Matador (MTDR) Q4 Earnings Beat Estimates on Higher Production

Matador Resources Company MTDR reported fourth-quarter 2023 adjusted earnings of $1.99 per share, which beat the Zacks Consensus Estimate of $1.75. However, the bottom line declined from the year-ago quarter’s level of $2.08.

Total quarterly revenues of $836 million beat the Zacks Consensus Estimate of $770 million. The top line increased from the year-ago quarter’s level of $707 million.

Better-than-expected fourth-quarter earnings were aided by Matador’s high total production volume, averaging more than 154,200 barrels of oil and natural gas equivalent per day. However, declining realized commodity prices offset the positive.

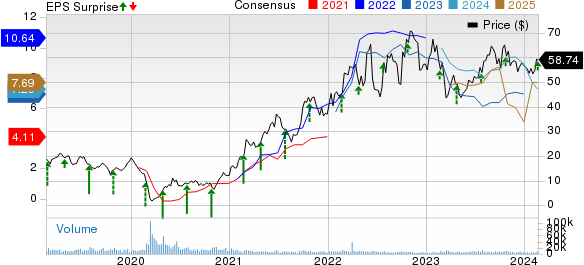

Matador Resources Company Price, Consensus and EPS Surprise

Matador Resources Company price-consensus-eps-surprise-chart | Matador Resources Company Quote

Upstream Business in Q4

Since MTDR is engaged in oil and gas exploration and production activities, the fate of its overall business primarily depends on the oil and gas pricing scenario. The majority of Matador’s production comprises oil (57% of total production in the fourth quarter), making this commodity’s price the prime factor in determining the company’s earnings.

Let’s take a look at Matador’s average sales price of commodities, along with production.

Declining Average Sales Price of Commodities

MTDR reported fourth-quarter 2023 average sales price for oil (without realized derivatives) at $79.00 per barrel, down from $83.90 in the year-ago period. The commodity price was also lower than our projection of $79.36 per barrel. The price of natural gas was recorded at $3.01 per thousand cubic feet (Mcf), which slipped from $5.65 in the year-ago quarter. The figure also missed our estimate of $3.33 Mcf.

Notably, our estimates and the reported figures for oil and gas prices were significantly lower year over year in the fourth quarter. This was possibly due to concerns over a looming recession and an economic slowdown.

Increasing Production

Matador reported fourth-quarter 2023 oil production of 88,663 barrels per day (B/D), up from 62,316 B/D in the prior-year quarter. The figure also beat our estimate of 86,750 B/D. Natural gas production was recorded at 393.6 million cubic feet per day (MMcf/D), up from 296.5 MMcf/D recorded a year ago. The reported figure also outpaced our estimate of 351 MMcf/D.

The higher production was driven by increased output from wells in the Stateline asset area and Rodney Robinson leasehold, the exceptional performance of Margarita wells, land acquisitions contributing approximately 1,000 BOE per day more than expected, and higher-than-anticipated production from non-operated assets. Total oil equivalent production in the fourth quarter was 154,261 BOE/D, which not only surged from the year-ago quarter’s level of 111,735 BOE/D but also surpassed our projection of 145,249 BOE/D.

Operating Expenses

MTDR’s plant and other midstream services’ operating expenses declined to $2.56 per BOE from the year-earlier level of $2.85. Our estimate for the same was pinned at $2.53. However, lease operating costs increased from $3.98 per BOE in fourth-quarter 2022 to $5.06. Our projection for the metric was pinned at $5.44 per BOE. Yet, production taxes, transportation and processing costs declined to $5.31 per BOE from $6.10 in the year-ago quarter.

Total operating expense per BOE was $30.52, higher than the prior-year reported figure of $29.09, yet well below our estimate of $32.53.

Balance Sheet & Capital Spending

As of Dec 31, 2023, Matador had cash and restricted cash of $106.3 million, and a long-term debt of $2,206.6 million. The company spent $337.3 million for the drilling, completion and equipment of wells in the fourth quarter.

Outlook

For full-year 2024, Matador expects its average daily oil equivalent production to be in the range of 153,000-159,000 BOE/d, indicating an 18% year-over-year increase. It also expects total capital expenditures for the full year between $1.30 billion and $1.55 billion.

Zacks Rank & Stocks to Consider

Matador currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy sector are Equitrans Midstream ETRN, Energy Transfer ET, and Subsea 7 S.A. SUBCY, which currently sport a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Equitrans Midstream owns, operates, acquires and develops midstream assets, primarily in the Appalachian Basin. It manages natural gas transmission, storage and gathering systems, and high and low-pressure gathering lines.

The Zacks Consensus Estimate for ETRN’s 2024 EPS is pegged at 90 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. ETRN’s 2024 earnings are expected to rise 34.3% year over year.

Energy Transfer is a publicly traded limited partnership, focused on diverse energy assets in the United States. Its core operations involve natural gas midstream services, transportation, storage, crude oil facilities and marketing assets.

The Zacks Consensus Estimate for ET’s 2024 EPS is pegged at $1.45. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. ET’s 2024 earnings are expected to rise 12.4% year over year.

Subsea 7 S.A. helps build underwater oil and gas fields. It is a top player in the Oil and Gas Equipment and Services market, which is expected to grow as oil and gas production moves further offshore.

The Zacks Consensus Estimate for SUBCY’s 2024 EPS is pegged at 91 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. SUBCY’s 2024 earnings are expected to soar 277% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energy Transfer LP (ET) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Equitrans Midstream Corporation (ETRN) : Free Stock Analysis Report