Marsh & McLennan (MMC) Q2 Earnings Beat on Solid Marsh Business

Marsh & McLennan Companies, Inc. MMC reported second-quarter 2023 adjusted earnings per share of $2.20, which beat the Zacks Consensus Estimate by 3.8%. The bottom line improved 16% year over year.

Consolidated revenues of MMC advanced 9% year over year to $5,876 million. The figure rose 11% on an underlying basis in the quarter under review. The top line outpaced the consensus mark by 2.5%.

Strong performance of the Risk and Insurance Services segment, led by the Marsh business' robust international operations, aided the quarterly results of Marsh & McLennan. A well-performing Consulting unit also contributed to the upside. However, an elevated expense level acted as a partial offset to the results.

Total operating expenses of $4,419 million escalated 10.1% year over year in the second quarter due to increased compensation and benefits and, other operating expenses. Total expenses increased 9.3% year over year at the Risk and Insurance Services segment, while the same in the Consulting segment witnessed a 10.9% year-over-year increase.

Adjusted operating income improved 17% year over year to $1,540 million but missed our estimate of $1,701.3 million. The adjusted operating margin of 27.7% improved 100 basis points year over year in the quarter under review but came lower than our estimate of 30.2%.

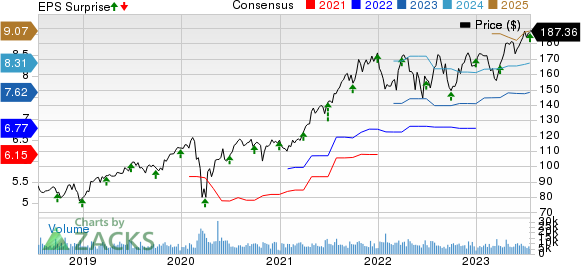

Marsh & McLennan Companies, Inc. Price, Consensus and EPS Surprise

Marsh & McLennan Companies, Inc. price-consensus-eps-surprise-chart | Marsh & McLennan Companies, Inc. Quote

Segmental Performances

Risk and Insurance Services

The segment recorded revenues of $3,722 million in the second quarter, which advanced 12% year over year, or 13% on an underlying basis. The metric outpaced our estimate of $3,555.3 million. Adjusted operating income climbed 18% year over year to $1,198 million but fell short of our estimate of $1,230.5 million.

Revenues of Marsh, a unit within the segment, came in at $3,038 million, higher than our estimate of $2,779.9 million. The reported figure rose 9% year over year, or 10% on an underlying basis, in the quarter under review. In the United States/Canada, underlying revenues improved 9% year over year. International operations registered underlying revenue growth of 10%. Among the international operations, Latin America witnessed the highest underlying revenue growth of 17%, followed by increases of 11% in EMEA and 6% in Asia Pacific.

Guy Carpenter’s (another unit within the Risk and Insurance Services segment) revenues advanced 10% year over year, or 11% on an underlying basis, to $576 million in the second quarter. Yet, the reported figure missed our estimate of $690.6 million.

Consulting

The segment’s revenues of $2,172 million grew 4% year over year, or 8% on an underlying basis. The figure surpassed our estimate of $2,095.3 million. Adjusted operating income increased 9% year over year to $403 million in the second quarter.

Revenues of Mercer, a unit within this segment, dipped 1% year over year but rose 6% on an underlying basis to $1,374 million. However, it fell short of our estimate of $1,378.8 million. Wealth revenues registered year-over-year growth of 3% on an underlying basis in the quarter under review. Meanwhile, Health and Career revenues improved 10% and 6%, respectively, on an underlying basis.

Another unit under the Consulting segment, Oliver Wyman Group, reported revenues of $798 million, up 15% year over year, or 11% on an underlying basis. It also outpaced our estimate of $716.5 million.

Financial Update (as of Jun 30, 2023)

Marsh & McLennan exited the second quarter with cash and cash equivalents of $1,171 million, which tumbled 18.8% from the 2022-end level. Total assets of $46,566 million increased 5.6% from the figure at 2022 end.

Long-term debt amounted to $10,247 million, down 8.7% from the figure as of Dec 31, 2022. Short-term debt of $2,375 million increased nearly ninefold from the 2022-end figure.

Total equity grew 12.9% from the 2022-end level to $12,139 million.

MMC generated cash flows from operations of $665 million in the first half of 2023, which advanced 14.7% from the prior-year comparable period’s level.

Capital Deployment Update

In the second quarter, Marsh & McLennan bought back 1.7 million shares worth $300 million.

Management approved a hike of 20% in the quarterly dividend in July 2023. The increased dividend amounting to 71 cents per share will be paid out on Aug 15, 2023, to shareholders of record as of Jul 27, 2023.

Zacks Rank

Marsh & McLennan currently carries a Zacks Rank #2 (Buy).

Upcoming Releases

Here are three other companies from the insurance space that are likely to report their respective quarterly earnings soon.

American Equity Investment Life Holding Company AEL has an earnings ESP of +1.70% and a Zacks Rank #2, at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for AEL’s second-quarter 2023 earnings stands at $1.67 per share, implying 70.4% surge from the year-ago quarter’s reported figure. American Equity’s earnings beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 13.01%.

Brown & Brown, Inc. BRO has an Earnings ESP of +4.10% and a Zacks Rank #3 (Hold) at present. The Zacks Consensus Estimate for BRO’s second-quarter 2023 earnings is pegged at 59 cents per share, which indicates an improvement of 15.7% from the year-ago quarter’s reported figure.

Brown & Brown’s earnings beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 1.19%.

Aon plc AON has an earnings ESP of +2.56% and a Zacks Rank of 3, at present. The Zacks Consensus Estimate for AON’s second-quarter 2023 earnings stands at $2.82 per share, suggesting a 7.2% rise from the year-ago quarter’s reported figure.

Aon’s earnings beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 1.64%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report