Marsh & McLennan Companies Inc (MMC) Reports Strong 2023 Financial Results

Full-Year Revenue: Increased by 10% to $22.7 billion, with underlying growth of 9%.

Full-Year Adjusted Operating Income: Rose by 17% compared to the previous year.

Full-Year GAAP EPS: Grew by 25% to $7.53, with adjusted EPS up 17% to $7.99.

Fourth Quarter Highlights: GAAP EPS at $1.52, with adjusted EPS climbing 14% to $1.68.

Acquisitions: Significant acquisition activity in 2023, including the purchase of Honan Insurance Group.

Share Repurchase: MMC repurchased 6.4 million shares for $1.15 billion in 2023.

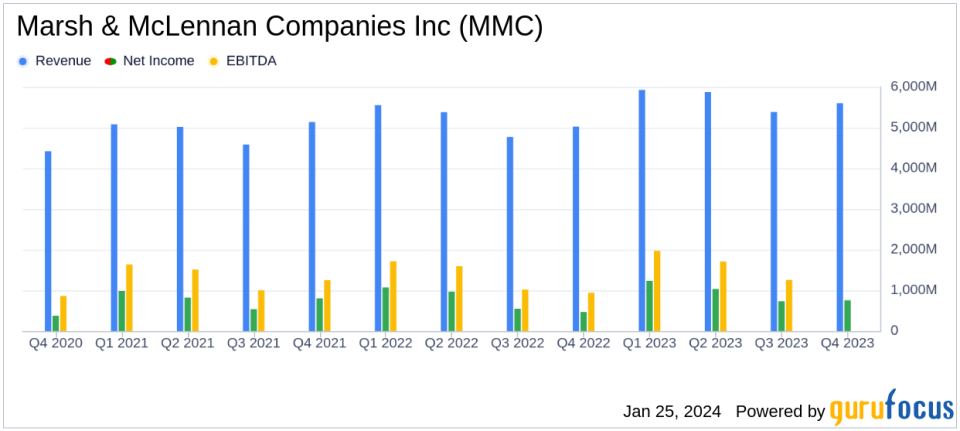

On January 25, 2024, Marsh & McLennan Companies Inc (NYSE:MMC) released its 8-K filing, announcing robust financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in professional services in risk, strategy, and people, reported a full-year revenue increase of 10% to $22.7 billion, with underlying revenue growth of 9%. MMC's full-year GAAP operating income surged by 23%, while adjusted operating income saw a 17% increase. The full-year GAAP earnings per share (EPS) grew by 25% to $7.53, with adjusted EPS up by 17% to $7.99.

Marsh & McLennan operates through two segments: Risk and Insurance Services and Consulting. The Risk and Insurance Services segment, which includes Marsh and Guy Carpenter, reported an 11% revenue increase to $14.1 billion for the year. Marsh's revenue grew by 8%, with Guy Carpenter's revenue up by 12%. The Consulting segment, which includes Mercer and Oliver Wyman, also saw a 7% revenue increase to $8.7 billion for the year.

President and CEO John Doyle commented on the company's performance, stating, "Our fourth quarter results highlight a strong finish to another outstanding year for Marsh McLennan." He emphasized the company's 16th consecutive year of reported margin expansion and noted the strategic investments made throughout the year, positioning MMC well for 2024.

Our results and investments have us well positioned for 2024 as we remain focused on supporting our clients and helping them thrive," said John Doyle.

MMC's fourth-quarter revenue stood at $5.6 billion, an 11% increase over the same period in the previous year, with underlying growth at 7%. The quarter's operating income reached $1.1 billion, and adjusted operating income rose by 16% to $1.2 billion. Net income attributable to the company was $756 million, with earnings per share increasing by 63% to $1.52. Adjusted earnings per share for the quarter increased by 14% to $1.68.

The company's financial achievements, particularly the consistent margin expansion and EPS growth, underscore its operational efficiency and strategic focus in a competitive insurance industry. These metrics are crucial as they reflect the company's profitability and ability to deliver value to shareholders.

During the year, MMC continued its strategic acquisitions, including the purchase of Honan Insurance Group, which expands its presence in Australia and New Zealand. The company also repurchased 6.4 million shares for $1.15 billion, demonstrating confidence in its financial stability and commitment to delivering shareholder value.

Marsh & McLennan's balance sheet remains robust, with total assets of $32.5 billion and total liabilities of $19.9 billion as of December 31, 2023. The company's cash flow from operations for the year was $3.5 billion, highlighting its strong liquidity position and ability to fund operations and growth initiatives.

In conclusion, Marsh & McLennan Companies Inc (NYSE:MMC) has reported a strong financial performance for 2023, with significant revenue growth and profitability. The company's strategic investments and share repurchase program reflect its commitment to long-term growth and shareholder returns. As MMC moves into 2024, it remains well-positioned to continue its trajectory of success in the professional services industry.

Explore the complete 8-K earnings release (here) from Marsh & McLennan Companies Inc for further details.

This article first appeared on GuruFocus.