Matson Inc (MATX) Reports Decline in Q4 Earnings Amid Challenging Market Conditions

Net Income: $62.4 million for Q4 2023, down from $78.0 million in Q4 2022.

Revenue: $788.9 million for Q4 2023, a slight decrease from $801.6 million in the same quarter last year.

Operating Income: Ocean Transportation segment saw a decrease, while Logistics faced lower contribution from transportation brokerage.

China Service: Increased container volume by 23.3% in Q4 2023, despite lower freight rates.

Effective Tax Rate: 26.0 percent for Q4 2023, with an expectation of approximately 22.0 percent for full year 2024.

Capital Expenditures: Totalled $248.4 million for the year ended December 31, 2023.

Share Repurchase: Approximately 2.1 million shares repurchased in 2023 for a total cost of $158.2 million.

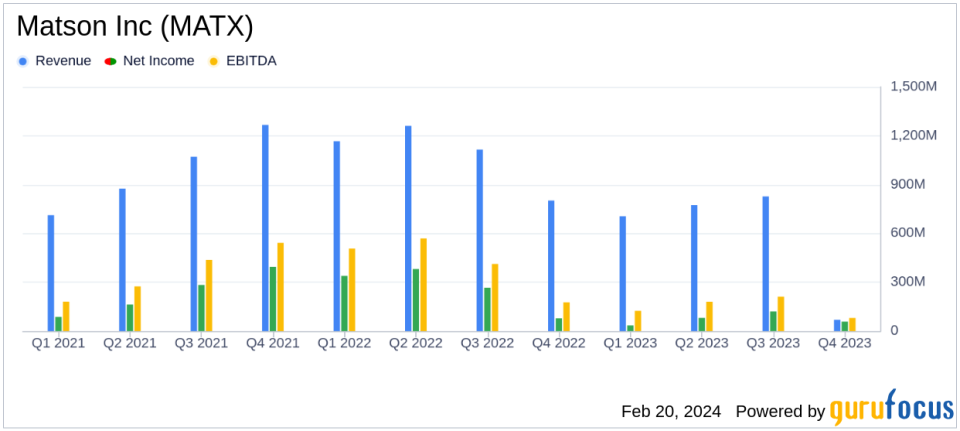

On February 20, 2024, Matson Inc (NYSE:MATX) released its 8-K filing, announcing its fourth quarter and full year 2023 results. The company, a leading U.S. carrier in the Pacific, reported a net income of $62.4 million, or $1.78 per diluted share, for the quarter ended December 31, 2023, down from $78.0 million, or $2.10 per diluted share, for the same period in 2022. Consolidated revenue for the fourth quarter of 2023 was $788.9 million, compared to $801.6 million for the fourth quarter of 2022.

Matson's Ocean Transportation and Logistics business segments faced challenges in the fourth quarter, with a year-over-year decline in operating income. The company's China service experienced solid freight demand with higher year-over-year volume but lower freight rates, combined with higher operating costs across all tradelanes. Logistics operating income also declined, contributing to the decrease in consolidated operating income. For the full year 2023, Matson's consolidated operating income declined primarily due to lower volume and freight rates in its China service as the Transpacific marketplace transitioned from the pandemic period.

Despite these challenges, Matson anticipates steady U.S. consumer demand, which is expected to lead to similar demand for the company's CLX and CLX+ services in 2024 as in 2023. However, challenging business conditions for transportation brokerage are expected to lead to lower year-over-year business segment operating income for Logistics in 2024. Matson expects consolidated operating income for 2024 to approximate the level achieved last year.

Matson's Ocean Transportation segment saw a slight increase in revenue, primarily due to higher volume in China and higher revenue in Alaska and Hawaii, partially offset by lower freight rates in China and lower fuel-related surcharge revenue. The segment's operating income decreased due to lower freight rates in China and higher operating costs and expenses, including fuel-related expenses.

Logistics revenue decreased due to lower revenue in transportation brokerage, and operating income decreased due to a lower contribution from transportation brokerage. Matson's effective tax rate for the fourth quarter of 2023 was 26.0 percent, and the company expects its effective tax rate for the full year 2024 to be approximately 22.0 percent.

Matson's capital expenditures totaled $248.4 million for the year ended December 31, 2023, and the company expects to make other capital expenditure payments of approximately $180 to $200 million in 2024. The company also continued its share repurchase program, buying back approximately 2.1 million shares for a total cost of $158.2 million in 2023.

In summary, Matson Inc (NYSE:MATX) faces a mixed financial landscape with declining net income and operating income in the fourth quarter of 2023, but with a stable outlook for 2024. The company's ability to navigate the challenging market conditions and maintain a steady demand for its services will be crucial for its performance in the upcoming year.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Matson Inc for further details.

This article first appeared on GuruFocus.