Masimo's (MASI) LiDCO to Boost Hemodynamic Monitoring Post CE Mark

Masimo Corporation MASI recently received the CE mark, under the European Union Medical Device Regulation (EU MDR), for the LiDCO board-in-cable (BIC) module. However, the parameter as a measure of continuous oxygen delivery has not received the FDA’s clearance and is not currently available in the United States.

Notably, the use of LiDCO has been shown to reduce postoperative complications, costs and mortalities at 30 and 180 days after surgery in clinical studies.

The latest regulatory clearance is expected to significantly strengthen Masimo’s patient monitoring business on a global scale.

Significance of the Approval

The LiDCO BIC module is designed to connect to multi-patient monitoring platforms, like the Masimo Root Patient Monitoring and Connectivity Hub, to provide advanced hemodynamic monitoring. With this solution, clinicians are expected to be able to easily add LiDCO hemodynamic monitoring, with its unique PulseCO algorithm, to their Root patient monitoring hubs.

Following the receipt of the EU MDR CE Mark, there will likely be a solution that can enable hemodynamic monitoring alongside other supported parameters without having a dedicated hemodynamic monitoring box.

Per an expert familiar with the LiDCO module, the introduction of the module is expected to deliver dynamic hemodynamic monitoring with a known documented positive impact on patient outcomes.

Management believes that bringing LiDCO’s beat-to-beat advanced hemodynamic monitoring to Masimo Root will likely open up the possibility of providing a more complete, continuous picture of cardiac output (CO) and oxygen delivery. Currently, clinicians receive only half of the information as hemodynamic monitors can provide continuous analysis of blood pressure information but rely on intermittent data from other monitors for oxygenation.

Per management, using both Masimo’s non-invasive rainbow SET Pulse CO-Oximetry parameters and LiDCO’s PulseCO algorithm, clinicians are now expected to be able to view a continuous and simultaneous display of all the components that make up a patient’s oxygen delivery.

Industry Prospects

Per a report by Mordor Intelligence, the global patient monitoring market is anticipated to grow from $43,808.29 million in 2023 to $62,571.34 million by 2028 at a CAGR of approximately 7.4%. Factors like the rising burden of chronic diseases due to lifestyle changes, growth in the elderly population, increasing preference for home and remote monitoring and the ease of use of portable devices are expected to drive the market.

Given the market potential, the latest regulatory clearance is likely to provide a significant boost to Masimo’s business.

Notable Developments

In August, Masimo announced the full U.S. market release of the Stork smart home baby monitoring system.

The same month, Masimo announced the findings of a prospective, randomized study in which researchers assessed the use of non-invasive, continuous Masimo pleth variability index, as part of goal-directed fluid therapy, to guide intraoperative fluid administration during gastrointestinal surgery on elderly patients by comparing it to conventional fluid therapy. The findings were published in Perioperative Medicine.

Also, in August, Masimo reported its second-quarter 2023 results, wherein it registered an expansion of its installed base. Management confirmed that the company gained new hospital customers during the quarter at a record level. The expansion of both margins in the quarter was also recorded.

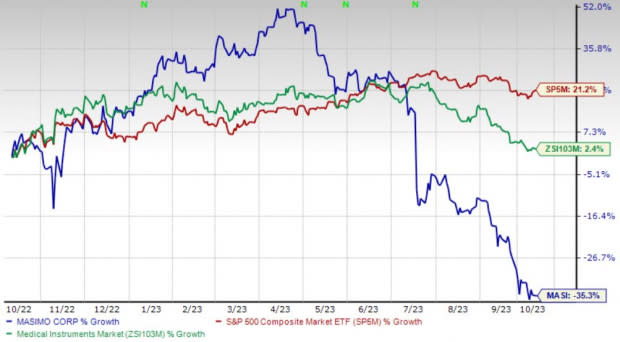

Price Performance

Shares of Masimo have lost 35.3% in the past year against the industry’s 2.4% rise and the S&P 500’s 21.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Masimo carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, McKesson Corporation MCK and Integer Holdings Corporation ITGR.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 0.6% against the industry’s 5.7% decline over the past year.

McKesson, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 8.1%.

McKesson has gained 28.5% compared with the industry’s 23.5% rise over the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 52.3% compared with the industry’s 2.4% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report