Marten Transport Ltd (MRTN) Faces Headwinds as Q4 Earnings Dip

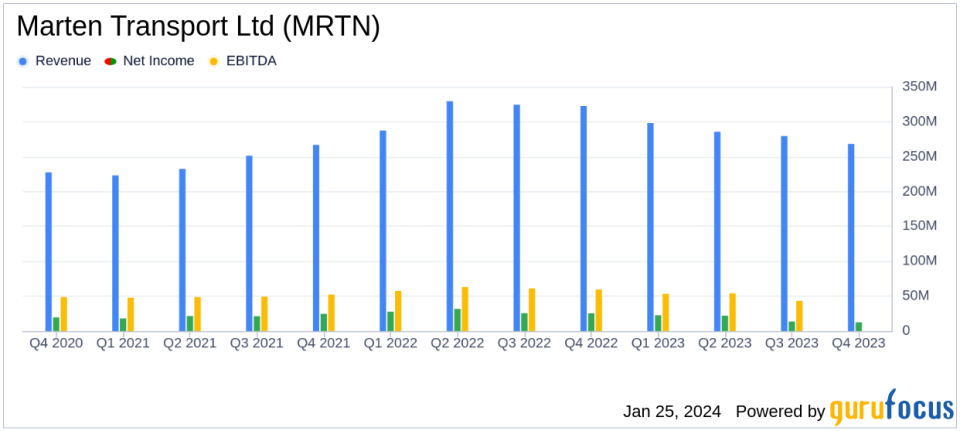

Net Income: Q4 net income fell to $12.4 million from $25.5 million in the prior year.

Operating Revenue: Q4 operating revenue decreased to $268.2 million, down from $322.6 million year-over-year.

Operating Income: Operating income for Q4 dropped to $15.7 million from $32.8 million in the same quarter last year.

Operating Ratio: Q4 operating expenses as a percentage of operating revenue increased to 94.2% from 89.8% year-over-year.

Annual Performance: 2023 annual net income was $70.4 million, a decrease from $110.4 million in 2022.

Marten Transport Ltd (NASDAQ:MRTN) released its 8-K filing on January 25, 2024, revealing a challenging quarter and year-end financial performance. The company, a leading temperature-sensitive truckload carrier in the United States, reported a significant decline in net income and operating revenue for both the fourth quarter and the full year of 2023 compared to the previous year. This performance reflects the broader challenges faced by the transportation industry, including a freight market recession, inflationary operating costs, and decreased freight rates.

Company Overview

Marten Transport Ltd operates through four segments: Truckload, Dedicated, Intermodal, and Brokerage, with the Truckload segment being the primary revenue generator. The company specializes in transporting and distributing food, beverages, and other consumer packaged goods that require a temperature-controlled or insulated environment. Marten's services span the United States, Mexico, and Canada, focusing on expedited movements for high-volume customers.

Financial Performance and Challenges

The fourth quarter saw net income halve to $12.4 million, or 15 cents per diluted share, from $25.5 million, or 31 cents per diluted share, in the same quarter of the previous year. Operating revenue for the quarter fell to $268.2 million from $322.6 million year-over-year. When excluding fuel surcharges, the decrease was from $269.7 million to $229.4 million. The company's operating income also suffered, dropping to $15.7 million from $32.8 million in the fourth quarter of 2022.

For the full year, Marten Transport reported a net income of $70.4 million, or 86 cents per diluted share, down from $110.4 million, or $1.35 per diluted share, for 2022. The annual operating revenue decreased to $1.131 billion from $1.264 billion. Operating income for the year was $90.1 million, a decline from $143.3 million in the previous year.

Executive Chairman Randolph L. Marten commented on the results, stating:

This quarters earnings were heavily pressured by the freight market recessions weak demand and oversupply, inflationary operating costs, and cumulative impact of decreased freight rates leading to freight network disruptions. Additionally, our higher insurance and claims and health insurance expense and less revenue equipment gains reduced our operating income by $4.8 million, or 4.4 cents per diluted share, from this years third quarter.

Financial Achievements and Industry Significance

Despite the downturn, Marten Transport's commitment to not agreeing to any rate reductions since last August highlights the company's focus on maintaining the value of its premium services. The transportation industry, particularly the temperature-sensitive truckload sector, is highly competitive and sensitive to market fluctuations. Marten's ability to navigate these challenges without compromising on rates underscores its strategic approach to financial management and its dedication to quality service.

Analysis and Outlook

The increase in operating expenses as a percentage of operating revenue, both including and excluding fuel surcharges, indicates rising costs and margin pressures. The company's operating ratio worsened, with a year-over-year increase from 89.8% to 94.2% for the quarter and from 88.7% to 92.0% for the full year. These figures suggest that Marten Transport is facing an uphill battle in managing its expenses relative to its revenue.

However, Marten Transport's solid balance sheet, with an increase in total assets from $965.679 million to $990.339 million year-over-year, provides some financial stability. The company's cash and cash equivalents decreased from $80.6 million to $53.2 million, reflecting the challenging operating environment.

As the market moves toward equilibrium from its current recessionary late stages, Marten Transport remains focused on minimizing the freight market's impact on its operations and investing in opportunities for profitable organic growth. The company's resilience and strategic initiatives will be key factors in its recovery and future performance.

For detailed financial tables and further information, please refer to the full 8-K filing.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Marten Transport Ltd for further details.

This article first appeared on GuruFocus.