Mason Hawkins' Strategic Moves: A Deep Dive into the 13F Filing with a Spotlight on General ...

Insights from Southeastern Asset Management's Latest Portfolio Adjustments

Renowned value investor Mason Hawkins (Trades, Portfolio), at the helm of Southeastern Asset Management since 1975, has recently disclosed his firm's 13F holdings for the third quarter of 2023. With a philosophy rooted in acquiring undervalued securities, Hawkins' investment strategy focuses on identifying companies with strong balance sheets and capable management, available at prices below their intrinsic value. His latest report reveals a series of strategic moves, including new acquisitions, increased stakes, complete exits, and reduced positions in the portfolio.

New Additions to the Portfolio

Mason Hawkins (Trades, Portfolio) has expanded his portfolio with four new stocks, making notable additions:

SharkNinja Inc (NYSE:SN) leads the new entries with 1,905,157 shares, comprising 3.27% of the portfolio and valued at $88.32 million.

RTX Corp (NYSE:RTX) follows with 809,958 shares, representing 2.16% of the portfolio, totaling $58.29 million.

Park Hotels & Resorts Inc (NYSE:PK) was also added with 1,819,318 shares, accounting for 0.83% of the portfolio, with a value of $22.41 million.

Significant Increases in Existing Holdings

In addition to new acquisitions, Mason Hawkins (Trades, Portfolio) has bolstered his position in nine companies:

Kellanova Co (NYSE:K) saw an impressive 43.08% increase in shares, now totaling 1,865,301, impacting the portfolio by 1.16% and valued at $104.16 million.

Fortune Brands Innovations Inc (NYSE:FBIN) experienced a 57.09% hike in share count, reaching 1,342,759 shares with a total value of $83.47 million.

Strategic Exits from the Portfolio

The third quarter also saw Mason Hawkins (Trades, Portfolio) exit positions in three companies:

Hasbro Inc (NASDAQ:HAS) was completely sold off, with 665,106 shares eliminated, impacting the portfolio by -1.52%.

All 19,655 shares of Syneos Health Inc (NASDAQ:SYNH) were liquidated, resulting in a -0.03% portfolio impact.

Noteworthy Reductions in Holdings

Hawkins also trimmed positions in 22 stocks, with significant reductions in:

General Electric Co (NYSE:GE) saw a drastic 98.86% decrease in shares, leading to a -3.58% portfolio impact. GE's stock traded at an average price of $112.61 during the quarter, with a 1.54% return over the past three months and a 79.75% year-to-date gain.

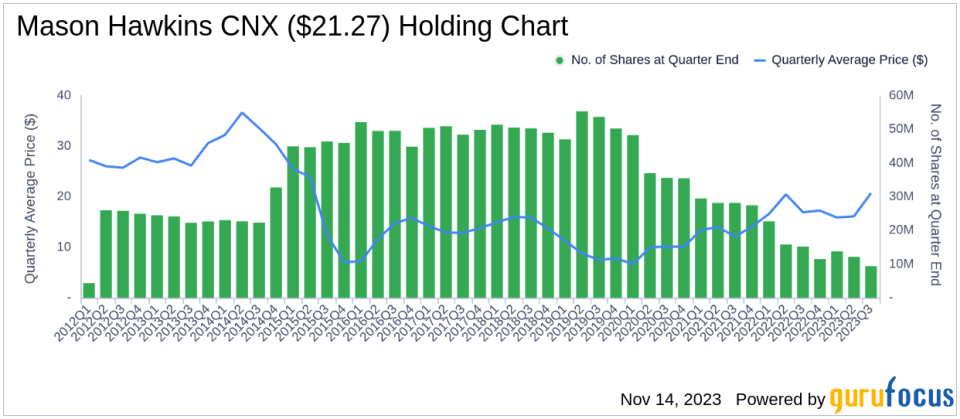

CNX Resources Corp (NYSE:CNX) shares were cut by 22.89%, affecting the portfolio by -1.74%. CNX traded at an average price of $20.73 and returned -1.71% over the past three months, with a 26.31% year-to-date increase.

Portfolio Composition and Industry Concentration

As of the third quarter of 2023, Mason Hawkins (Trades, Portfolio)'s portfolio is composed of 45 stocks. The top holdings include 7.84% in CNX Resources Corp (NYSE:CNX), 7.34% in Mattel Inc (NASDAQ:MAT), 5.86% in FedEx Corp (NYSE:FDX), 4.91% in Warner Bros. Discovery Inc (NASDAQ:WBD), and 4.38% in Affiliated Managers Group Inc (NYSE:AMG). The investments are predominantly spread across ten industries, with significant concentration in Consumer Cyclical, Communication Services, Industrials, and others.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.