Mastercard (MA) Earnings to Fly on High Spending, Low Tax

Mastercard Inc. MA is scheduled to report first-quarter 2018 results on May 1, before the opening bell. We expect earnings to see an upside from a strong U.S economy, solid consumer confidence and low unemployment which must have led to higher spending via cards, thereby boosting gross dollar volumes.

Among regions, business growth will be seen in Asia, Australia, ASEAN countries, led by improvement in consumer and business sentiment. The Latin American region which is recovering from economic recession should also lead to business growth, while Europe should see mild growth. The company’s global business should drive its worldwide gross dollar volume, which is expected to be $1.34 trillion, up 13% year over year.

A number of acquisitions made by the company should contribute to its inorganic growth.

We expect an increase in revenues from the company’s Service Business led by its efforts in expanding this business, which has been posting strong earnings for the past many years. Higher utilization of the company's service offerings led to revenue acceleration in the previous quarter, and the same is expected in the quarter to be reported.

A decline in tax rate as a result of the recently passed Tax Cuts and Jobs Act will aid the company’s margins.

The weakening of dollar in the first quarter will provide a tailwind to earnings.

On the expense front, the company continues to invest in key long-term growth areas such as digital, security solutions and geographic expansion in addition to incremental employee and technology investment. The company expects operating expense increase in the first quarter of 2018 to be $250 million higher than the company’s annual estimated increase rate of low double digit, due to the timing of the market development programs, (due to new revenue recognition rules), the impact of the acquisitions, which occurred after first-quarter 2017 and the $100-million charge for the center for inclusive growth, which will be absorbed in the to-be reported quarter.

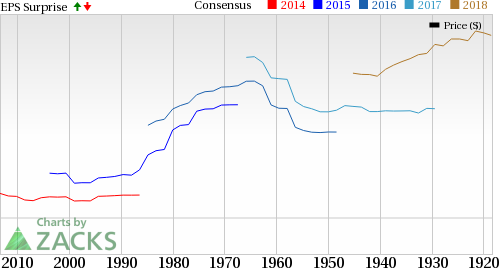

Earnings Surprise History

The company boasts an attractive earnings surprise history, having surpassed estimates in each of the trailing four quarters, with an average positive surprise of 5.99%. This is depicted in the chart below:

Mastercard Incorporated Price and EPS Surprise

Mastercard Incorporated Price and EPS Surprise | Mastercard Incorporated Quote

Why a Likely Positive Surprise?

Our proven model indicates that chances of Mastercard beating the Zacks Consensus Estimate is high as it has the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Earnings ESP for Mastercard is +0.03%.

Zacks Rank: Mastercard has a Zacks Rank # 2(Buy), which increases the predictive power of ESP.

Other Stocks That Warrant a Look

Here are some companies that you may consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

FleetCor Technologies, Inc. FLT is expected to report first-quarter 2018 earnings results on May 3. The company has an Earnings ESP of +0.79% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

WEX Inc. WEX has an Earnings ESP of +0.44% and a Zacks Rank #2. The company is expected to report first-quarter earnings results on May 3.

Cardtronics Plc CATM is expected to report first-quarter 2018 earnings results on May 3. The company has an Earnings ESP of +10.00% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardtronics PLC (CATM) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

To read this article on Zacks.com click here.