Can Mastercard's (MA) Q3 Earnings Beat on Transactions Growth?

Mastercard Incorporated MA is set to beat on earnings for the third quarter of 2023, the results for which are scheduled to be released on Oct 26, before the opening bell.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter earnings per share of $3.21 suggests a 19.8% increase from the prior-year figure of $2.68. The consensus mark has jumped one penny over the past week. The consensus estimate for third-quarter revenues of $6.5 billion indicates a 13.4% increase from the year-ago reported figure.

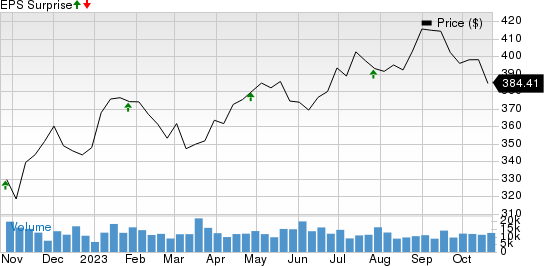

Mastercard beat estimates in all the trailing four quarters, delivering an average surprise of 3.2%. This is depicted in the graph below.

Mastercard Incorporated Price and EPS Surprise

Mastercard Incorporated price-eps-surprise | Mastercard Incorporated Quote

What the Quantitative Model Suggests

Our proven model predicts a likely earnings beat for Mastercard this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is precisely the case here.

Earnings ESP: Mastercard has an Earnings ESP of +0.12%. This is because the Most Accurate Estimate is currently pegged at higher than the Zacks Consensus Estimate of $3.21. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Mastercard currently has a Zacks Rank #3.

Before we get into what to expect for the to-be-reported quarter in detail, it’s worth taking a look at MA’s previous-quarter performance first.

Q2 Earnings Rewind

In the last reported quarter, the leading global payment solutions company’s adjusted earnings per share of $2.89 beat the Zacks Consensus Estimate by 1.8%. This was primarily driven by strong consumer spending, specifically across the travel sector and an enhanced services suite. Robust growth in cross-border volume also contributed to the upside. However, the performance was partly offset by an escalating operating cost level.

Now, let’s see how things have shaped up prior to the third-quarter earnings announcement.

Factors Driving Q3 Performance

Mastercard's third-quarter revenues are expected to have received a boost from amplified spending in the travel and entertainment sectors. MA's GDV (Gross Dollar Volume), measuring the value of transactions on Mastercard-branded cards, is likely to have been positively influenced by increased card usage, both domestically and internationally, in the to-be-reported quarter.

The Zacks Consensus Estimate for the company’s total GDV for all MA-branded programs suggests a 12.3% rise from the prior-year quarter’s reported figure, whereas our model predicts a nearly 10% increase. We expect GDV from domestic operations to have increased almost 6% year over year and 12% in international operations. Growing strength in Latin American and European operations is likely to have driven the metric.

Processed transactions are expected to have experienced an upsurge, driven by resilient consumer spending and increased contactless acceptance initiatives pursued by the technology company. The Zacks Consensus Estimate for its processed transactions indicates a 14.8% rise from the prior-year quarter’s reported figure, whereas our estimate suggests a 13.5% increase.

The expansion of cross-border travel is anticipated to have had a positive impact on Mastercard's cross-border volumes. The consensus estimate for cross-border assessments suggests an increase of nearly 21% compared with the previous year, while our projection indicates growth exceeding 22%. Further, our model predicts domestic assessments and transaction processing assessments to witness a 12.7% and 12.9% year-over-year increase, respectively.

All the factors mentioned above are expected to have propelled Mastercard's results for the reviewed quarter, driving substantial growth compared to the prior year and positioning it for a potential earnings beat. However, it is likely that the company also faced increased costs, as well as higher rebates and incentives in the September quarter, which could partially offset these positive developments.

Mastercard’s operating costs are likely to have increased in the third quarter due to higher G&A costs, potentially hampering its profitability. We expect total adjusted operating expenses to increase 11.6% from the prior-year quarter’s actuals.

Furthermore, our estimate for payments network rebates and incentives suggests a nearly 20% year-over-year increase. Also, due to the high interest rate environment, the company’s interest expense figure is likely to have jumped around 19% from the prior-year period.

Other Stocks That Warrant a Look

Here are some other companies worth considering from the broader Business Services space, as our model shows that these, too, have the right combination of elements to beat on earnings this time around:

FirstCash Holdings, Inc. FCFS has an Earnings ESP of +5.71% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FirstCash’s bottom line for the to-be-reported quarter is pegged at $1.40 per share, indicating 7.7% year-over-year growth. The estimate increased by a penny over the past week. Furthermore, the consensus mark for FCFS’ revenues is pegged at $767 million, suggesting 14.1% growth from a year ago.

PagSeguro Digital Ltd. PAGS has an Earnings ESP of +1.96% and a Zacks Rank of 3.

The Zacks Consensus Estimate for PagSeguro’s bottom line for the to-be-reported quarter is pegged at 26 cents per share, which suggests an 8.3% year-over-year jump. The estimate remained stable over the past week. PAGS beat earnings estimates in all the past four quarters, with an average of 9.3%.

Shift4 Payments, Inc. FOUR has an Earnings ESP of +9.38% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Shift4 Payments’ bottom line for the to-be-reported quarter is pegged at 70 cents per share, indicating 59.1% year-over-year growth. FOUR beat earnings estimates in all the past four quarters, with an average surprise of 21.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report

Shift4 Payments, Inc. (FOUR) : Free Stock Analysis Report