Martin Marietta (MLM) to Divest Tehachapi, CA Cement Plant

Martin Marietta Materials, Inc. MLM inked a deal with UNACEM Corp S.A.A. to sell the Tehachapi, CA, cement plant for $317 million in cash. The deal is likely to close in the second half of 2023, subject to certain regulatory approvals and other customary closing conditions.

The transaction is in line with MLM’s Strategic Operating Analysis and Review (SOAR) 2025 plan.

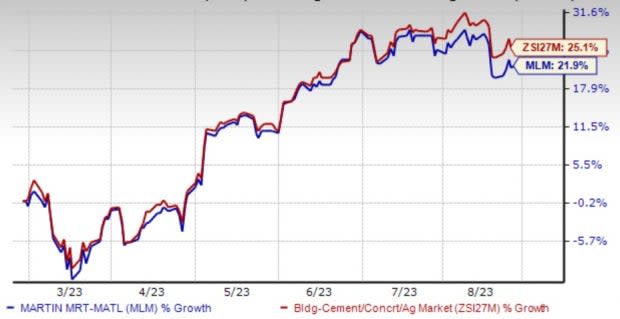

Shares of this leading Aggregates supplier have gained 21.9% in the past six months versus the Zacks Building Products - Concrete and Aggregates industry’s 25.1% rally.

Image Source: Zacks Investment Research

Inorganic Moves Bode Well

Martin Marietta has been gaining strength from long-term strategic plans — markedly SOAR (Strategic Operating Analysis and Review) 2025 initiatives — and has delivered the most profitable 2021 performance in its history.

It is to be noted that 2022 marked the 11th consecutive year of growth in consolidated products and services revenues, adjusted gross profit and adjusted EBITDA.

Martin Marietta has been focusing on SOAR plans that include portfolio optimization, assessing business combinations and arrangements with other companies engaged in similar businesses, increasing footprint in core businesses, investing in internal expansion projects in high-growth markets and pursuing new opportunities associated with the existing markets served.

The company has been reviewing its overall portfolio for opportunities to maximize value by monetizing or exchanging select assets. Consistent with this approach, Martin Marietta divested its California-based Stockton cement import terminal on May 3.

In 2022, the company announced various divestitures. On Jul 15, 2022, the company divested its interest in a joint venture that operates a cement distribution terminal. It also divested the Redding cement plant, related cement distribution terminals and 14 ready-mix concrete plants in California to CalPortland Company on Jun 30, 2022. In addition, the company divested its Colorado and Central Texas ready-mix concrete businesses to the nation's largest privately owned concrete producer on Apr 1, 2022.

Zacks Rank & Other Key Picks

MLM currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks from the Zacks Construction sector are:

Summit Materials, Inc. SUM sports a Zacks Rank #1. SUM has a trailing four-quarter earnings surprise of 13.1%, on average.

The Zacks Consensus Estimate for SUM’s 2023 sales and earnings per share (EPS) indicates rises of 7.1% and 23.6%, respectively, from the year-ago period’s levels.

EMCOR Group, Inc. EME flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 17.2%, on average.

The Zacks Consensus Estimate for EME’s 2023 sales and EPS suggests growth of 11.5% and 35.9%, respectively, from the year-ago period’s levels.

TopBuild Corp. BLD flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 14.1%, on average.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates gains of 3.3% and 6.1%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Summit Materials, Inc. (SUM) : Free Stock Analysis Report