Matrix Service Co (MTRX) President & CEO John Hewitt Sells 10,000 Shares

On March 20, 2024, John Hewitt, the President & CEO of Matrix Service Co (NASDAQ:MTRX), sold 10,000 shares of the company. The transaction was filed with the SEC and can be found in the following SEC Filing.

Matrix Service Co, headquartered in Tulsa, Oklahoma, is a leading North American industrial engineering and construction contractor that specializes in the design, construction, and maintenance of infrastructure critical to the energy and industrial sectors. The company's services include construction and repair for storage solutions, industrial cleaning, and maintenance and repair for various energy infrastructure facilities.

According to the filing, the insider has been active in the market over the past year, selling a total of 17,500 shares and making no purchases of the company's stock.

The insider transaction history for Matrix Service Co indicates a pattern of insider selling, with 5 insider sells and no insider buys over the past year.

On the date of the recent sale, shares of Matrix Service Co were trading at $13.25, giving the company a market cap of $353.327 million.

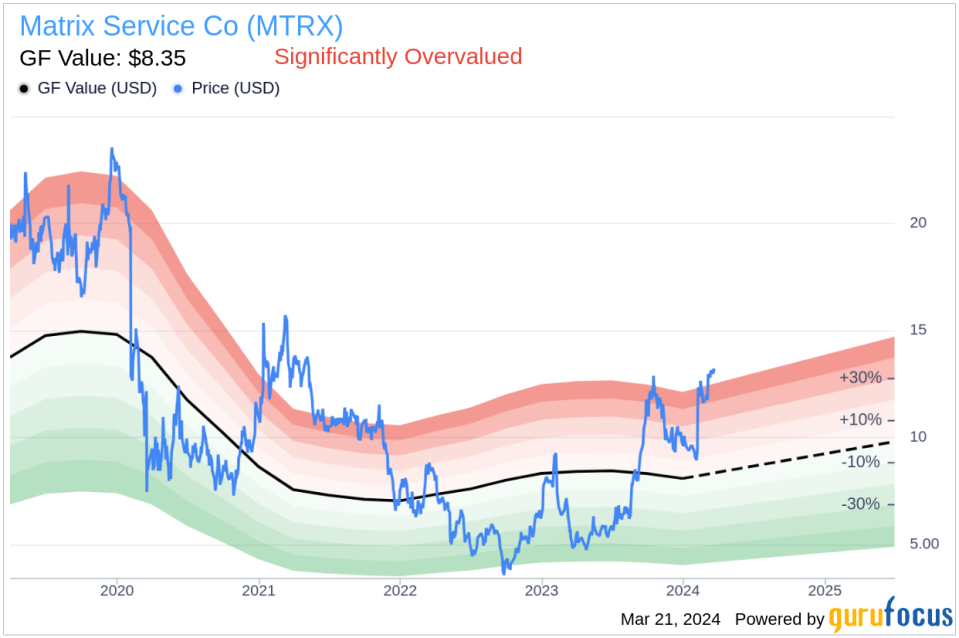

The stock's valuation, as indicated by the price-to-GF-Value ratio of 1.59, suggests that Matrix Service Co is significantly overvalued when compared to the GuruFocus Value of $8.35. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which is derived from historical trading multiples, an adjustment factor based on the company's past performance, and future business projections provided by Morningstar analysts.

The GF Value chart provides a visual representation of the stock's current valuation in relation to its intrinsic value.

Investors often monitor insider selling as it can provide insights into an insider's perspective on the value of the company's stock. However, it is important to note that insider selling can occur for various reasons and may not necessarily indicate a negative outlook on the company's future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.