Martin Marietta (MLM) to Divest South Texas Business for $2.1B

Martin Marietta Materials, Inc. MLM has entered into a definitive agreement to divest its South Texas cement business and certain of its related concrete operations to CRH plc’s CRH subsidiary, CRH Americas Materials, Inc.

Post this $2.1 billion worth divestiture, the assets of the acquirer will include the Hunter cement plant in New Braunfel, a chain of terminals along the eastern Gulf coast of Texas and 20 concrete plants serving the Austin and San Antonio region. The integrated portfolio of these assets is expected to generate pro-forma 2023 EBITDA of nearly $170 million. This transaction is subject to regulatory approval and is expected to close in the first half of 2024.

Martin Marietta shares optimistic views on this strategic transaction as this divestiture takes it a step forward in successfully achieving its Strategic Operating Analysis and Review (SOAR) 2025 objectives. The company believes that monetizing these operations is in its best interests to maximize near, medium and long-term stakeholder value.

Long-Term Growth Plans

Martin Marietta’s SOAR initiatives were carefully crafted to provide it with a framework to responsibly and sustainably grow the business and deploy capital for long-term success. The company has been focusing on SOAR plans, which include portfolio optimization, assessing business combinations and arrangements with other companies engaged in similar businesses, increasing footprint in core businesses, investing in internal expansion projects in high-growth markets and pursuing new opportunities associated with the existing markets served.

The company drafted its SOAR 2025 objectives, which are refreshed every five years, in early 2021, thus reflecting the goal of driving significant value creation for its business and stakeholders over the next five years.

Aiming toward the successful execution of the 2025 initiative, Martin Marietta divested the Tehachapi California cement plant to UNACEM Corp. SAA. on Oct 31, 2023. The transaction was completed for $315 million. This divestiture provides it with additional balance sheet flexibility to advance toward quality aggregates-led growth. Also, it divested its California-based Stockton cement import terminal on May 3, 2023.

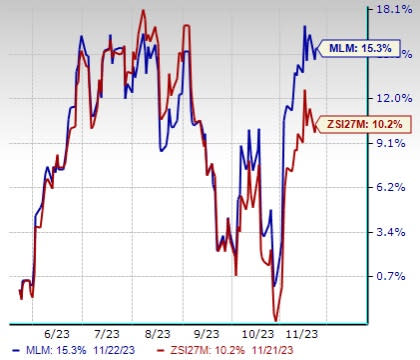

Image Source: Zacks Investment Research

Shares of this producer and supplier of construction aggregates and other heavy building materials have increased 15.3% in the past six months, outperforming the Zacks Building Products - Concrete and Aggregates industry’s 10.2% growth.

Zacks Rank

Martin Marietta currently carries a Zacks Rank #2 (Buy).

About CRH

CRH is a provider of building materials solutions with operating locations in 29 countries. It operates in two divisions, which are CRH Americas and CRH Europe. In 2022, the Americas division contributed 63% of its global sales and the Europe division contributed 37% of the same. In the third quarter of 2023, both its operating divisions contributed strongly, thus resulting in sales growth year over year. Also, year to date, the company made 16 bolt-on acquisitions worth $700 million.

The company currently carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for CRH’s 2023 sales and earnings per share indicates growth of 12% and 28.5%, respectively, from the previous year’s reported levels.

Other Key Picks

Here are some other top-ranked stocks that investors may consider from the Construction sector.

Acuity Brands, Inc. AYI currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AYI delivered a trailing four-quarter earnings surprise of 12%, on average. The stock has declined 3.6% in the past year. The Zacks Consensus Estimate for AYI’s fiscal 2024 sales and earnings per share (EPS) indicates a decline of 3% and 4.7%, respectively, from a year ago.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 298.4% in the past year.

The Zacks Consensus Estimate for MPTI’s 2023 sales and EPS indicates growth of 30.6% and 156.7%, respectively, from the previous year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report