Match Group Inc (MTCH) Posts Strong Earnings Amid Operational Efficiency and Revenue Growth

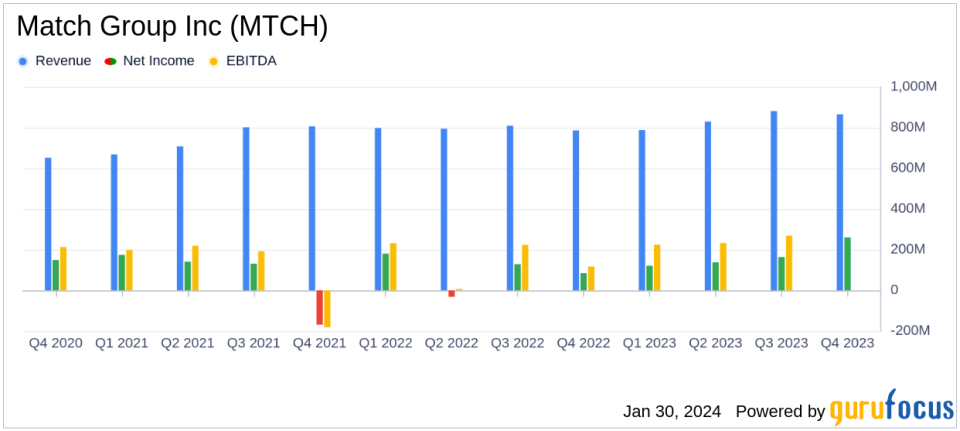

Revenue Growth: Match Group Inc (NASDAQ:MTCH) reported a 10% year-over-year increase in total revenue, reaching $866 million in Q4.

Operating Income: Operating income soared by 144% compared to the prior year quarter, hitting $260 million.

Adjusted Operating Income: Adjusted operating income rose by 27% year-over-year, amounting to $362 million.

Payers Decline: Despite revenue growth, the number of payers declined by 5% to 15.2 million.

Revenue Per Payer (RPP): RPP saw a significant increase of 17% from the prior year quarter, reaching $18.67.

Free Cash Flow: Match Group reported strong cash flow metrics with $829 million in free cash flow for the full year 2023.

Share Repurchase Program: A new $1.0 billion share repurchase program has been authorized by the Board.

On January 30, 2024, Match Group Inc (NASDAQ:MTCH) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, known for its diverse portfolio of online dating services including Tinder, Hinge, and Match.com, has demonstrated a robust financial performance with significant growth in operating income and a solid increase in revenue.

Financial Performance and Challenges

Match Group's revenue growth is a testament to the company's ability to innovate and adapt in the dynamic online dating industry. The 10% increase in total revenue and the 144% surge in operating income reflect the company's operational efficiency and successful revenue initiatives, particularly with Tinder and Hinge. However, the decline in the number of payers by 5% poses a challenge, indicating potential issues in user retention or market saturation.

The increase in RPP suggests that Match Group has been successful in monetizing its user base more effectively, despite the decrease in payers. This metric is crucial as it indicates the company's ability to extract more value from each user, which is particularly important in the competitive online dating market where user acquisition costs can be high.

Strategic Initiatives and Leadership Changes

Match Group's strategic focus on product innovation and leadership restructuring has been pivotal in driving sustainable long-term growth. The appointment of Faye Iosotaluno as CEO of Tinder is expected to bring a strategic perspective to the brand's challenges and opportunities. The company's emphasis on AI technology and product refreshes aimed at improving user experience, especially among women and younger users, is a forward-thinking move that could redefine the dating experience and attract new users.

The company's financial achievements, including the record levels of profitability and cash flow, are significant as they provide the financial flexibility to invest in growth initiatives and return capital to shareholders. The authorization of a new $1.0 billion share repurchase program underscores the company's commitment to shareholder value and confidence in its cash flow generation capabilities.

Outlook and Capital Allocation

Looking ahead, Match Group anticipates continued revenue growth and has provided a positive outlook for 2024, with expected total revenue growth of 6% to 9%. The company's capital allocation strategy, which includes returning at least half of the free cash flow to shareholders, reflects a balanced approach to investing in the business while rewarding shareholders.

Match Group's financial health is further evidenced by its liquidity position, with $869 million in cash and cash equivalents and a manageable leverage ratio. The company's ability to generate strong operating cash flow and free cash flow positions it well to invest in strategic initiatives and navigate any potential market challenges.

Conclusion

Match Group's Q4 earnings report paints a picture of a company that is successfully navigating the complexities of the online dating industry. With solid revenue growth, increased profitability, and strategic investments in product innovation and AI, Match Group is well-positioned for future growth. The company's focus on capital allocation and shareholder returns further solidifies its standing as a prudent and forward-looking enterprise in the interactive media space.

Investors and potential GuruFocus.com members interested in the interactive media industry and value creation strategies may find Match Group's latest earnings report and future outlook compelling. The company's ability to adapt and innovate, coupled with its strong financial performance, suggests that Match Group is a noteworthy player in the online dating market with the potential for continued success.

Explore the complete 8-K earnings release (here) from Match Group Inc for further details.

This article first appeared on GuruFocus.