Mastercard Inc (MA) Reports Solid Growth in Q4 and Full Year 2023 Earnings

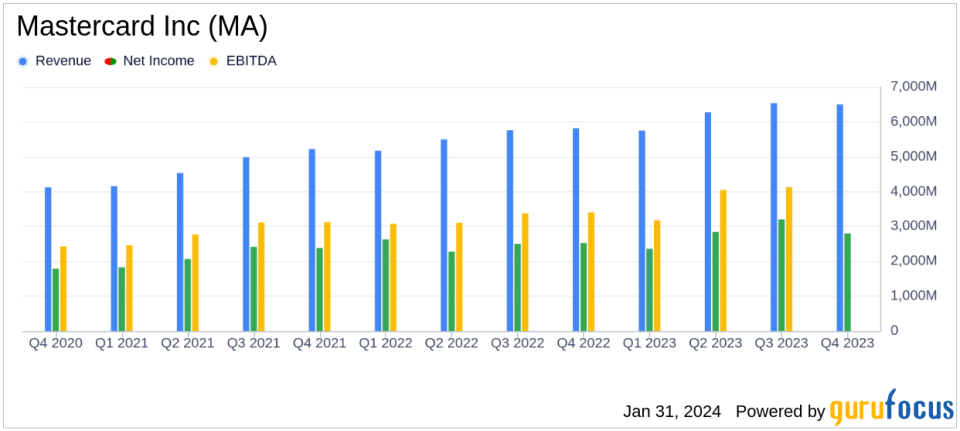

Net Revenue: Q4 net revenue increased by 13% to $6.5 billion, with full-year revenue also up 13%.

Net Income: Q4 net income rose to $2.8 billion, marking an 11% increase, while adjusted net income for the quarter reached $3.0 billion.

Diluted EPS: Q4 diluted EPS grew by 13% to $2.97, with adjusted diluted EPS up 20% to $3.18.

Operating Margin: Adjusted operating margin for Q4 improved to 56.2%, reflecting a 1.2 percentage point increase.

Share Repurchase: During Q4, Mastercard repurchased 4.5 million shares at a cost of $1.8 billion and paid $534 million in dividends.

Business Drivers: Gross dollar volume and purchase volume grew by 10% and 11% respectively on a local currency basis in Q4.

On January 31, 2024, Mastercard Inc (NYSE:MA) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a global payments technology giant, reported a net income of $2.8 billion for the quarter, translating to a diluted earnings per share (EPS) of $2.97. Adjusted figures were even more robust, with net income reaching $3.0 billion and adjusted diluted EPS climbing to $3.18.

Mastercard, the second-largest payment processor worldwide, processed approximately $8 trillion in transactions in 2022 and operates in over 200 countries, handling transactions in more than 150 currencies. The company's performance is a critical indicator of consumer spending trends and the health of the global economy.

Financial Performance and Challenges

The company's fourth-quarter revenue saw a 13% increase to $6.5 billion, with a similar growth rate on a currency-neutral basis. This growth was driven by a 10% increase in gross dollar volume, an 18% rise in cross-border volume, and a 12% growth in switched transactions, all on a local currency basis. For the full year, net revenue also increased by 13%, with gross dollar volume and cross-border volume growing by 12% and 24% respectively.

Despite these gains, Mastercard faced increased operating expenses, which rose by 21% in the fourth quarter, attributed primarily to higher personnel costs. Adjusted operating expenses, which exclude special items, saw a more moderate increase of 10%. The company's operating margin declined slightly due to these higher expenses, yet the adjusted operating margin improved, indicating effective cost management when adjusting for one-time factors.

Financial Achievements and Industry Significance

Mastercard's financial achievements, particularly in adjusted net income and EPS growth, underscore the company's ability to leverage its vast payment network and value-added services. The growth in cyber and intelligence solutions, as well as marketing, data analytics, and loyalty services, reflects the company's strategic focus on diversifying its revenue streams beyond transaction processing fees.

In the competitive credit services industry, Mastercard's continued investment in technology and innovation, as well as its strategic partnerships and customer deals, are vital for maintaining its market position and responding to evolving consumer and business needs.

Key Financial Metrics and Commentary

Mastercard's CEO, Michael Miebach, highlighted the company's strategic execution, stating:

"We delivered strong earnings and revenue growth for the full year 2023, driven by healthy consumer spending, cross-border volume growth of 24 percent, and the solid execution of our strategy."

This commentary emphasizes the importance of Mastercard's global reach and its ability to capitalize on increased spending and cross-border transactions.

Analysis of Mastercard's Performance

Mastercard's performance in the fourth quarter and full year of 2023 reflects a resilient payments industry and the company's robust business model. The growth in key metrics such as gross dollar volume and cross-border volume indicates strong consumer confidence and spending. However, the increase in operating expenses and the slight decline in operating margin suggest areas where the company may seek to optimize costs.

The company's return of capital to shareholders through share repurchases and dividends demonstrates confidence in its financial health and commitment to delivering shareholder value. With $13.6 billion remaining under the approved share repurchase programs, Mastercard continues to prioritize capital allocation strategies that enhance shareholder returns.

Overall, Mastercard's financial results for the fourth quarter and full year of 2023 indicate a positive trajectory, with significant growth in revenue and earnings per share. The company's strategic focus on expanding its suite of services and solutions, along with its global presence, positions it well for continued success in the dynamic payments industry.

Explore the complete 8-K earnings release (here) from Mastercard Inc for further details.

This article first appeared on GuruFocus.