Mastech Digital Inc (MHH) Faces Revenue Decline Amid Economic Challenges

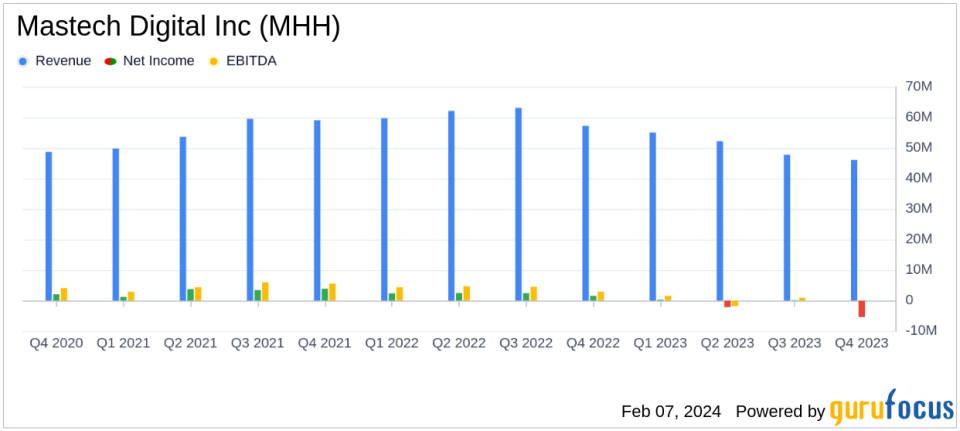

Revenue: Q4 revenue fell to $46.1 million, a 20% decrease from $57.2 million in the same quarter last year.

Net Income: GAAP net loss was $5.4 million in Q4, a significant downturn from a net income of $1.5 million in Q4 2022.

Earnings Per Share (EPS): GAAP EPS dropped to a loss of $0.46, compared to a gain of $0.13 per diluted share in the prior year's quarter.

Non-GAAP Measures: Non-GAAP net income for Q4 stood at $1.3 million, or $0.11 per diluted share, down from $2.8 million, or $0.23 per diluted share, in Q4 2022.

Gross Margin: Gross profit margin slightly decreased to 25.4% of total revenues in 2023 from 26.1% in 2022.

Cash Position: The company reported $21.1 million in cash with no bank debt and a borrowing availability of approximately $22.5 million.

Order Bookings: The Data and Analytics segment saw a notable uptick in order bookings, reaching $19 million in Q4.

On February 7, 2024, Mastech Digital Inc (MHH), a leading provider of Digital Transformation IT Services, released its 8-K filing, revealing a challenging fourth quarter and full year of 2023. The company reported a 20% year-over-year decline in fourth-quarter revenue, totaling $46.1 million compared to $57.2 million in the same period last year. The gross profits for the quarter also fell to $11.3 million from $14.2 million in the fourth quarter of 2022.

Mastech Digital Inc is known for its data and analytics solutions, IT staffing services, and digital transformation services, including staffing and project-based services around digital learning. The company primarily operates in two segments: Data & Analytics Services and IT Staffing Services, with the majority of its revenue generated from IT staffing services. Geographically, its primary market is the United States.

The company's performance was significantly impacted by economic headwinds, leading to a GAAP net loss of $5.4 million, or $0.46 per diluted share, in stark contrast to the net income of $1.5 million, or $0.13 per diluted share, during the same period in 2022. Non-GAAP net income also decreased to $1.3 million, or $0.11 per diluted share, from $2.8 million, or $0.23 per diluted share, in the fourth quarter of the previous year.

Despite the downturn, Mastech Digital's Data and Analytics segment reported strong order bookings during the quarter, signaling potential growth opportunities. The IT Staffing Services segment, however, experienced a decline in billable consultants, which the company attributes to seasonal trends and clients' completion of projects by year-end.

For the full year of 2023, Mastech Digital's revenues totaled $201.1 million, down from $242.2 million in 2022. The gross profits for the year were $51.0 million, or 25.4% of total revenues, compared to $63.2 million, or 26.1% of total revenues in 2022. The GAAP net loss for the year was $7.1 million, or $0.61 per diluted share, compared to a net income of $8.7 million, or $0.72 per diluted share in 2022. Non-GAAP net income for 2023 was $5.3 million, or $0.44 per diluted share, compared to $13.7 million, or $1.13 per diluted share in 2022.

The company's President and CEO, Vivek Gupta, commented on the results, stating,

Challenging economic conditions weighed on clients spending practices for most of 2023. As a result, both of our business segments experienced revenue declines during the year. However, during the fourth quarter 2023, our Data and Analytics segment saw a notable uptick in order bookings, and our IT Staffing segment achieved billable consultant headcount growth in October and November, before experiencing the seasonally high project ends of December. We are encouraged by both indicators as we enter the new year. Despite 2023s difficulties, we believe that our businesses remain fundamentally sound and that we are well positioned for a successful year in 2024."

Jack Cronin, Mastech Digital's Chief Financial Officer, also provided insights into the company's financial position, stating,

On December 31, 2023, we had $21.1 million of cash balances on hand, no bank debt, and borrowing availability of approximately $22.5 million under our revolving credit facility. Our Days Sales Outstanding (DSO) measurement stood at 53 days on December 31, 2023, which is well within our targeted range."

The company's balance sheet remains strong with $21.1 million in cash and cash equivalents and no bank debt. The total assets amounted to $105.2 million, while total liabilities were $23.8 million, resulting in total shareholders' equity of $81.4 million.

In conclusion, Mastech Digital Inc (MHH) faced significant challenges in 2023, reflected in the year-over-year decline in revenue and net income. However, the company's strong order bookings in the Data and Analytics segment and a robust balance sheet with no bank debt provide a foundation for potential recovery in 2024. Investors and stakeholders will be watching closely to see if the company can leverage these strengths to navigate the uncertain economic landscape.

Explore the complete 8-K earnings release (here) from Mastech Digital Inc for further details.

This article first appeared on GuruFocus.