Marriott Vacations (NYSE:VAC) Beats Q4 Sales Targets

Vacation ownership company Marriott Vacations (NYSE:VAC) beat analysts' expectations in Q4 FY2023, with revenue flat year on year at $1.19 billion. It made a non-GAAP profit of $1.88 per share, down from its profit of $2.74 per share in the same quarter last year.

Is now the time to buy Marriott Vacations? Find out by accessing our full research report, it's free.

Marriott Vacations (VAC) Q4 FY2023 Highlights:

Revenue: $1.19 billion vs analyst estimates of $1.15 billion (4.3% beat)

EPS (non-GAAP): $1.88 vs analyst estimates of $1.78 (5.7% beat)

Gross Margin (GAAP): 74.9%, down from 76.7% in the same quarter last year

Market Capitalization: $3.05 billion

“After a challenging year, we ended the year on a very positive note, growing contract sales by 4% in the fourth quarter on a year-over-year basis with VPG in-line with the prior year, after adjusting for the estimated impact of the Maui wildfires,” said John Geller, President and Chief Executive Officer.

Spun off from Marriott International in 1984, Marriott Vacations (NYSE:VAC) is a vacation company providing leisure experiences for travelers around the world.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

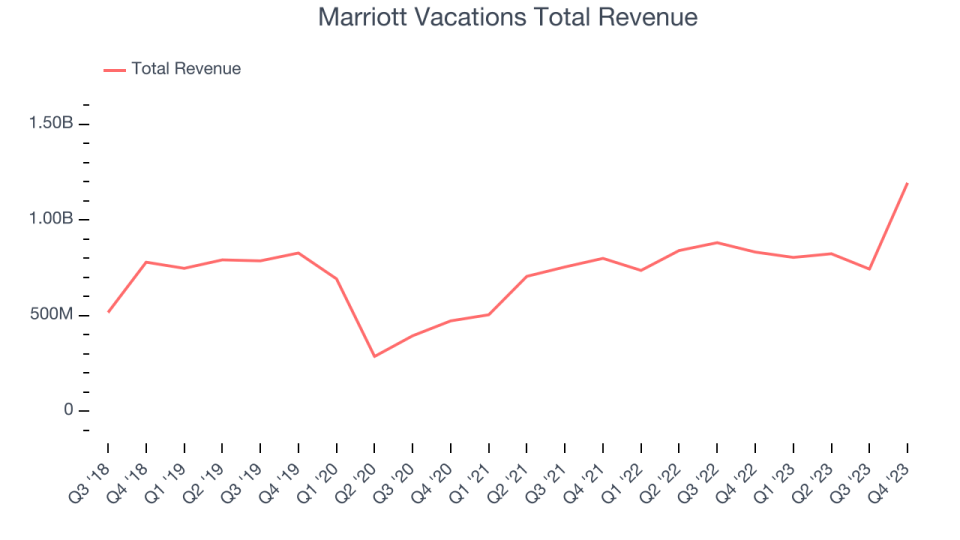

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Marriott Vacations's annualized revenue growth rate of 9.8% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Marriott Vacations's annualized revenue growth of 10.2% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

This quarter, Marriott Vacations's $1.19 billion of revenue was flat year on year but beat Wall Street's estimates by 4.3%. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Marriott Vacations has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer discretionary business, producing an average operating margin of 14.9%.

in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Key Takeaways from Marriott Vacations's Q4 Results

We enjoyed seeing Marriott Vacations exceed analysts' revenue expectations this quarter as its Vacation Ownership segment outperformed. We were also happy its adjusted EBITDA and EPS topped Wall Street's estimates. The company noted that the wildfires in Maui, Hawaii impacted its performance as it operates four resorts on the island. As a result, its contract sales declined 2% year on year during the quarter-without the fires, Marriott Vacations estimates it would have grown contract sales by 4%. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 3.9% after reporting and currently trades at $91 per share.

So should you invest in Marriott Vacations right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.