MasterCraft Boat Holdings Inc (MCFT) Faces Headwinds as Q2 Net Sales Dip 37.5%

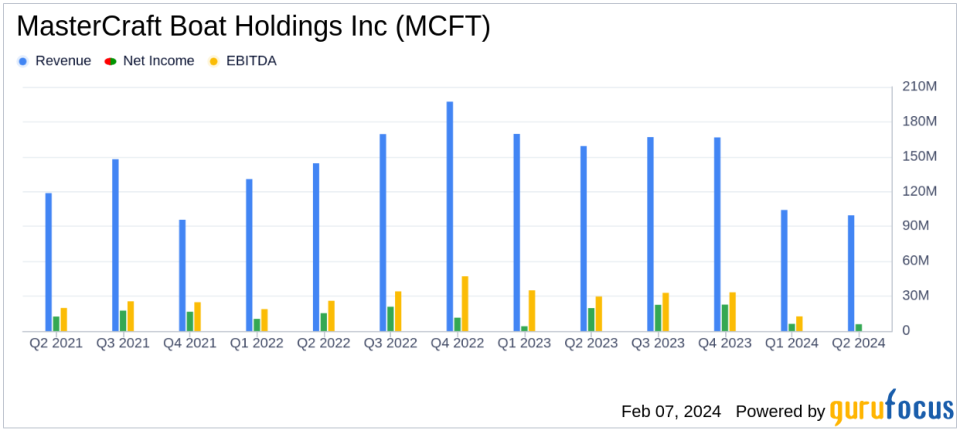

Net Sales: $99.5 million, a decrease of 37.5% from the prior-year period.

Net Income: $5.9 million from continuing operations, translating to $0.35 per diluted share.

Adjusted EBITDA: $9.8 million, down 67.2% from the prior-year period.

Share Repurchases: $4.4 million during the quarter, with a total of $58.6 million since June 2021.

Outlook: Full-year guidance narrowed, with net sales expected between $400 million and $412 million.

On February 7, 2024, MasterCraft Boat Holdings Inc (NASDAQ:MCFT) released its 8-K filing, detailing financial results for its fiscal 2024 second quarter ended December 31, 2023. The company, known for designing, manufacturing, and marketing performance sport boats and outboard boats, faced significant headwinds this quarter, with net sales falling to $99.5 million, a 37.5% decrease from the prior-year period.

Performance Amidst Challenges

MasterCraft's net income from continuing operations stood at $5.9 million, or $0.35 per diluted share, a stark contrast to the $20.0 million, or $1.12 per diluted share, reported in the same quarter of the previous fiscal year. The diluted Adjusted Net Income per share, a non-GAAP measure, was $0.37, reflecting a 69.2% decline from the prior-year period. Adjusted EBITDA also saw a significant drop to $9.8 million, down 67.2% from the prior-year period.

Despite these challenges, CEO Fred Brightbill highlighted the company's performance, which exceeded previously issued guidance amidst macroeconomic uncertainty and a competitive retail environment. Brightbill emphasized the company's focus on rebalancing dealer inventories with anticipated retail demand and investing in initiatives to capitalize on positive industry trends.

Financial Resilience and Strategic Initiatives

MasterCraft's disciplined approach to capital allocation was evident in its operational cash flow generation of $19.2 million year-to-date and a strong balance sheet with $108.8 million in cash and investments. The company's commitment to shareholder returns continued with the repurchase of more than 214,000 shares of common stock during the quarter, totaling $4.4 million.

The company's gross margin percentage declined by 520 basis points due to lower cost absorption, higher dealer incentives, and increased costs related to material, labor, and overhead inflation, partially offset by higher prices. Operating expenses remained relatively consistent as the company continues to invest in product development and marketing.

Outlook and Industry Conditions

Looking forward, MasterCraft has narrowed its full-year guidance, with consolidated net sales expected to be between $400 million and $412 million, Adjusted EBITDA between $42 million and $47 million, and Adjusted Earnings per share between $1.53 and $1.78. The company anticipates capital expenditures to be approximately $20 million for the full year.

Brightbill concluded with caution, noting mixed economic outlooks and limited visibility on retail demand. The competitive retail environment, with increased promotional activity, is likely to pressure margins across the industry. MasterCraft will continue to monitor retail results and adjust its production and shipment plans accordingly.

For value investors and potential GuruFocus.com members, MasterCraft's latest earnings report presents a mixed picture. While the company's net sales have declined significantly, its ability to exceed guidance and maintain a strong balance sheet with ongoing share repurchases may signal underlying resilience. The company's strategic initiatives, including the launch of a new pontoon brand, could offer long-term growth potential despite short-term market challenges.

For a more detailed analysis and updates on MasterCraft Boat Holdings Inc (NASDAQ:MCFT), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from MasterCraft Boat Holdings Inc for further details.

This article first appeared on GuruFocus.