Mason Hawkins' Southeastern Buys 5 Stocks in 3rd Quarter

- By Margaret Moran

Southeastern Asset Management recently disclosed its portfolio updates for the third quarter of 2020, which ended on Sept. 30.

Founded by Mason Hawkins (Trades, Portfolio) in 1975, the Memphis, Tennessee-based firm manages the Longleaf Partners Funds. The firm employs a fundamental, bottom-up appraisal process based on in-house research in order to select a concentrated portfolio of quality investments that have strong balance sheets, good management teams and attractive valuations.

Based on its investment criteria, the firm made five new buys during the quarter: MGM Resorts International (NYSE:MGM), Everest Re Group Ltd. (NYSE:RE), Liberty Braves Group (NASDAQ:BATRK), Summit Materials Inc. (NYSE:SUM) and Worthington Industries Inc. (NYSE:WOR).

MGM Resorts International

The firm invested in 4,962,956 shares of MGM Resorts International, impacting the equity portfolio by 2.78%. During the quarter, shares traded for an average price of $19.83.

MGM Resorts is a hospitality company based in Las Vegas. It owns and operates entertainment destination resorts in Las Vegas, Massachusetts, Detroit, Mississippi, Maryland and New Jersey through brand names that include Bellagio, Mandalay Bay, MGM Grand and Park MGM.

On Nov. 11, shares of MGM Resorts traded around $26.29 for a market cap of $13.08 billion. According to the GuruFocus Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. The cash-debt ratio is lower than 63% of other companies in the industry, while the Altman Z-Score of 0.95 indicates the company may need to raise additional liquidity to avoid bankruptcy. The three-year revenue growth rate is 13.9%, while the three-year Ebitda growth rate is 24.7%.

Everest Re Group

The firm also established a new position worth 400,518 shares in Everest Re Group, impacting the equity portfolio by 2.04%. Shares traded for an average price of $213.91 during the quarter.

Based in Hamilton, Bermuda for tax reasons, Everest is a reinsurance and insurance company that offers plans in the U.S. and many other countries globally. Its products include coverage for specialty casualty, workers' comp, professional liability, short tail, financial lines and property and casualty, among others.

On Nov. 11, shares of Everest traded around $229.47 for a market cap of $9.20 billion. According to the GuruFocus Value chart, the stock is modestly undervalued.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 6 out of 10. The interest coverage ratio of 24.46 is higher than the industry median of 12.12, while the Piotroski F-Score of 7 out of 9 indicates a healthy financial situation. The weighted average cost of capital has typically been higher than the return on invested capital, indicating long-term issues with creating shareholder value.

Liberty Braves Group

The firm bought 2,482,772 shares of Liberty Braves Group, impacting the equity portfolio by 1.34%. During the quarter, shares traded for an average price of $19.35.

Through its subsidiary, Braves Holdings LLC, Liberty Braves Group indirectly owns the Atlanta Braves Major League Baseball club, the Atlanta Braves' stadium and associated real estate.

On Nov. 11, shares of Liberty traded around $23.95 for a market cap of $1.23 billion. According to the GuruFocus Value chart, the stock is significantly overvalued.

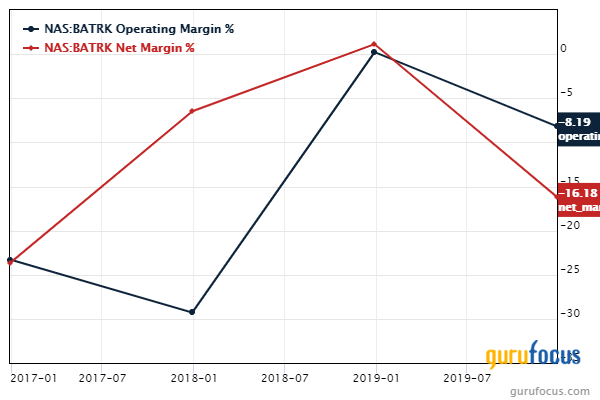

The company has a financial strength rating of 3 out of 10 and a profitability rating of 1 out of 10. The Piotroski F-Score of 2 out of 9 and the Altman Z-Score of 0.58 both indicate the company could be in danger of bankruptcy in the next couple of years. The operating margin and net margin are both in the negative range, indicating the company is spending more than it is earning.

Summit Materials

The firm established a new holding of 325,567 shares in Summit Materials Inc., impacting the equity portfolio by 0.14%. Shares traded for an average price of $ $16.27 during the quarter.

Summit Materials is a vertically integrated materials company that supplies aggregates, cement, ready-mix concrete and asphalt in the U.S. and Canada. It is based in Denver.

On Nov. 11, shares of Summit traded around $18.44 for a market cap of $2.11 billion. According to the GuruFocus Value chart, the stock is fairly valued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 5 out of 10. The cash-debt ratio of 0.15 is lower than 77% of competitors, but the Piotroski F-Score of 9 out of 9 indicates a very healthy financial situation. The operating margin and net margin have been in a general uptrend, though both faltered in the last couple of years.

Worthington Industries

The firm invested in 117,000 shares of Worthington Industries, impacting the equity portfolio by 0.12%. During the quarter, shares traded for an average price of $39.50.

Based in Columbus, Ohio, Worthington is a global diversified metals manufacturing company. It is a leading value-added steel processor in the U.S. and a leading global supplier of pressure tanks and cylinders.

On Nov. 11, shares of Worthington traded around $51.11 for a market cap of $2.78 billion. According to the GuruFocus Value chart, the stock is significantly overvalued.

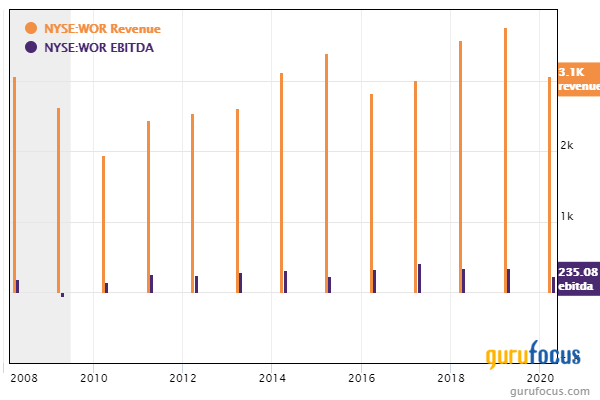

The company has a financial strength rating of 6 out of 10 and a profitability rating of 6 out of 10. The cash-debt ratio of 1.26 is higher than the industry median of 1.03, while the Altman Z-Score of 3.93 indicates the company is likely safe from bankruptcy concerns. The three-year revenue growth rate is 5.6%, but the three-year Ebitda growth rate is -13%.

Portfolio overview

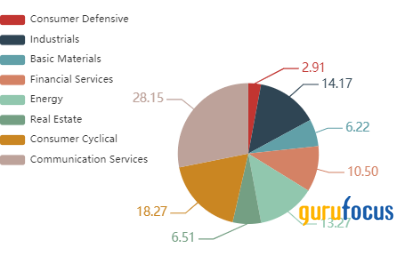

As of Nov. 20, Southeastern's equity portfolio consisted of holdings in 29 stocks valued at a total of $3.88 billion. The firm established five new positions, sold out of five other holdings and added to or reduced several other investments for a turnover of 9% for the quarter.

The top holdings at the quarter's end were Lumen Technologies Inc. (LUMN) with 16.36% of the equity portfolio, CNX Resources Corp. (CNX) with 8.65% and Mattel Inc. (MAT) with 8.46%. In terms of sector weighting, the firm was most invested in communication services, consumer cyclical and industrials.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Third Avenue Management's Top 3rd-Quarter Portfolio Updates

Howard Marks' Oaktree Buys Environmental Stock, Says Farewell to Caesars

George Soros' Firm Adds to D.R. Horton, Says Palantir Buy Was a Mistake

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.