Materion Corp (MTRN) Announces Record Full-Year Earnings and Positive Outlook for 2024

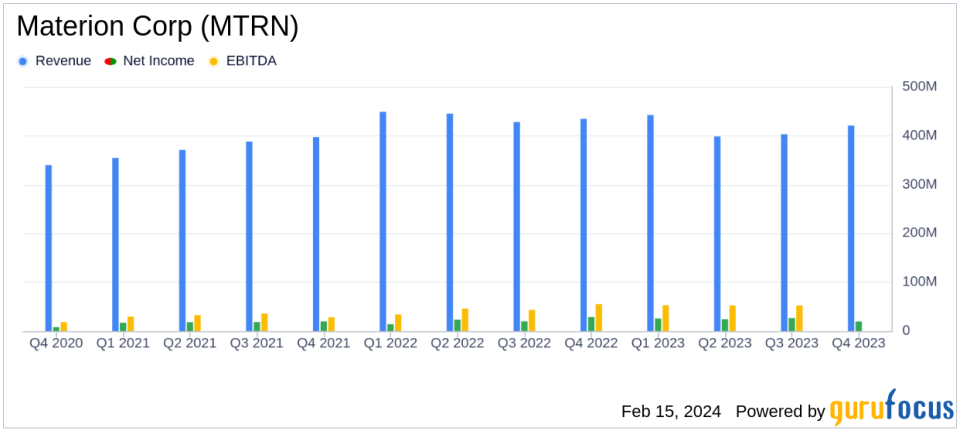

Net Sales: $1.67 billion for full-year 2023; $421.0 million for Q4 2023.

Value-Added Sales: Record $1.13 billion for the year, up 1% from the previous year.

Net Income: Increased to $95.7 million for the year; $19.5 million for Q4.

Earnings Per Share (EPS): $4.58 diluted for the year, up from $4.14 in the prior year.

Adjusted EBITDA: Record $217.7 million for the year, representing a margin expansion of 170 bps.

2024 Outlook: Adjusted EPS guidance of $6.10 to $6.50, a 12% increase at the midpoint.

On February 15, 2024, Materion Corp (NYSE:MTRN) released its 8-K filing, detailing a strong fourth quarter and record full-year financial results for 2023, while also providing an optimistic outlook for 2024. Materion Corp, a leading producer of engineered materials used in various high-performance industries, has reported significant financial achievements despite challenges in the semiconductor market, which is its largest end market.

Financial Performance and Strategic Highlights

Materion Corp's full-year net sales reached $1.67 billion, with value-added sales setting a new record at $1.13 billion, a slight increase from the previous year. This growth was primarily driven by strength in aerospace & defense and precision clad strip, which helped offset weaknesses in other key markets. The company's net income rose to $95.7 million, up from $86.0 million in the prior year, with diluted EPS climbing from $4.14 to $4.58. Adjusted EPS saw a 7% increase to a record $5.64, compared to $5.27 in the prior year.

The adjusted EBITDA for the year was a record $217.7 million or 19.3% of value-added sales, compared to $196.0 million or 17.6% in the prior year, demonstrating a significant margin expansion. Materion Corp also announced new customer partnerships and orders totaling $40 million, which are expected to contribute to future growth.

Challenges and Operational Excellence

Despite the semiconductor market weakness, Materion Corp's focused operational execution and improved product mix have led to strong performance. President and CEO Jugal Vijayvargiya highlighted the company's diverse portfolio and operational excellence as key factors in delivering another record year. The company's strategic initiatives and targeted cost improvement efforts have been instrumental in expanding margins.

"I am proud of our global team for delivering another record year, despite the significant headwinds facing our largest end market," said Jugal Vijayvargiya. "Our strong performance reflects the power of our diverse megatrend aligned portfolio, which continues to open new pathways for growth, and the importance of our relentless focus on driving operational excellence."

Looking Ahead: 2024 Outlook

Looking forward to 2024, Materion Corp expects to achieve another year of record results, driven by its organic pipeline and customer partnerships. The company has provided an adjusted EPS guidance range of $6.10 to $6.50, indicating a 12% increase at the midpoint from the prior year. This guidance reflects confidence in the company's ability to drive earnings growth through operational excellence and cost improvement initiatives.

Materion Corp will host an investor conference call to discuss these results and provide further insights into the company's performance and outlook.

For value investors and potential GuruFocus.com members, Materion Corp's latest earnings report and future guidance offer a compelling narrative of resilience and strategic growth, even in the face of market challenges. The company's ability to achieve record value-added sales and adjusted EBITDA in a difficult market environment underscores its operational strength and potential for continued success.

For more detailed financial information and future updates on Materion Corp (NYSE:MTRN), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Materion Corp for further details.

This article first appeared on GuruFocus.