Marsh & McLennan's (MMC) Unit Divests Atlas to Stoch Analytics

Marsh & McLennan Companies, Inc.’s MMC business, Oliver Wyman, recently announced the acquisition of its Atlas Software business by Stoch Analytics. Stoch Analytics Limited is a newly formed private firm and was earlier a business of Oliver Wyman.

Oliver Wyman Actuarial Consulting and Oliver Wyman will continue their partnership with Stoch Analytics in the future, further benefiting from its expertise. Atlas is a modeling platform based on the cloud used by companies in the Life insurance space for carrying out valuation, pricing, and asset liability management. Regulatory changes for Life and Retirement insurers will further foster the growth of analytical solutions.

This move bodes well for MMC’s Oliver Wyman, as it will be able to serve clients better with the help of Stoch Analytics. Stoch Analytics will be able to focus more on the development and delivery of risk management and actuarial solutions. Lately, the demand for performing complex modeling has increased for life insurers. Hence, to be able to serve this gap in the market bodes well for MMC. Atlas, being one of the most efficient and fast modeling platforms, should help insurers in decreasing their cloud expenditure and augmenting their actuarial and financial resources.

Stoch Analytics’ solutions will now include the Atlas software solutions and iReplicate policyholder compression tool, helping shorten the model runtime by 90% or more. Oliver Wyman is a faster-growing business for MMC. It expects business to register growth in mid-to-high-single digits over the long term. We expect Oliver Wyman’s revenues to grow at a three-year CAGR of 7.9% by 2025.

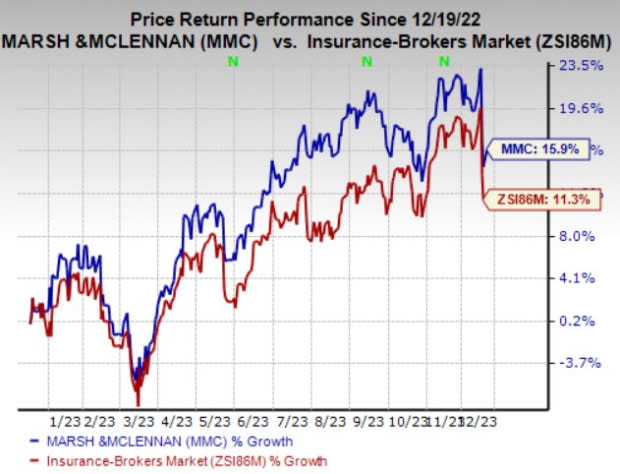

Price Performance

Shares of Marsh & McLennan have soared 15.9% in the past year compared with the industry’s 11.3% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Marsh & McLennan currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Finance space are Assurant, Inc. AIZ, Brown & Brown, Inc. BRO and Arthur J. Gallagher & Co. AJG. While Assurant currently sports a Zacks Rank #1 (Strong Buy), Brown & Brown and Arthur J. Gallagher carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Assurant’s current-year earnings indicates a 30.8% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 42.4%. Also, the consensus mark for AIZ’s 2023 revenues suggests 5.4% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $2.76 per share, which indicates 21.1% year-over-year growth. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 12.3%. Also, the consensus mark for BRO’s 2023 revenues suggests 17.9% year-over-year growth.

The consensus mark for Arthur J. Gallagher’s current-year earnings indicates a 13.4% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 2.2%. Furthermore, the consensus estimate for AJG’s 2023 revenues suggests 18.2% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report