MasTec Inc. (MTZ): A Construction Giant with Good Outperformance Potential

MasTec Inc. (NYSE:MTZ), a leading infrastructure construction company, is currently trading at $121.66 with a market capitalization of $9.59 billion. The company's stock price has seen a gain of 3.32% today and a 2.98% increase over the past four weeks. In this article, we will delve into the company's GF Score and its implications for potential investors.

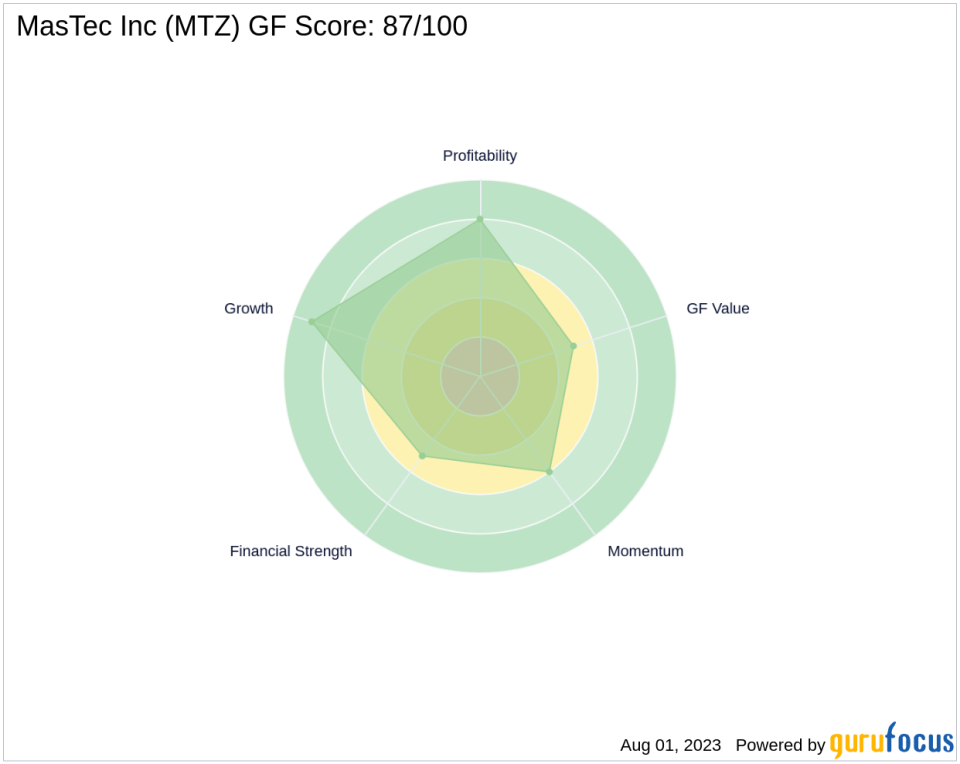

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus. It uses five aspects of valuation, which have been found to be closely correlated to the long-term performances of stocks. The GF Score ranges from 0 to 100, with 100 as the highest rank. The higher the GF Score, the higher the returns a stock is likely to generate. MasTec Inc. has a GF Score of 87 out of 100, indicating good outperformance potential.

Financial Strength Analysis

The Financial Strength rank measures a company's financial situation based on its debt burden, debt to revenue ratio, and Altman Z-Score. MasTec Inc. has a Financial Strength rank of 5 out of 10. Its interest coverage is 0.49, and its debt to revenue ratio is 0.34. The company's Altman Z score is 2.56, indicating it is not in immediate danger of bankruptcy but could improve its financial strength.

Profitability Rank Analysis

The Profitability Rank measures a company's profitability and its likelihood to remain profitable. MasTec Inc. has a Profitability Rank of 8 out of 10, indicating high profitability. The company's Operating Margin is 0.69%, and its Piotroski F-Score is 4, suggesting a stable financial situation.

Growth Rank Analysis

The Growth Rank measures a company's revenue and profitability growth. MasTec Inc. has a Growth Rank of 9 out of 10, indicating strong growth potential. The company's 5-year revenue growth rate is 8.60%, and its 3-year revenue growth rate is 10.70%.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. MasTec Inc. has a GF Value Rank of 5 out of 10, suggesting it is fairly valued.

Momentum Rank Analysis

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. MasTec Inc. has a Momentum Rank of 6 out of 10, indicating moderate momentum.

Comparison with Competitors

When compared to its main competitors in the construction industry, MasTec Inc. holds its ground. Tetra Tech Inc (NASDAQ:TTEK) has a GF Score of 87, TopBuild Corp (NYSE:BLD) has a GF Score of 93, and EMCOR Group Inc (NYSE:EME) has a GF Score of 84. This suggests that MasTec Inc. is competitive within its industry.

In conclusion, MasTec Inc. presents a good investment opportunity with its high GF Score, strong growth potential, and competitive standing in the construction industry. However, potential investors should also consider the company's moderate financial strength and momentum rank.

This article first appeared on GuruFocus.