Marrone Bio Innovations (NASDAQ:MBII) shareholder returns have been favorable, earning 55% in 5 years

If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. But Marrone Bio Innovations, Inc. (NASDAQ:MBII) has fallen short of that second goal, with a share price rise of 55% over five years, which is below the market return. Over the last twelve months the stock price has risen a very respectable 9.7%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Marrone Bio Innovations

Marrone Bio Innovations wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Marrone Bio Innovations can boast revenue growth at a rate of 25% per year. Even measured against other revenue-focussed companies, that's a good result. It's nice to see shareholders have made a profit, but the gain of 9% over the period isn't that impressive compared to the overall market. That's surprising given the strong revenue growth. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

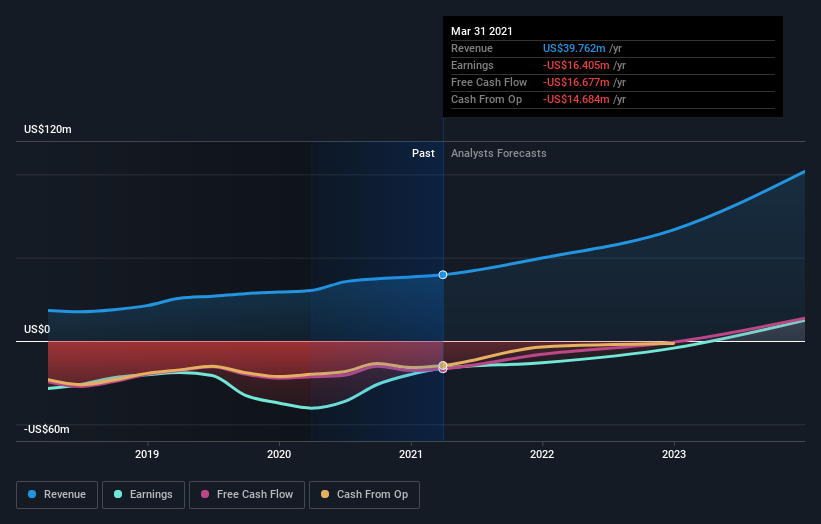

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Marrone Bio Innovations shareholders gained a total return of 9.7% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 9% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Marrone Bio Innovations has 2 warning signs we think you should be aware of.

But note: Marrone Bio Innovations may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.