Masco (MAS) Hits 52-Week High: What's Aiding its Growth?

Masco Corporation MAS touched a new 52-week high of $60.18 on Jul 14. The stock pulled back to end the trading session at $59.98, down 0.13% from the previous day’s closing price of $60.06.

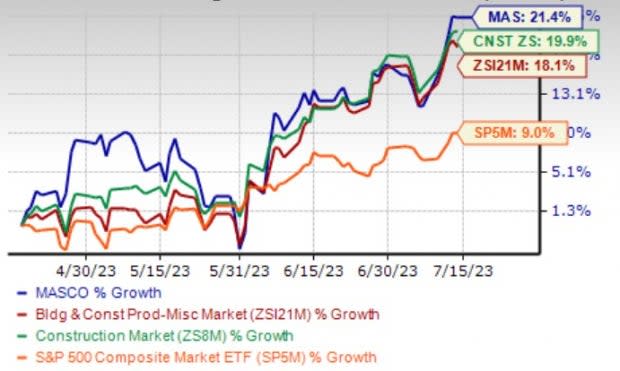

MAS has gained 21.4% in the past three months compared with the Zacks Building Products - Miscellaneous industry’s growth of 18.1%, the Zacks Construction sector’s increase of 19.9% and the S&P 500 Index’s growth of 9%.

The company has been benefiting from strong pricing actions and operational improvements. Market share gains in many key markets and growth in PRO (professional grade paint line) paint have also been driving the stock. Also, solid liquidity level, cost-saving efforts and accretive acquisitions are encouraging.

Image Source: Zacks Investment Research

The annual inflation rate in the United States slowed to 3% in June 2023, the lowest since March of 2021 and compared to 4% in May 2023. This positive trend is expected to have contributed to inducing bullish sentiments among the investors, resulting in the company’s share price touching a 52-week high.

Let’s delve deeper into the factors favoring this Zacks Rank #2 (Buy) company.

Factors Driving MAS’ Growth

Improving Housing Market Trend: Apart from the positive inflation data for June, the company is poised to benefit from positive trends in the new residential construction sector. Recent statistics released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development for May 2023 revealed significant growth in building permits, robust housing starts, and positive growth in housing completions. This is likely to help Masco witness higher demand for its products.

Cost-Saving Strategies: Masco is implementing various cost-saving measures, such as consolidating businesses, implementing new systems, closing plants and branches, and optimizing its global supply chain. These initiatives aim to simplify the company's organizational structure and reduce corporate expenses, leading to annual savings. To counter the effects of raw material inflation, it plans to take pricing actions while also exploring cost-reduction opportunities and gradually shifting production away from China to mitigate tariff-related challenges.

Solid Liquidity Position: MAS maintains a strong balance sheet, evident from its net debt to EBITDA ratio of 2.2X. By the end of the first quarter of 2023, the company had a liquidity of $1.3 billion. Cash and cash investments stood at $510 million at the end of 2022, showing an increase from $452 million in the previous year. As of Mar 31, 2023, MAS' long-term debt remained consistent at $2.946 billion, aligning with the 2022 figures. With a cash level of $413 million, the company has sufficient resources to meet its short-term obligations of $413 million.

In-organic Moves: Although the company has not made any acquisitions in 2023, it is benefiting from its earlier acquisitions. In the third quarter of 2021, Masco's Delta brand acquired Steamist, Inc., a prominent manufacturer of residential steam bath products. This acquisition aligned with Masco's robust trade and e-commerce offerings, further strengthening its product lineup.

Furthermore, in the first quarter of 2021, MAS acquired a 75.1% equity interest in Easy Sanitary Solutions B.V. (“ESS”) for approximately $58 million. ESS specializes in shower channel drains and provides a diverse range of products for barrier-free showering and bathroom wall niches. With a focus on innovation and design, ESS bolsters MAS' presence in the sanitary solutions sector, expanding its market presence.

As part of its growth strategy and commitment to enhancing shareholder value, Masco consistently divests less profitable and underperforming businesses. On May 31, 2021, the company completed the divestiture of Huppe GmbH, a shower enclosures and shower trays manufacturer, as a strategic move to streamline its Plumbing Products segment.

Other Key Picks

Some other top-ranked stocks from the Zacks Construction sector are:

Dycom Industries, Inc. DY sports a Zacks Rank #1 (Strong Buy). DY has a trailing four-quarter earnings surprise of 153.7%, on average. Shares of DY have gained 11.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DY’s 2024 sales and earnings per share (EPS) indicates a rise of 8.3% and 41%, respectively, from the year-ago period’s levels.

Eagle Materials Inc. EXP also sports a Zacks Rank #1 at present. The company has a trailing four-quarter earnings surprise of 6.5%, on average. Shares of EXP have gained 61.3% in the past year.

The Zacks Consensus Estimate for EXP’s 2024 sales and EPS indicates a rise of 2% and 8.3%, respectively, from the year-ago period’s levels.

Martin Marietta Materials, Inc. MLM carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 31%, on average. Shares of MLM have gained 45.5% in the past year.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates a rise of 18.7% and 32.3%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report