Matador (MTDR) Q3 Earnings Beat Estimates on Record Production

Matador Resources Company MTDR reported third-quarter 2023 adjusted earnings of $1.86 per share, which beat the Zacks Consensus Estimate of $1.59. However, the bottom line declined from the year-ago quarter’s level of $2.68.

Total quarterly revenues of $772 million beat the Zacks Consensus Estimate of $697 million. The top line, however, declined from the year-ago quarter’s level of $841 million.

Matador’s milestone with its highest-ever total production, averaging more than 135,000 barrels of oil and natural gas equivalent per day, led to better-than-expected third-quarter results. However, declining realized commodity prices offset the positive.

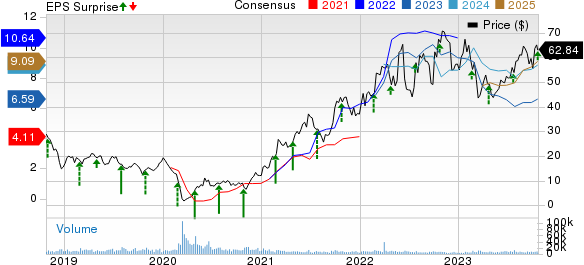

Matador Resources Company Price, Consensus and EPS Surprise

Matador Resources Company price-consensus-eps-surprise-chart | Matador Resources Company Quote

Upstream Business in Q3

Since MTDR is engaged in oil and gas exploration and production activities, the fate of its overall business primarily depends on the oil and gas pricing scenario. The majority of the company’s production comprises oil (57% of total production in the third quarter), making this commodity’s price the prime factor in determining MTDR’s earnings.

Let’s have a look at Matador’s average sales prices of commodities along with production.

Declining Average Sales Prices of Commodities

MTDR reported third-quarter 2023 average sales price for oil (without realized derivatives) at $82.49 per barrel, declining from $94.36 in the year-ago period. However, the commodity price was higher than our projection of $80.51 per barrel. The price of natural gas was recorded at $3.56 per thousand cubic feet (Mcf), which slipped from $9.22 in the year-ago quarter but beat our estimate of $3.23.

Notably, our estimates and the reported figures for oil and gas prices were significantly lower year over year in the third quarter. This was possibly due to concerns over a looming recession and an economic slowdown.

Increasing Production

Matador reported third-quarter 2023 oil production at 77,529 barrels per day (B/D), up from 60,163 in the prior-year quarter. The figure also beat our estimate of 76,084.3 B/D. Natural gas production was recorded at 345.4 million cubic feet per day (MMcf/D), up from 270.3 MMcf/D recorded a year ago. The reported figure also outpaced our estimate of 325.3 MMcf/D.

Significant success in MTDR’s drilling program in 2022 and 2023 primarily contributed to higher-than-expected production. Total oil equivalent production in the third quarter was 135,096 BOE/D, which not only surged from the year-ago quarter’s level of 105,214 BOE/D, but also surpassed our projection of 130,304.8 BOE/D.

Operating Expenses

MTDR’s plant and other midstream services’ operating expenses declined to $2.48 per barrel of oil equivalent (BOE) from the year-earlier level of $2.56 and our expected figure of $2.57. However, lease operating costs increased from $4.38 per BOE in third-quarter 2022 to $5.34, surpassing our projection of $5.12. Yet, production taxes, transportation and processing costs declined to $5.77 per BOE from $7.64 in the year-ago quarter and our projected figure of $5.86.

Total operating expense per BOE was $31.65, higher than the prior-year reported figure of $29.71. It was also marginally higher than our projection of $31.28.

Balance Sheet & Capital Spending

As of Sep 30, 2023, Matador had cash and restricted cash of $62.2 million. Long-term debt was $2,188.7 million. The company spent $315.9 million for the drilling, completing and equipping of wells in the third quarter.

Outlook

For the fourth quarter of 2023, Matador expects its average daily oil equivalent production to be 145,000 BOE. The recent guidance indicates a 2% upward revision from the prior projection of 143,000 BOE/D.

MTDR expects lower capital expenditures for full-year 2023, primarily due to lower midstream capital expenditures of $25 million.

Zacks Rank & Other Stocks to Consider

Matador currently sports a Zacks Rank #1 (Strong Buy). Some other top-ranked players in the energy sector are APA Corporation APA, currently sporting a Zacks Rank #1, and Pioneer Natural Resources Company PXD and Diamondback Energy Inc. FANG, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based APA Corporation is one of the world's leading independent energy companies engaged in the exploration, development and production of natural gas, crude oil and natural gas liquids. APA boasts a large geographically diversified reserve base with multi-year trends in reserve replacement. It has witnessed an upward earnings estimate revision for 2023 and 2024 in the past seven days.

APA’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 13.9%.

Pioneer Natural Resources is a leading upstream energy firm with primary operations in the Permian basin, which is among the lucrative oil shale plays in the United States with fewer risks. Its total holding of more than 1 million net acres in the Permian basin will support long-term oil production growth. PXD has witnessed an upward earnings estimate revision for 2023 in the past seven days.

PXD’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 4.34%.

Diamondback Energy is an independent oil and gas exploration and production company with its primary focus on the Permian Basin, where it has around 491,000 net acres. With an attractive production profile, favorable industry trends and FANG’s low breakeven economics, the margin of safety on investment is likely very high. The company has witnessed an upward earnings estimate revision for 2023 in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APA Corporation (APA) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report