Masco (MAS) Q2 Earnings & Net Sales Top Estimates, Margins High

Masco Corporation MAS reported strong earnings for second-quarter 2023. The bottom line surpassed the Zacks Consensus Estimate and increased from the prior year. Strong pricing actions and operational efficiency helped it deliver solid results.

Net sales topped the consensus mark but declined on a year-over-year basis. The benefits received from pricing actions were more than offset by lower volumes.

Shares of Masco jumped 2.26% in the pre-market trading session on Jul 27.

MAS focused on a balanced capital deployment strategy, returned $89 million to shareholders via dividends and share repurchases and announced a strategic bolt-on acquisition of Sauna360 Group Oy, which will expand its spa and wellness product offerings. Sauna360 Group Oy is a leading global manufacturer of sauna solutions. The deal is expected to close in the third quarter, subject to regulatory approval.

Inside the Headlines

Masco reported adjusted earnings of $1.19 per share, which robustly beat the consensus mark of 96 cents by 24% and increased 3% from the year-ago figure of $1.16.

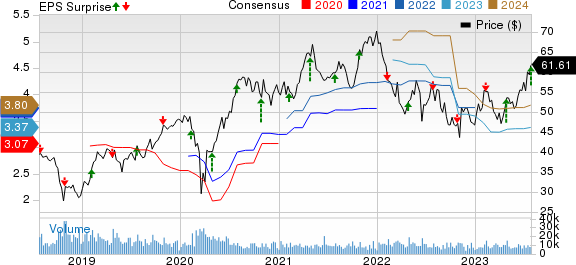

Masco Corporation Price, Consensus and EPS Surprise

Masco Corporation price-consensus-eps-surprise-chart | Masco Corporation Quote

Net sales of $2.127 billion topped the consensus estimate of $2.095 billion by 1.5% but decreased 10% from the prior-year period. Net sales fell 9% year over year in local currency.

Sales in the North American region decreased 10% from the prior year. Internationally, sales decreased by 9% as reported and by 8% in local currency.

Segmental Analysis

Plumbing Products: Sales in the segment fell 11% year over year to $1,225 million. In local currency, the segment’s sales declined 10% year over year. The adjusted operating margin expanded 270 basis points (bps) year over year to 20%. Adjusted EBITDA increased to $270 million from $263 million a year ago.

Decorative Architectural Products: The segment reported sales of $902 million, down 8% from the prior-year period. Paints, other coating products and PRO paint sales fell in mid-single digits. DIY paint sales declined in low single digits during the quarter. Adjusted operating margin contracted by 20 bps to 20%. Adjusted EBITDA declined to $189 million from the prior-year figure of $207 million.

Margins Performance

Adjusted gross margin improved 320 bps from the prior-year level to 36.2%. Adjusted selling, general and administrative expenses — as a percentage of net sales — were up 190 bps to 17.2% from the year-ago figure of 15.3%.

Adjusted operating margin improved 140 bps on a year-over-year basis to 19% due to lower volumes. Adjusted EBITDA also fell 2.4% year over year to $439 million.

Financials

As of Jun 30, 2023, Masco had total liquidity of $1.38 billion versus $1.45 billion at 2022-end and $1.44 billion at June 2022-end. This includes cash and cash investments of $380 million compared with $452 million recorded at 2022-end. Long-term debt was $2.95 billion, flat from 2022-end.

Net cash from operating activities was $448 million for the first half of 2023 compared with $174 million in the prior-year period.

During the reported period, the company repurchased 0.5 million shares for $25 million.

2023 Guidance Updated

Backed by strong execution during the first half of 2023, the company raised its adjusted earnings expectation to $3.50-$3.65 per share from a prior projection of $3.10-$3.40. In 2022, MAS delivered adjusted earnings of $3.77 per share.

Net sales are likely to decrease 10% in 2023, with Plumbing Products falling 10-12% and Decorative Architectural Products declining 8-10%. Earlier, MAS anticipated Plumbing Products sales to fall 10-14% and Decorative Architectural Products sales to decline by 5-10%.

Adjusted operating margin for the year is now projected to be 16% versus 15% expected earlier. It now expects an adjusted operating margin of 17% for both segments, up from 16% projected earlier.

Zacks Rank & Recent Construction Releases

Masco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVR, Inc. NVR reported second-quarter 2023 results, wherein its earnings surpassed the Zacks Consensus Estimate but revenues missed the same. The top and bottom lines declined on a year-over-year basis, thanks to delayed housing activities and macroeconomic woes.

NVR reported earnings of $116.54 per share, which topped the consensus mark of $100.98 by 15.4%. The reported figure, however, decreased by 6% from the prior-year quarter’s figure of $123.65 per share.

PulteGroup Inc. PHM reported impressive results in second-quarter 2023. Its earnings and revenues surpassed their respective Zacks Consensus Estimate and increased year over year. The upside was mainly driven by its solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups.

Backed by its disciplined and balanced business model, the company witnessed solid gross closings, orders and margins in the reported quarter and posted a 12-month return on equity of 32%.

D.R. Horton, Inc. DHI reported third-quarter fiscal 2023 (ended Jun 30, 2023) results, wherein earnings and revenues surpassed their respective Zacks Consensus Estimate.

On a year-over-year basis, although earnings declined, revenues increased. The company highlighted that the supply of both new and existing homes at affordable price points remains limited and that the demographics supporting housing demand remain favorable. This tailwind has helped this Arlington, TX-based homebuilder witness net sales order growth of 37% year over year in the fiscal third quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report