Marvell Technology Inc (MRVL) Reports Mixed Fiscal Year 2024 Results Amidst AI Growth

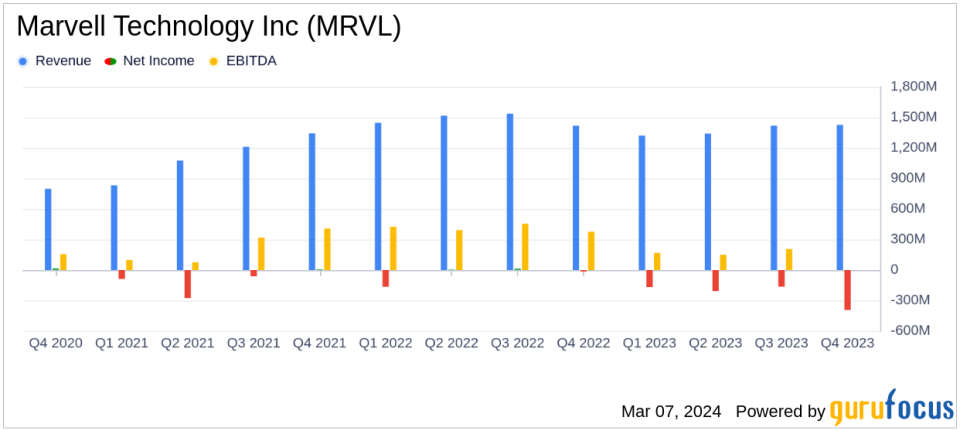

Net Revenue: Q4 net revenue slightly increased to $1.427 billion, with a 1% year-on-year growth.

Gross Margin: GAAP gross margin stood at 46.6%, while non-GAAP gross margin was notably higher at 63.9%.

Earnings Per Share: GAAP diluted loss per share was $(0.45), in contrast to non-GAAP diluted income per share of $0.46.

Annual Performance: Fiscal year 2024 net revenue totaled $5.508 billion with a GAAP net loss of $(933.4) million.

Operational Cash Flow: Cash flows from operations for Q4 reached $546.6 million.

Future Outlook: Q1 fiscal 2025 net revenue is expected to be $1.150 billion +/- 5%, with a non-GAAP diluted income per share of $0.23 +/- $0.05.

On March 7, 2024, Marvell Technology Inc (NASDAQ:MRVL) released its 8-K filing, detailing the financial results for the fourth quarter and fiscal year ended February 3, 2024. Marvell Technology, a fabless chip designer with a strong presence in wired networking, serves a diverse range of markets with its processors, optical and copper transceivers, switches, and storage controllers.

Financial Performance and Challenges

Marvell Technology reported a slight year-on-year increase in Q4 net revenue, reaching $1.427 billion. However, the company faced a GAAP net loss of $(392.7) million for the quarter, translating to a $(0.45) loss per diluted share. Despite this, non-GAAP figures were more positive, with a net income of $401.6 million, or $0.46 per diluted income per share. The discrepancy between GAAP and non-GAAP results highlights significant charges and adjustments, including stock-based compensation and amortization of acquired intangible assets.

The company's performance is critical as it reflects the challenges and opportunities within the semiconductor industry, particularly in the context of AI growth. Marvell's success in the data center market, driven by AI applications, underscores the company's strategic positioning. However, the reported net loss indicates potential concerns over profitability and cost management.

Financial Achievements and Industry Significance

Marvell Technology's non-GAAP gross margin of 63.9% is a testament to the company's ability to maintain profitability in its core operations, excluding certain non-recurring items. This is particularly important in the semiconductor industry, where gross margins can be indicative of a company's pricing power and cost control. The strong operational cash flow of $546.6 million also demonstrates Marvell's capacity to generate liquidity from its business activities.

Key Financial Metrics

Marvell Technology's balance sheet shows a cash and cash equivalents balance of $950.8 million as of February 3, 2024. The company's total assets stood at $21.228 billion, with long-term debt at $4.058 billion. These figures are crucial for investors to assess the company's financial health and its ability to sustain operations and manage debt.

"Marvell delivered fourth quarter fiscal 2024 revenue of $1.427 billion, above the mid-point of guidance. AI drove strong growth in our data center end market revenue which increased 38% sequentially and 54% year-over-year. As a critical enabler of accelerated infrastructure for AI, Marvell is well positioned to capitalize on this massive technology inflection, which continues to gain momentum," said Matt Murphy, Marvells Chairman and CEO.

Analysis of Company's Performance

Marvell Technology's mixed financial results reflect a company at the intersection of growth and challenge. The growth in the data center segment, particularly due to AI, is a strong indicator of the company's innovative capabilities and market demand for its products. However, the overall net loss and the expected soft demand in consumer, carrier infrastructure, and enterprise networking in the near term suggest that Marvell must navigate industry headwinds carefully.

The company's outlook for the first quarter of fiscal 2025 indicates a cautious approach, with expected sequential growth in data center revenue but soft demand in other segments. Marvell's management anticipates a recovery in the second half of the fiscal year, which will be critical for investors to monitor.

For a more detailed analysis and continuous updates on Marvell Technology Inc (NASDAQ:MRVL), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Marvell Technology Inc for further details.

This article first appeared on GuruFocus.