MasterBrand Inc (MBC) Reports Mixed Fiscal Year 2023 Results Amid Market Headwinds

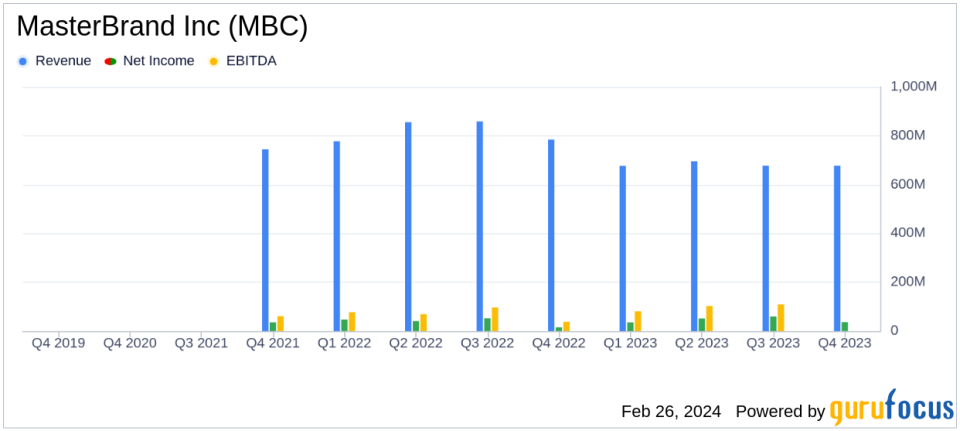

Net Sales: 2023 net sales saw a year-over-year decrease of 17% to $2.7 billion.

Net Income: A significant increase in net income, up 17% year-over-year to $182.0 million.

Adjusted EBITDA Margin: Improved by 150 basis points to 14.1% for the full year.

Free Cash Flow: Demonstrated strong cash generation with free cash flow of $348.3 million.

2024 Outlook: MasterBrand anticipates a low single-digit percentage to flat year-over-year net sales decline and adjusted EPS in the range of $1.40 to $1.60.

On February 26, 2024, MasterBrand Inc (NYSE:MBC) released its 8-K filing, announcing the financial results for the fourth quarter and full year of 2023. The company, a leading North American residential cabinet manufacturer, reported a decrease in net sales but an increase in net income and adjusted EBITDA margins, highlighting the effectiveness of its strategic initiatives and operational efficiencies.

MasterBrand's net sales for the fourth quarter were $677.1 million, a 14% decrease from the previous year, primarily due to lower volumes influenced by softer end-market demand. However, the company's gross profit margin saw a significant increase of 550 basis points to 32.9%, driven by savings from strategic initiatives, particularly in supply chain management and cost actions. This margin expansion contributed to a net income of $36.1 million for the quarter, more than doubling from the $15.4 million reported in the fourth quarter of 2022.

For the full year, MasterBrand's net sales totaled $2.7 billion, a 17% decrease from the previous year. Despite this, the company's net income increased by 17% to $182.0 million, and the adjusted EBITDA margin expanded by 150 basis points to 14.1%. The company's operational performance and working capital reduction plans led to a robust operating cash flow of $405.6 million and free cash flow of $348.3 million.

MasterBrand's balance sheet remained strong, with $148.7 million in cash and $480.2 million of availability under its revolving credit facility. The company's net debt to adjusted EBITDA ratio was 1.5x, reflecting a solid financial position.

Looking ahead to 2024, MasterBrand expects net sales to decline by a low single-digit percentage to flat, with adjusted EBITDA in the range of $370 million to $400 million. The adjusted EPS is projected to be between $1.40 and $1.60. These expectations are based on the company's ability to flex manufacturing, execute strategic initiatives, and continuous improvement efforts.

President and CEO Dave Banyard expressed confidence in the company's ability to navigate market dynamics and continue driving operational efficiencies. CFO Andi Simon highlighted the launch of new products and channel-specific packages aimed at capturing market share.

MasterBrand's performance in a challenging market environment demonstrates the resilience of its business model and the success of its strategic initiatives. The company's ability to expand margins and generate strong cash flows, even with declining sales, is a testament to its operational strength. As MasterBrand enters the new fiscal year, investors will be watching closely to see if the company can maintain its momentum and achieve its 2024 financial targets.

For more detailed financial information and the full earnings report, please refer to the 8-K filing.

Investors and stakeholders are encouraged to join MasterBrand's conference call and webcast later today for further discussion on the financial results and business outlook.

For further inquiries, please contact MasterBrand's Investor Relations at Investorrelations@masterbrand.com or visit the company's website at www.masterbrand.com.

Explore the complete 8-K earnings release (here) from MasterBrand Inc for further details.

This article first appeared on GuruFocus.