Mason Hawkins Adjusts Stake in Oscar Health Inc

Recent Transaction Overview

On December 31, 2023, Mason Hawkins (Trades, Portfolio), through Southeastern Asset Management, made a notable adjustment to their investment in Oscar Health Inc (NYSE:OSCR). The transaction involved a reduction of 1,689,008 shares, which resulted in a 22.80% change in their holdings. This move had a -0.57% impact on the portfolio, leaving Southeastern Asset Management with a total of 5,718,273 shares in the healthcare company. The shares were traded at a price of $9.15 each, and post-transaction, the position in Oscar Health Inc represents 1.95% of the firm's equity portfolio and 3.00% of the company's outstanding shares.

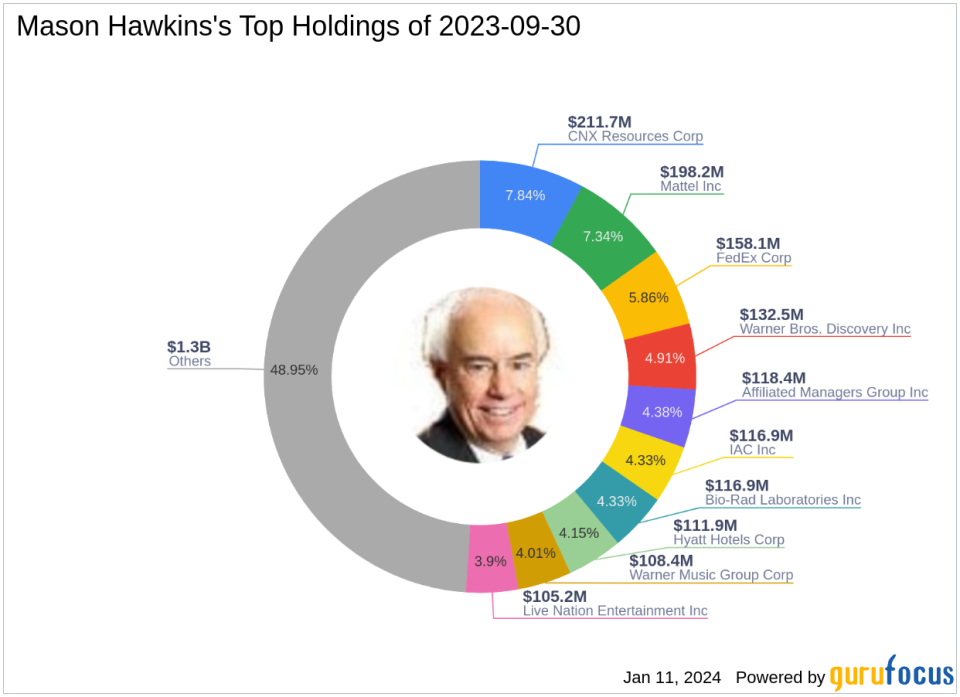

Mason Hawkins (Trades, Portfolio)'s Investment Profile

Mason Hawkins (Trades, Portfolio) has been at the helm of Southeastern Asset Management since 1975, overseeing the Longleaf Partners Funds. A graduate with a B.A. in Finance from the University of Florida and an M.B.A. from the University of Georgia, Hawkins is a seasoned value investor. The firm's investment philosophy centers on acquiring stakes in businesses that are not only well-understood but also have robust balance sheets and competent management, all available at prices below their intrinsic value. Southeastern Asset Management's portfolio is concentrated, typically holding fewer than 25 stocks, with a focus on long-term performance. As of the latest data, the firm manages an equity portfolio worth $2.7 billion, with top holdings in Warner Bros. Discovery Inc (NASDAQ:WBD), Mattel Inc (NASDAQ:MAT), and others in sectors like Consumer Cyclical and Communication Services.

About Oscar Health Inc

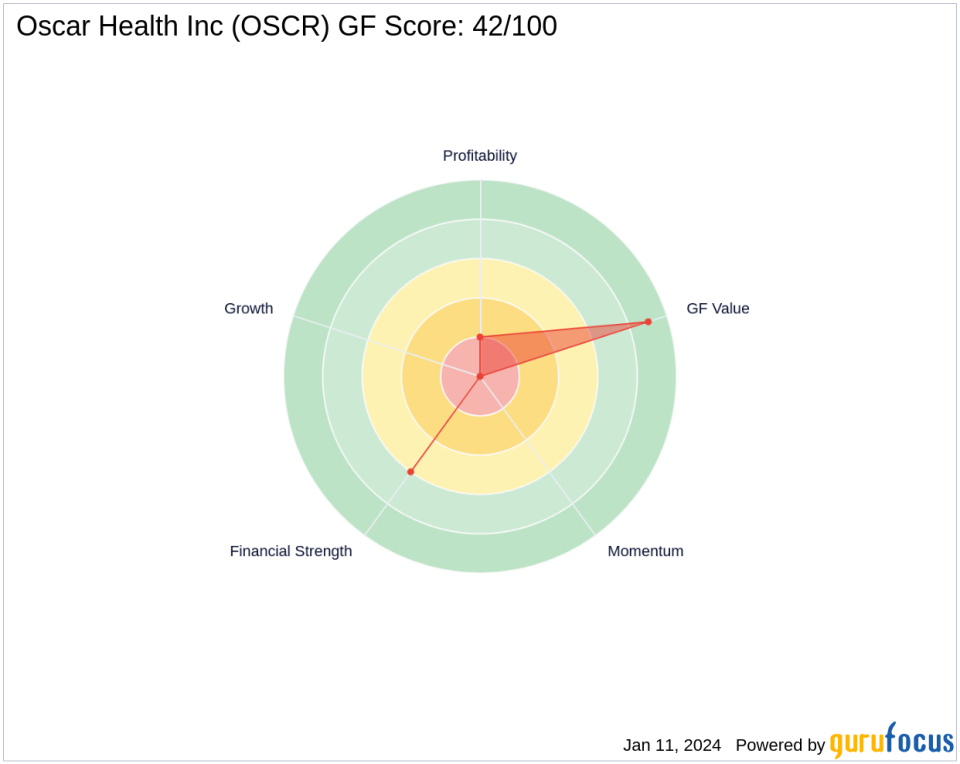

Oscar Health Inc, operating in the USA since its IPO on March 3, 2021, is a health insurance provider offering a range of plans for individuals, families, and businesses. The company is known for integrating virtual care and support services into its offerings. Despite being a relatively new player in the market, Oscar Health has a market capitalization of $2.18 billion. Currently, the stock is considered modestly undervalued with a GF Value of $11.02 and trades at a price to GF Value ratio of 0.88. However, the company's financial performance has been challenging, with a PE Ratio of 0.00 indicating losses, and a GF Score of 42/100, suggesting poor future performance potential.

Significance of the Trade

The recent trade by Mason Hawkins (Trades, Portfolio) is significant as it adjusts the firm's exposure to Oscar Health Inc, which has seen a 5.57% gain in stock price since the transaction, currently trading at $9.66. The trade price was slightly below the current market price, suggesting a strategic reduction in the position. The trade's impact on the portfolio was modest, yet it reflects the firm's ongoing assessment of the stock's value and potential.

Oscar Health's Market Performance

Since its IPO, Oscar Health's stock has experienced a decline of -73.17%, with a year-to-date change of 6.15%. The company's financial strength and profitability have been areas of concern, with a Financial Strength rank of 6/10 and a Profitability Rank of 2/10. The Growth Rank is not applicable due to insufficient data, and the same goes for the Momentum Rank. However, the GF Value Rank stands at 9/10, indicating that the stock may be undervalued.

Healthcare Sector and Market Context

Mason Hawkins (Trades, Portfolio)'s investment in Oscar Health Inc aligns with the firm's broader strategy of investing in undervalued companies. The healthcare plans industry, where Oscar Health operates, is subject to regulatory changes and competitive pressures, factors that value investors like Hawkins monitor closely. Southeastern Asset Management's top holdings reflect a diversified approach, with significant positions in various sectors, including the healthcare plans industry.

Other Notable Investors

Apart from Mason Hawkins (Trades, Portfolio), other prominent investors like Joel Greenblatt (Trades, Portfolio) have also taken an interest in Oscar Health Inc. While Southeastern Asset Management remains a significant shareholder, the comparison of positions among guru investors can provide insights into the stock's appeal within the value investing community.

Conclusion

Mason Hawkins (Trades, Portfolio)'s recent transaction in Oscar Health Inc offers valuable insights for value investors. The reduction in shares by Southeastern Asset Management suggests a strategic move that aligns with the firm's investment philosophy. Despite the stock's modest undervaluation and challenging financial metrics, the firm's continued interest in Oscar Health Inc may signal a belief in the company's long-term potential. Value investors will be watching closely to see how this investment unfolds in the context of the healthcare plans industry's dynamics and Oscar Health's fundamental strengths and weaknesses.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.