its luxury and leisure offerings. Presently, it holds the top position in global luxury hotel distribution, boasting nearly 500 luxury hotels in operation, which accounts for approximately 17 percent of the market share.

This leads its nearest competitor by a significant margin, being approximately 1.5 times larger in size. MAR continues to concentrate on further strengthening its leading position, with an additional 225 luxury properties in development.

Key Picks

Live Nation Entertainment, Inc. LYV sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 34.6% on average. Shares of LYV have increased 2.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Hilton Worldwide Holdings Inc. HLT currently carries a Zacks Rank #2 (Buy). HLT has a trailing four-quarter earnings surprise of 12.5% on average. Shares of HLT have gained 19.1% in the past year.

The Zacks Consensus Estimate for HLT’s 2023 sales and EPS suggests jumps of 14.8% and 23.7%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW presently carries a Zacks Rank #2. OSW has a trailing four-quarter earnings surprise of 42.6% on average. Shares of OSW have improved 22.7% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS implies growth of 44.5% and 117.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report