Marriott Vacations (VAC) Cheers Investors With 5% Dividend Hike

Marriott Vacations Worldwide Corporation VAC recently announced a hike in its quarterly dividend payout. The company raised its quarterly dividend by 5%, which reflects its intention to utilize free cash to boost shareholders’ returns.

VAC increased its quarterly dividend to 76 cents per share (or $3.04 annually) from the previous payout of 72 cents (or $2.88 annually). The hiked dividend will be paid out on (or around) Jan 4, 2024, to shareholders on record as of Dec 22, 2022.

Based on the closing price of $77.66 per share on Dec 7, 2023, the stock has a dividend yield of 3.9%. VAC’s payout ratio is 33, with a five-year dividend growth rate of 10.9%. Along with boosting shareholders’ returns, dividend hikes raise the market value of the stock. Companies often attract new investors and retain old ones through this strategy.

We appreciate Marriott Vacations' consistent efforts to enhance shareholder returns, despite the high inflation affecting most industries. These initiatives reflect the company’s business strength and the sustainability of its cash flows.

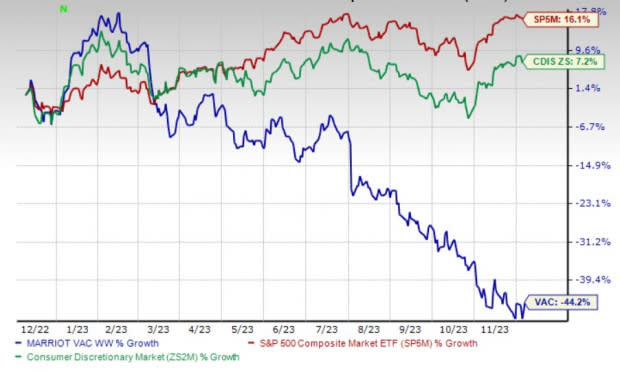

In the past year, this Zacks Rank #5 (Strong Sell) stock has declined 44.2% against the industry’s 7.2% growth.

What’s Driving the Dividend Policy?

Marriott Vacations has been witnessing improvement in occupancy rates, thereby highlighting people’s willingness to go on vacations. During the third quarter of 2023, the company reported solid occupancies (nearly 90%) with respect to its Vacation Ownership business. The upside was backed by solid demand for leisure travel. Also, strength in occupancy levels (despite a challenging macro environment) added to the positives.

On the Legacy-Welk side, VAC is aligning business models and sales processes for long-term improvement. Management is also focusing on driving new owner growth. In the third quarter of 2023, first-time buyers accounted for half of the tours and one-third of the total contract sales.

During the third quarter of 2023, Marriott Vacations launched the Hyatt Vacation Club brand, consolidating 22 former Hyatt Residence Club and Legacy-Welk resort properties into a unified brand. VAC also introduced the new BEYOND program, providing owners access to additional travel options like cruises and vacation experiences. This initiative aims to enhance owners’ satisfaction and boost participation in tours.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 112.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 57.7% and 187.9%, respectively, from the year-ago levels.

Live Nation Entertainment, Inc. LYV flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 37.5% on average. Shares of LYV have increased 17.4% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests an improvement of 28.6% and 132.8%, respectively, from the prior-year levels.

NIKE, Inc. NKE carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 27.1% on average. Shares of NKE have gained 4.9% in the past year.

The Zacks Consensus Estimate for NKE’s fiscal 2024 sales and EPS implies a climb of 3.7% and 15.8%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report