Matador Resources Co's Meteoric Rise: Unpacking the 15% Surge in Just 3 Months

Matador Resources Co (NYSE:MTDR), an independent energy company in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 14.70% over the past three months, reaching a current price of $63.61. This impressive performance has pushed the company's market cap to $7.58 billion, reflecting a strong investor confidence in the company's prospects.

Stock Performance Analysis

Over the past week, Matador Resources Co's stock price has seen a gain of 13.89%, continuing the upward trend observed over the past three months. The company's GF Value, a measure of a stock's intrinsic value defined by GuruFocus.com, currently stands at $63.87, indicating that the stock is fairly valued. This is a slight shift from three months ago when the GF Value was $71.79, suggesting that the stock was modestly undervalued. This change in valuation reflects the stock's recent price gains and the market's evolving perception of the company's value.

Company Overview

Matador Resources Co is engaged in the exploration, development, production, and acquisition of oil and natural gas resources. The majority of the company's assets are located in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. The company often uses advanced formation evaluation, 3-D seismic technology, horizontal drilling, and hydraulic fracturing technology to enhance the development of the basins in which it operates.

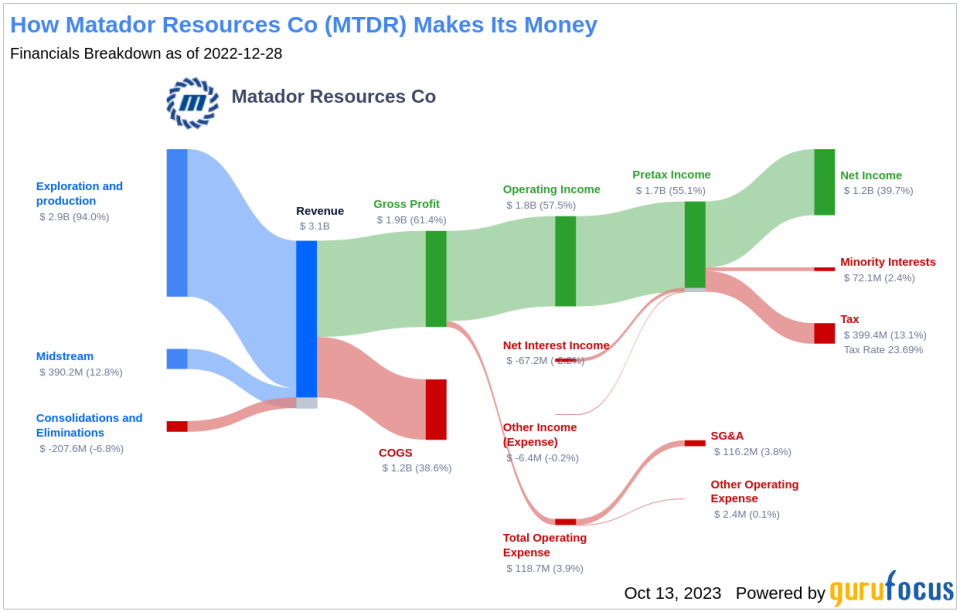

Profitability Analysis

Matador Resources Co has a Profitability Rank of 8/10, indicating a high level of profitability. The company's Operating Margin of 49.46% is better than 90.84% of companies in the industry. Furthermore, the company's ROE, ROA, and ROIC, which are all measures of profitability, are higher than the majority of companies in the industry. Over the past 10 years, the company has demonstrated consistent profitability, with 7 years of profitability.

Growth Analysis

The company's Growth Rank of 6/10 indicates moderate growth. The company's 3-year and 5-year revenue growth rates per share are better than the majority of companies in the industry. The company's future total revenue growth rate estimate of 6.28% is better than 59.85% of companies in the industry. Furthermore, the company's 3-year EPS without NRI growth rate is better than 94.93% of companies in the industry.

Major Stock Holders

Steven Cohen (Trades, Portfolio), Chuck Royce (Trades, Portfolio), and First Eagle Investment (Trades, Portfolio) are the top three holders of Matador Resources Co's stock. Steven Cohen (Trades, Portfolio) holds 581,658 shares, representing 0.49% of the total shares, while Chuck Royce (Trades, Portfolio) holds 392,372 shares, representing 0.33% of the total shares. First Eagle Investment (Trades, Portfolio) holds 171,745 shares, representing 0.14% of the total shares.

Competitor Analysis

Matador Resources Co faces competition from Murphy Oil Corp (NYSE:MUR), PDC Energy Inc (PDCE), and Civitas Resources Inc (NYSE:CIVI). Murphy Oil Corp has a market cap of $7.29 billion, PDC Energy Inc has a market cap of $6.43 billion, and Civitas Resources Inc has a market cap of $7.16 billion. Despite the competition, Matador Resources Co's recent performance and growth prospects position it favorably in the industry.

Conclusion

In conclusion, Matador Resources Co's recent stock performance, high profitability, and moderate growth make it a compelling investment. The company's strong position in the Oil & Gas industry, coupled with its impressive financial performance, suggest a promising future for the stock. However, investors should continue to monitor the company's performance and the market's valuation of the stock to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.