Is Mastercard's Premium Valuation Deserved?

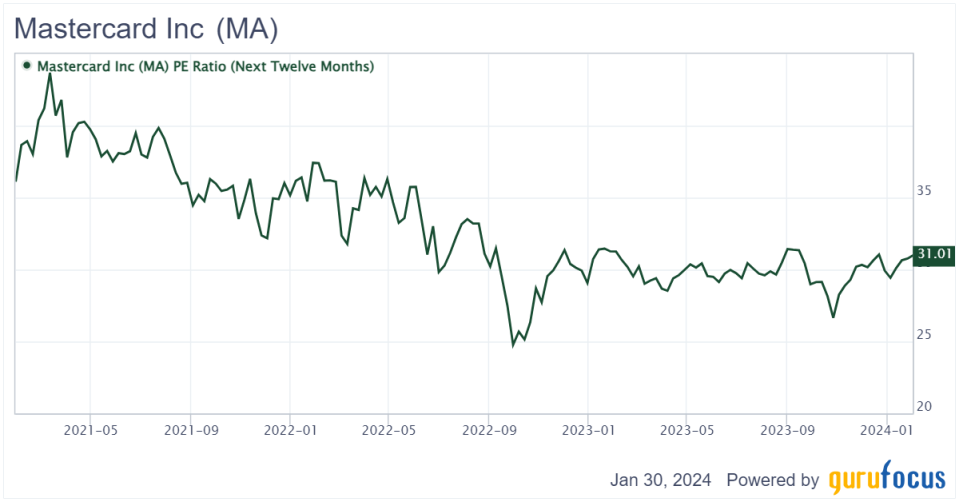

Mastercard Inc. (NYSE:MA) trades at approximately 31 times consensus 2024 earnings per share. Comparably, the S&P 500 trades at roughly 21 times consensus earnings.

Warren Buffett (Trades, Portfolio) appears to believe the stock is worth its premium valuation as Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) owns nearly 4 million shares. Based on current market prices, this position is worth roughly $1.6 billion.

I agree with Buffett and believe that Mastercard is worth its premium valuation due to its wide moat and strong growth prospects.

Wide-moat business

Mastercard is the third-largest payments processing company globally with an estimated total market share of 24%. The global payments market is highly concentrated with the leading player, Visa (NYSE:V), having an estimated 39% market share. China-based UnionPay is the second-largest player globally with an estimated 34% market share. Outside of China, the payments network business is dominated by Visa and Mastercard as the vast majority of UnionPay volume is inside China.

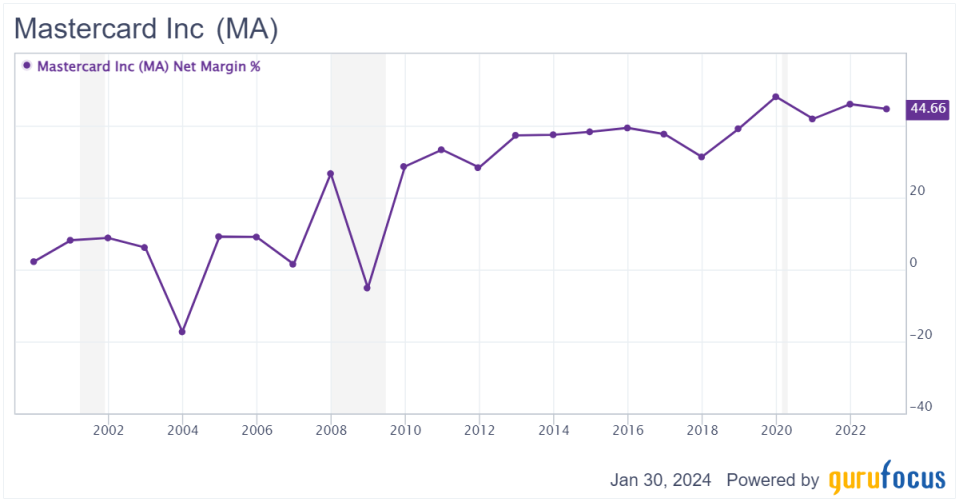

In the U.S., Mastercard competes with smaller players such as American Express (NYSE:AXP), Capital One (NYSE:COF) and Discover (NYSE:DFS). However, the marketplace is dominated by Mastercard, Visa and American Express. For these reasons, the payment network business can be characterized as an oligopoly. This market structure results in a low degree of competition and high profit margins. The company's consistently high profit margins, which have averaged over 40% over the past 10 years, serve as evidence of the wide moat that Mastercard enjoys.

Barriers to entry for new players are very high in the card network business as it would require massive adoption among merchets to be competitive with the coverage of Visa or Mastercard networks.

The result of a low degree of existing competition and high barriers to entry is that Mastercard is a wide-moat business.

MA Data by GuruFocus

Strong growth prospects

Mastercard has several key growth drivers, including annual increases in card spending due to economic growth and a continued transition toward spending on credit cards versus cash. Historically, nominal U.S. gross domestic product has grown at around 6%. Thus, assuming no increase in the proportion of transactions executed on cards versus cash, Mastercard should be able to grow revenue at 6%. Research conducted the Pew Research Center suggests that roughly 41% of Americans do not use cash for any of their purchases, while 44% of Americans still use cash for some of their purchases. This is a significant change from 2015, when it was estimated that roughly 24% of Americans did not use cash for any of their purchases while 51% of Americans did. Thus, while the trend away from cash has been growing, there is significant room for a further shift in spending volumes away from cash and toward cards.

Current consensus estimates call for Mastercard to report revenue growth of 12.20% in 2024, 13% in 2025 and 10.90% in 2026. I view these estimates as fairly reasonable given the company has grown revenue at an annual rate of roughly 11% over the past five years. Consensus estimates call for the company to report earnings per share growth of 16.90% for 2024, 18% for 2025 and 18.20% for 2026. I view these estimates as reasonable since the company has grown earnings per share over the past five years at an annual rate of roughly 18%. Earnings are likely to grow faster than revenue due to the impact of share repurchases and modest margin expansion. I view modest margin expansion as likely given that the company's cost base is unlikely to rise at the same pace as revenues since Mastercard has very little marginal costs for additional spend on its network.

Valuation is reasonable versus peers

Mastercard is currently trading at approximately 31 times forward earnings per share. This compares to its larger peer Visa, which trades at approximately 28 times forward earnings. I view this relative premium valuation as reasonable given that the company has historically experienced slightly better growth prospects due to a higher percentage of its volume being outside the U.S. compared to Visa. Mastercard is also expected to experience modestly better revenue and earnings per share growth than Visa over the next few years, which further supports the case that it should trade at a premium. For context, consensus estimates for 2024 to 2026 call for Visa to grow earnings per share at rates of 12.60%, 12.90% and 14.60%.

I also find Mastercard's premium valuation to the broader market as reasonable as it has better near-term growth prospects than the broader market. While consensus estimates call for the S&P 500 to grow earnings by roughly 12% for fiscal year 2024, I expect growth to moderate back toward historical norms of high single digits in the years that follow. I view 10% as a reasonable five-year earnings growth estimate for the S&P 500. Comparably, over the next five years, I believe Mastercard can grow earnings at a annual rate of 16%, which represents a small discount to the growth rate over the past five years. Thus, based on these growth estimates, the stock is trading at a forward PEG ratio of 1.90 while the broader market is trading at a PEG ratio of 2.10.

Mastercard's forward price-earnings ratio of 31 is also fairly attractive versus historical norms. Over the past few years, the stock has traded at an average forward price-earnings ratio of approximately 35. Over the past 10 years, it has traded at an average trailing price-earnings ratio of approximately 37. Thus, based on these metrics, I view the company's current valuation as attractive versus historical norms.

MA Data by GuruFocus

Risks to the bull case

I believe the biggest risk to the Mastercard bull case is the potential for regulatory reform, which might limit how much card network operators can change or increase competition. For example, the proposed Credit Card Competition Act would require banks to give merchants a choice of two different network to process credit card transactions on. In response to this proposed legislation, Mastercard released a public letter to a number of U.S. Senators noting the proposed legislation would remove customer choice, erode security, eliminate rewards and prevent small businesses from investing in their future.

I view near-term passage of the Credit Card Competition Act unlikely given the other events, including wars in the Middle East and Ukraine, competing for time on the congressional agenda. That said, investors should continue to actively monitor the regulatory environment as it poses a key risk to the business over the longer term.

Conclusion

Mastercard trades at a premium valuation to the broader market and its closest peer. I view the premium as warranted given the company's wide-moat business and solid growth potential. Additionally, I view the modest valuation premium relative to Visa as appropriate given the fact Mastercard has modestly better growth prospects. The stock is trading at a discount to its historical valuation norms, which suggests it is undervalued relative to its own historical valuation norm.

The biggest risk facing the company is potential regulatory reform. However, I view this as unlikely given the current political climate.

For these reasons, I believe Mastercard is worthy of its premium valuation and view the shares as attractive currently.

This article first appeared on GuruFocus.