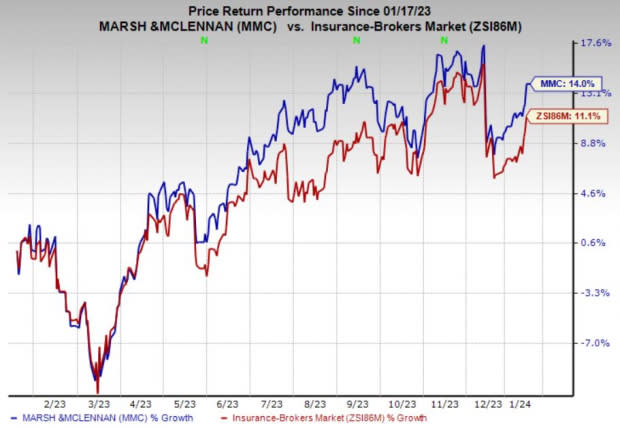

Marsh & McLennan (MMC) Up 14% in a Year: Upside Potential Left?

Shares of Marsh & McLennan Companies, Inc. MMC have jumped 14% in the past year compared with the 11.1% increase of the industry, courtesy of strong international operations of the Marsh business and contributions from the Consulting unit in the form of expanding Wealth, Health and Career solutions.

Headquartered in New York, Marsh & McLennan is a leading insurance broker. MMC has a market cap of $96.6 billion and operates in 130 countries. Its strong Risk and Insurance Services segment and a highly active inorganic growth strategy are major tailwinds. All these factors collectively contributed to this Zacks Rank #3 (Hold) company's notable price appreciation.

Image Source: Zacks Investment Research

Can It Retain Momentum?

The ingredients are there, and now let’s get into the details and show you how its estimates for the coming days stand.

The Zacks Consensus Estimate for 2023 earnings per share currently stands at $7.92, indicating a 15.6% increase from the year-ago reported figure. MMC’s earnings beat estimates in each of the last four quarters, the average being 6.5%.

The consensus mark for full-year 2023 revenues stands at nearly $22.7 billion, suggesting a 9.6% rise from the prior-year reported number. Our model indicates 2023 revenues from Marsh, Guy Carpenter, Mercer and Oliver Wyman to increase 8.1%, 8.4%, 4% and 11.8%, respectively.

Marsh & McLennan’s Risk and Insurance Services business, which accounts for the majority of the revenues, is expected to register exponential growth in the coming days, primarily on the back of its Marsh unit. Growth in the Latin America and Asia regions is expected to buoy its results. We expect revenues from the EMEA region to cross the $3.2 billion mark.

As economies continue their recovery, MMC's Consulting business is poised to thrive. Sales in the Career sub-segment are expected to climb, with more and more individuals joining the working population.

Strategic acquisitions fuel Marsh and McLennan's growth. MMC consistently makes purchases across its operating units to enter new regions, expand existing ones, venture into new businesses, develop segments and specialize within its current operations. Its business, Oliver Wyman, agreed to buy SeaTec Consulting last month, which will boost its position in the aviation space. Also, in the last month, its Mercer business agreed to buy the outsourced chief investment officer business of Vanguard.

Its dividend yield is higher than the industry average. In July 2023, its board of directors approved a 20% hike in the quarterly dividend, reflecting the 14th consecutive year of dividend increase. The company had roughly $3.4 billion left under its share buyback fund as of Sep 30, 2023.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

Rising operating expenses are eating into its margins. Due to its vast presence in so many countries, foreign exchange rate movements play a crucial role in its top line. Also, a high debt load of $11.8 billion and low cash and cash equivalents of $2.9 billion remain a woe. Nevertheless, we believe that a systematic and strategic plan of action will drive its long-term growth.

Key Picks

Investors interested in the broader Finance space can look at some better-ranked stocks like Ryan Specialty Holdings, Inc. RYAN, Chubb Limited CB and Brown & Brown, Inc. BRO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ryan Specialty’s 2023 full-year earnings indicates a 20.9% year-over-year increase. It beat earnings estimates in two of the past four quarters and met twice, with an average surprise of 5.1%. Also, the consensus mark for RYAN’s 2023 full-year revenues suggests 20.2% year-over-year growth.

The consensus mark for Chubb’s 2023 full-year earnings indicates a 26.4% year-over-year increase. It beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 6.5%. Furthermore, the consensus estimate for CB’s 2023 full-year revenues suggests 13.4% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s 2023 full-year earnings is pegged at $2.76 per share, which indicates 21.1% year-over-year growth. The estimate remained the same in the past week. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 12.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report