Marvell Technology: Overvalued With High Goodwill and Intangible Assets

Marvell Technology Inc. (NASDAQ:MRVL) has experienced significant volatility in the stock market. Over the past three years, its share price has fluctuated widely, ranging from $36 to $89. Recently, it plunged nearly 11.40% following the announcement of first-quarter guidance that fell short of expectations. Despite this recent drop, I believe Marvell remains significantly overvalued.

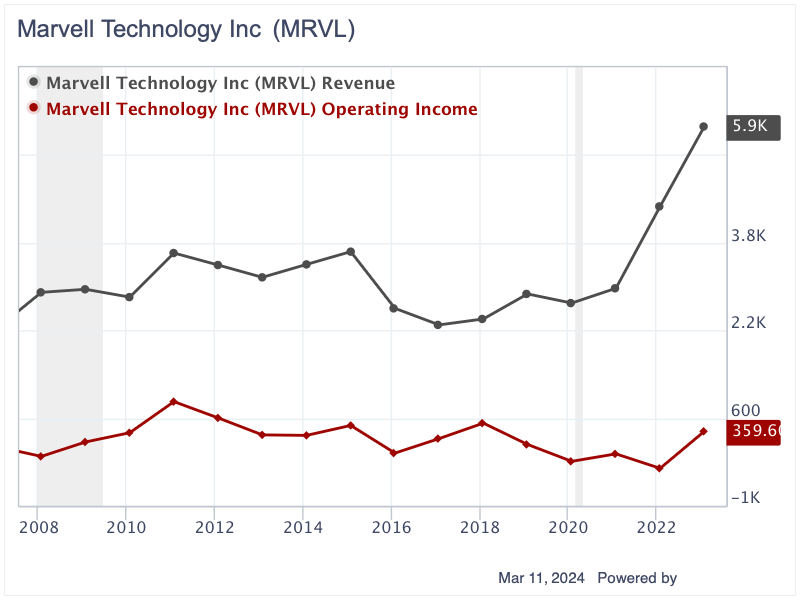

Growing revenue, but fluctuating operating income

A leading provider of semiconductor solutions for data infrastructure, Marvell serves five primary end markets: Data Center, Enterprise Networking, Carrier Infrastructure, Consumer and Automotive/Industrial. The Data Center market is the company's largest revenue source, contributing $2.40 billion or 41% of its total revenue in fiscal 2023. Enterprise Networking ranked second, accounting for 23% of total sales. Carrier Infrastructure and Consumer markets made up 18% and 12% of the total year revenue. The company has some customer concentration risks, with its top 10 customers generating 63% of its revenue. Notably, one distributor alone comprised 20% of the total sales in 2023.

From 2008 to 2021, Marvell Technology's revenue fluctuated between $2.30 billion and $3.64 billion. In the next two subsequent years, its revenue soared to $5.92 billion in 2023, driven by higher product sales, increased prices and the acquisition of Inphi, a high-speed semiconductor specialist. Despite this surge, 2024 saw a 7.60% drop to $5.50 billion. In 2024, only the Data Center market grew by 54%, while other four markets faced double-digit declines.

Marvell's operating income has also experienced wide fluctuations, moving from a $315 million loss to a $901.2 million profit between 2018 and 2023. In 2024, the company produced losses of $567.70 million. The 2024 losses were caused by falling revenue, rising research and development expenses and high restructuring-related charges.

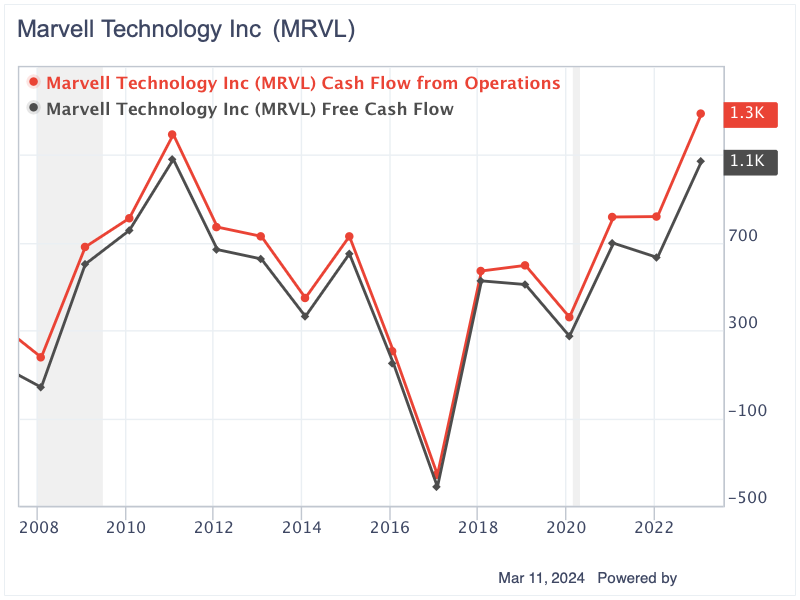

Consistent cash flow generation

Despite the volatile operating income, Marvell has consistently generated positive operating cash flow and free cash flow in 15 out of the past 16 years. The only exception was in 2017 when the company produced negative operating cash flow and free cash flow, primarily due to a $736 million litigation settlement with Carnegie Mellon University. The settlement was related to read-channel integrated circuit devices and the hard drives incorporating such devices.

The discrepancy between operating income and operating cash flow can be attributed to substantial amounts of depreciation, amortization of acquired intangible assets and non-cash stock-based compensation to employees. In 2024, Marvell reported an operating cash flow of $1.37 billion and free cash flow of $1.10 billion, with non-cash stock-based compensation amounting to nearly $610 million. The significant stock-based compensation has led to an increase in the total number of shares outstanding. Since 2008, the total share count has risen by 46.50%, from 590.30 million to 864.50 million shares.

High but manageable leverage

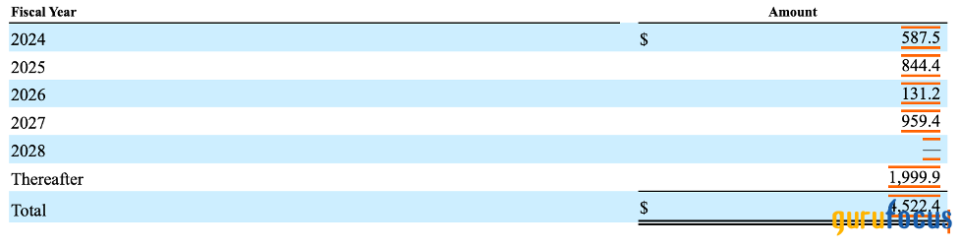

Many investors might worry about Marvell's high leverage level. As of February, Marvell reported $14.83 billion in shareholders' equity, including $950.80 million in cash and cash equivalents. The interest-bearing debt reached $4.17 billion. In the next five years, the principal debt due per year ranged from $131.20 million to nearly $960 million. With an operating cash flow of $1.37 billion and a solid cash position, the company is in a good position to settle its debt obligations comfortably.

Source: Marvell's 10-K

On the asset side, a significant portion of the company's assets consist of goodwill, amounting to $11.59 billion, and acquired intangible assets valued at $4 billion. Goodwill represents the excess payment made over the net asset value for acquisitions, whereas intangible assets include patents, brands, trademarks and copyrights. Holding a high level of goodwill and intangible assets poses the risk of potential write-downs or impairments if the performance of the acquired companies or the value of intangible assets falls short of expectations. Such financial adjustments could substantially reduce reported earnings and adversely affect the company's stock price.

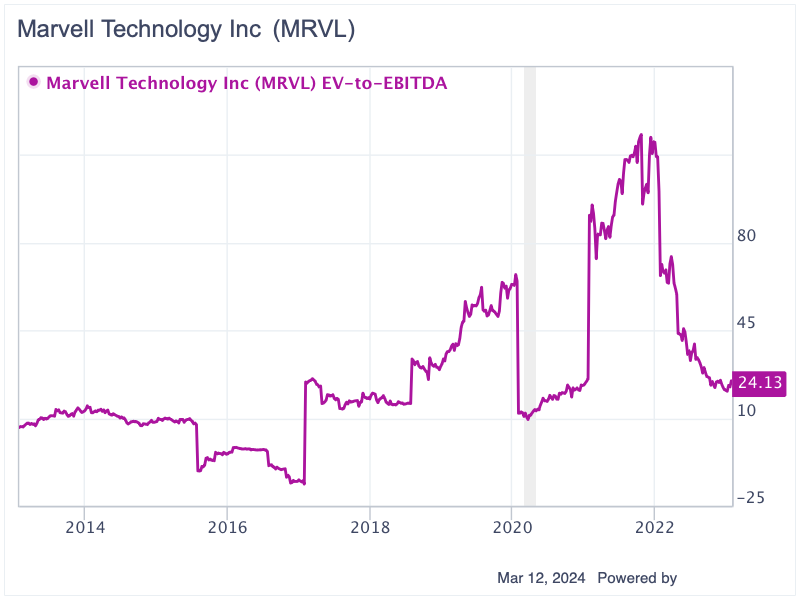

Significantly overvalued

By 2026, Marvell is expected to generate revenue of approximately $7 billion. Assuming an Ebitda margin of around 25%, which is similar to the 2023 margin, Marvell's Ebitda is estimated to be $1.75 billion.

Over the past decade, Marvell's Ebitda multiples have exhibited significant volatility, ranging from a low of -16.30 to a high of 123.15. The average multiple over the past 10 years stands at 27, slightly higher than the company's current Ebitda multiple of 24.13.

If we apply the 10-year average Ebitda multiple of 27, Marvell's enterprise value would be estimated at $47.25 billion. After adjusting for net debt of $3.22 billion, the equity value is calculated to be $44 billion. Assuming a 20% increase in total share count due to stock-based compensation, the number of outstanding shares would rise to 1.04 billion. Consequently, Marvell's intrinsic value per share is estimated to be $42.30, only 56% of the current trading price.

Conclusion

Despite Marvell's strong position within the semiconductor industry and consistent cash flow generation, the volatility in operating income, coupled with the recent revenue drop and the high levels of goodwill and intangible assets, signals potential risks for investors. These assets, while valuable, carry the threat of impairments that could significantly impact financial results. Furthermore, based on my estimation, Marvell's current share price appears significantly overvalued. As a result, investors should wait for a better price before initiating a long position.

This article first appeared on GuruFocus.