Can Marsh & McLennan (MMC) Q3 Earnings Beat on Consulting Boost?

Marsh & McLennan Companies, Inc. MMC is set to continue its earnings beat streak for the third quarter of 2023, the results for which are scheduled to be released on Oct 19, before the opening bell.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter earnings per share of $1.38 has witnessed two upward revisions in the past week against one movement in the opposite direction. The estimate is indicative of a 17% increase from the year-ago quarter’s reported earnings of $1.18 per share. The consensus estimate for revenues is pegged at $5.2 billion, suggesting a rise of 8.8% from the year-ago quarter’s reported figure.

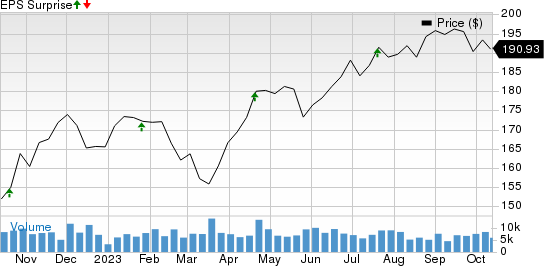

Marsh & McLennan’s earnings beat estimates in all the trailing four quarters, the average surprise being 3.4%. This is depicted in the graph below.

Marsh & McLennan Companies, Inc. Price and EPS Surprise

Marsh & McLennan Companies, Inc. price-eps-surprise | Marsh & McLennan Companies, Inc. Quote

What the Quantitative Model Suggests

Our proven model predicts a likely earnings beat for Marsh & McLennan this time around as well. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is precisely the case here.

Earnings ESP: Marsh & McLennanhas anEarnings ESP of +0.56%. This is because the Most Accurate Estimate is currently pegged at $1.39 per share, higher than the Zacks Consensus Estimate of $1.38 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Marsh & McLennan currently has a Zacks Rank #3.

Before we get into what to expect for the to-be-reported quarter in detail, it’s worth taking a look at MMC’s previous-quarter performance first.

Q2 Earnings Rewind

In the last reported quarter, this globally leading insurance broker company’s adjusted earnings per share of $2.20 beat the Zacks Consensus Estimate by 3.8%, primarily on the back of strong performance in the Risk and Insurance Services segment, led by the Marsh business' robust international operations. A well-performing Consulting unit also contributed to the upside. However, an elevated expense level acted as a partial offset to the results.

Now, let us see how things have shaped up prior to the third-quarter earnings announcement.

Factors Driving Q3 Performance

The third-quarter top-line performance of Marsh & McLennan is anticipated to have been boosted by robust showings in its Risk and Insurance Services, as well as Consulting segments. The Risk and Insurance Services segment is expected to have gained on the back of solid contributions from its Marsh and Guy Carpenter sub-divisions. MMC's performance in the third quarter is likely to have received a significant boost from robust operations in the international market, with a particular focus on Latin America and Asia.

The Zacks Consensus Estimate for revenues from the Risk and Insurance Services segment indicates a rise of 11.3% from the prior-year quarter’s level of $2,838 million, whereas our estimate suggests a 12% jump. Also, the consensus mark for the segment’s adjusted operating income suggests an almost 23% increase from the prior-year quarter’s figure of $562 million, whereas our model indicates a nearly 27% rise.

The Consulting segment of Marsh & McLennan is anticipated to have gained momentum in the third quarter, driven by the impressive performance of its sub-unit, Oliver Wyman. The performance of the Oliver Wyman sub-unit is likely to have been bolstered by several strategic acquisitions aimed at enhancing its capabilities and expanding its geographic presence. Also, sequentially improving returns from Wealth and Health operations are likely to have aided the Mercer (another sub-unit of the Consulting segment) business in the to-be-reported quarter.

The Zacks Consensus Estimate for revenues of the Mercer sub-division indicates a 4.6% increase from the prior-year quarter’s level of $1,284 million, while the same for the Oliver Wyman business' revenues indicates 6% growth.

The Zacks Consensus Estimate for the overall Consulting segment’s revenues indicates growth of more than 5% from the prior-year quarter’s $1,951 million, whereas our estimate for the metric suggests a 4.5% rise. Also, the consensus mark for the segment’s adjusted operating income is pegged at $384.8 million, suggesting 6.3% growth from the year-ago quarter’s reported number.

The factors stated above are expected to have positioned the company for not only year-over-year growth in the third quarter but also a likely earnings beat. However, the positives are anticipated to be partially offset by increasing expenses. Our estimate for total operating expenses in the quarter under review suggests a 7.6% year-over-year jump.

Other Stocks That Warrant a Look

Here are some other companies worth considering from the broader Finance space, as our model shows that these, too, have the right combination of elements to beat on earnings this time around:

Aon plc AON has an Earnings ESP of +1.12% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AON’s bottom line for the to-be-reported quarter is pegged at $2.24 per share, which witnessed one upward estimate revision in the past week against none in the opposite direction. The consensus estimate for AON’s revenues is pegged at $2.9 billion, suggesting a 6.7% increase from a year ago.

Brown & Brown, Inc. BRO has an Earnings ESP of +4.92% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Brown & Brown’s bottom line for the to-be-reported quarter is pegged at 61 cents per share, indicating 22% year-over-year growth. The estimate remained stable over the past week. BRO beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 4%.

The Hartford Financial Services Group, Inc. HIG has an Earnings ESP of +1.61% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Hartford Financial’s bottom line for the to-be-reported quarter is pegged at $1.95 per share, suggesting a 35.4% year-over-year increase. The estimate witnessed three upward estimate revisions in the past week against one in the opposite direction. HIG beat earnings estimates in three of the past four quarters and met once, with an average surprise of 9.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report