Martin Marietta Materials Inc (MLM): A Deep Dive into Financial Metrics and Competitive Strengths

Martin Marietta Materials Inc (NYSE:MLM) has recently been in the spotlight, drawing interest from investors and financial analysts due to its robust financial stance. With shares currently priced at $416.07, Martin Marietta Materials Inc has witnessed a daily gain of 2.9%, marked against a three-month change of -8.18%. A thorough analysis, underlined by the GF Score, suggests that Martin Marietta Materials Inc is well-positioned for substantial growth in the near future.

What Is the GF Score?

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

Here are the key components of Martin Marietta Materials Inc's GF Score:

Financial strength rank: 5/10

Profitability rank: 9/10

Growth rank: 10/10

GF Value rank: 5/10

Momentum rank: 9/10

Each one of these components is ranked and the ranks also have positive correlation with the long term performances of stocks. The GF score is calculated using the five key aspects of analysis. Through backtesting, we know that each of these key aspects has a different impact on the stock price performance. Thus, they are weighted differently when calculating the total score. With a high profitability rank and growth rank, and a moderate financial strength rank, GuruFocus assigned Martin Marietta Materials Inc the GF Score of 92 out of 100, which signals the highest outperformance potential.

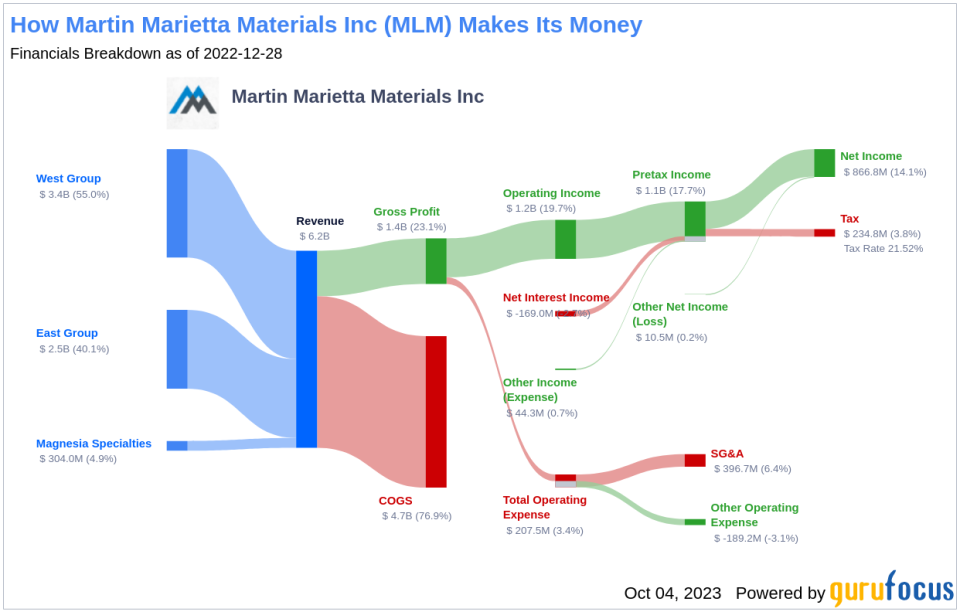

Understanding Martin Marietta Materials Inc Business

Martin Marietta Materials Inc, with a market cap of $25.71 billion and sales of $6.46 billion, is one of the United States' largest producers of construction aggregates (crushed stone, sand, and gravel). In 2022, Martin Marietta sold 207 million tons of aggregates. Martin Marietta's most important markets include Texas, Colorado, North Carolina, Georgia, and Florida, accounting for most of its sales. The company also produces cement in Texas and uses its aggregates in its asphalt and ready-mixed concrete businesses. Martin's magnesia specialties business produces magnesia-based chemical products and dolomitic lime. The company's operating margin stands at 20.63%.

Profitability Rank Breakdown

The Profitability Rank shows Martin Marietta Materials Inc's impressive standing among its peers in generating profit. Martin Marietta Materials Inc Operating Margin has increased (18.94%) over the past five years, as shown by the following data: 2018: 16.59; 2019: 18.68; 2020: 21.28; 2021: 19.06; 2022: 19.74. Furthermore, the company's Gross Margin has seen a consistent rise over the past five years, as evidenced by the data: 2018: 22.77; 2019: 24.88; 2020: 26.49; 2021: 24.91; 2022: 23.10. This trend underscores the company's growing proficiency in transforming revenue into profit. Martin Marietta Materials Inc's strong Predictability Rank of 5.0 stars out of five underscores its consistent operational performance, providing investors with increased confidence.

Growth Rank Breakdown

Ranked highly in Growth, Martin Marietta Materials Inc demonstrates a strong commitment to expanding its business. The company's 3-Year Revenue Growth Rate is 9.3%, which outperforms better than 64.59% of 353 companies in the Building Materials industry. Moreover, Martin Marietta Materials Inc has seen a robust increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA) over the past few years. Specifically, the three-year growth rate stands at 12.4, and the rate over the past five years is 12. This trend accentuates the company's continued capability to drive growth.

Conclusion

Given the company's strong financial strength, profitability, and growth metrics, the GF Score highlights Martin Marietta Materials Inc's unparalleled position for potential outperformance. This analysis underscores the importance of considering a company's GF Score when making investment decisions. GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.